End of monetary violence in sight?

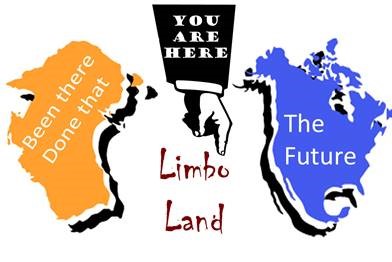

Interest rates and inflation One of the difficult aspects of investing is that sometimes one would want to be happy with price declines and still be disappointed with price rises. They are, of course, weird emotions, but they do fit with the defensive investor, which we have been for a while. At the same time, … Read more