Interest rate cuts postponed

February showed that financial markets can also move forward without the support of the bond market. Central banks are still reluctant to cut interest rates already now. For that, inflation, especially in the service sector in the US and Europe, is still falling too slowly. If the money market expected around Christmas that there would be 7 0.25% interest rate cuts in the US within 1 year, only 3 to 4 of those remain now. And let that be exactly as many as the Fed Governors themselves indicated a few months back. So, euphoria in the bond market has given way to realism. Bond and mortgage rates rose again, so we decided in February to extend the fixed-income portfolio further. We did so via the sale of a very short-term bond fund and the purchase of a European fund that focuses on Investment Grade corporate bonds of average medium maturity. This fund currently has an average yield of around 4.25%.

These higher bond yields proved no reason for equity investors to slow down in February. New all-time highs were set on most major stock exchanges, except for China (although its market recovered). On average, stock prices rose around 5% worldwide. Chip manufacturers and AI-related companies were the driving forces behind this rally.

Are we getting hot on AI yet? We don’t know yet, but we are already experimenting with it. For instance, we have our conversations with fund managers recorded (with their permission) and summarised via AI-driven software. These look neat, but they are not the conclusions I would draw from such conversations. Those tend to transcend the actual content of such a conversation. I suspect that AI will indeed take off, as many companies will start experimenting with it, with not all of them knowing right now exactly where its added value will lie.

AI requires enormous computing power and massive data storage. Those required data centres are now mostly owned by US companies, such as Google and Microsoft. If the US government asks for it, these companies are obliged to share those data with the government. That is why calls are increasing in Europe to build its own data centres, to ensure independency from the US.

Independence is an expensive pursuit

The “own people or region first” idea came from a geopolitical distrust between the US and China, but now Europe is also building its own goods economy (cars, batteries, chips) and energy supply. Soon, it will also build its own defence force with its associated industry. This will cost fortunes, but I think we have no other choice. The goods industry will soon be followed by services and data management. Slowly but surely, we are moving away from US technological and military dominance. Although this will really take quite some time.

In almost every field, every region wants to be as self-sufficient as possible. This is exactly the opposite of what our global economy and trade was based on. Cooperating and trading with whoever did something best and cheapest. Trade flows are shifted, whether because of the revised relationship with China or because of the boycott of Russia. It is mainly the countries around it (Vietnam, Indonesia respectively Kazakhstan and Georgia for instance) that benefit. These are typical examples also from our Frontier Markets funds, which continue to perform well.

On average, however, our new world order is becoming a lot more inefficient and therefore more expensive than the old one. This is not yet clear to everyone, but soon the taxman will come to us to ask for a contribution for all these (collective) investments, which we insist to make ourselves ‘coûte que coûte’ to stand more on our own two feet. We will think back with nostalgia to the old economic order, when we still traded with everyone cheaply and the US mainly took care of our international defence.

How much is technological progress worth?

Offensively, America is also doing well, especially with its technology stocks. After the sharp decline in 2022, valuations and profits recovered (except for Tesla and Apple). Meanwhile, the sector quotes a Price to Sales ratio of around 8.5x, higher even than the previous high in 2021. It says something about the confidence these stocks enjoy on the stock market in the sustainability of their earnings (margins).

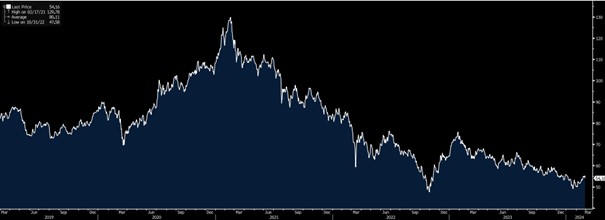

Whether this high confidence is justified is THE debate in the financial world. Of course, much of the earnings growth is real and structural in nature. But it is also possible that the current distrust of China has led to a diversion of money flows towards the US stock market, which has added to valuations there. China has now put sovereign wealth funds to work buying back shares on its own stock market: this has since neutralised a 16% fall in share prices early this year. Perhaps we have finally seen the bottom here, although distrust remains hight.

Performance of Chinese stocks 2019-2024

Are new stock market records cause for concern?

We continued to see remarkable price movements in Tokyo, where the 40,000-point barrier in the Nikkei index was passed, without the stock market here being extremely expensive. The enthusiasm in India, which is also reaping a benefit from the diversion of trade flows, is even greater. Here, regulators are concerned about the large inflows of individuals into the stock market at price-to-earnings ratios, which already significantly exceed even US ones. Not surprisingly, this is a topic of conversation in our review of a fund manager who is heavily invested in this very country.

Illiquid investments, finally, are performing well across the board, but are not keeping up with the current pace of stock markets. Our Infrastructure fund returned +7.2% in 2023, after +11.6% in 2022. The 2023 results of our Private Debt funds were recently released and range between 5-7%. In our mixed fund, over 60% Private Equity and the rest Real Estate, Infra and Private Debt, the decline in Real Estate and the low number of deals in Private Equity stood out, where underlying performance was otherwise good. The fund rose 3% in value last year, having lost no money in 2022. For years, we have held off on including separate Real Estate funds, partly because of concerns about rising interest rates, but also because many of our clients already own relatively large amounts of Real Estate themselves. It will take some time before the surplus of shops and offices is cleaned up. Gradually, more investment opportunities will then emerge.

As I am finalising this newsletter, the results of the US Super Tuesday primaries are coming in. They are not surprising: Trump and Biden will engage in another duel in November. The outcome of their duel will go on to determine America’s role on the world stage for the next four years. But even if Biden were to win again, I think more and more countries and regions will choose to stand more on their own two feet. With their own defence, their own batteries, their own chips, their own energy supply, in short with more “own people first”, whether we like it or not.

BY: WOUTER WEIJAND, Chief Investment Officer