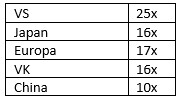

Stock market sentiment remained again positive in March, with several markets breaking records: the US, Japan and the Netherlands are a few examples. With that enthusiasm, valuation levels also rise, although it is not a given that profits will increase correspondingly in a coming economic recovery. While the US economy is still barely faltering, economic growth for Germany was recently revised sharply downwards this year, from +1.3% to almost 0. In Japan, the yen remained weak, driving export growth and tourism. The country seems about to be overrun, especially by Chinese tourists. Last, but not least, the Chinese economy finally seems to be recovering a bit: a survey of purchasing managers indicated some more optimism. But how expensive are all these stock markets by now? Here is a table with our recent estimates of price-earnings ratios, based on gains made in 2023:

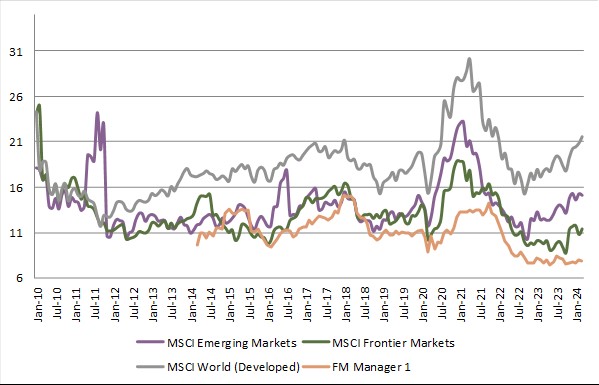

And then I left out a few extremes: India stands around 25x earnings. Indian regulators are so worried about the run on their stock market that they are asking the public to calm down. This looks like a healthy reaction to an unhealthy situation. At the other end of the valuation spectrum are the Frontier Markets (FM), a seemingly somewhat obscure group of developing countries that are not yet mature enough to be admitted to the Emerging Markets. These Frontier Markets stand at only 10x earnings. Pictured in orange is the valuation of one of the two FM funds, in which we are invested: that even stands at only 7-8x earnings.

The valuation of developed stock exchanges vs. EM -and Frontier markets

If Frontier Markets are that cheap, why were they still able to advance 16% in our portfolios in the first quarter, even outperforming the US, for example? Were they even cheaper before or did their gains grow so fast? This time let’s take a deeper look at the group of countries that make up Frontier Markets. Unknown perhaps to many of you, but certainly not unloved by us. Who exactly are these FM countries?

More spread across developing countries

The biggest small country in this FM universe is Vietnam. With all the geopolitical tensions between the US and China in particular, Vietnam seems to be the biggest beneficiary in Asia. Not that many companies left China, but large foreign companies have mainly chosen Vietnam as a place of business in recent years besides Taiwan. The work ethic and labour costs here are at Chinese levels and the business environment is flexible. The result is rapid economic growth.

Other countries that stand out in our FM managers’ portfolios are bordering Russia. Here too, geopolitical tensions and an economic boycott play a major role. Now it is Russia, which should be shunned. Much trade now goes through surrounding countries. Furthermore, the area boosts uranium mines. With the renewed interest in nuclear power in the West, the price of uranium has skyrocketed, so regional mines are making a big profit. At the same time, hundreds of thousands of Russians have fled to Tbilisi in Georgia to avoid conscription. These highly educated men and women are boosting the Georgian economy. Both banks and internet-driven consumer shops are showing sharp increases in profits.

The Middle East is another region, where Frontier Markets can be found: Saudi Arabia and the United Arab Emirates are examples of countries, whose stock markets seemed to have stood still for a long time but experienced a remarkable development in recent years. The managers we choose often succeeded to position themselves in time for this. Timing such a position, of a new trend, is not easy. There are plenty of countries, especially in Africa, where such a success story is only incidental. Kenya is finally making a spurt recently. Egypt often struggled. Even in Asia, there are still plenty of FM countries, which have yet to really break through: Pakistan, Bangladesh, Sri Lanka, Laos. In Latin America, there are not many FM stock exchanges. Colombia is part of it, Peru too. But our managers don’t find them very promising. So, within FM, there is a lot of chaff among the wheat, which requires sharp choices from the manager.

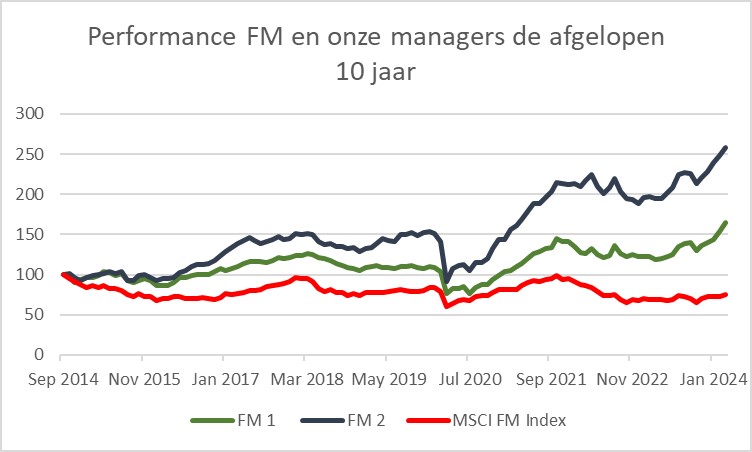

Active management is essentialctief

As you may have gathered from the above, Frontier Markets are grist to the mill of the active fund manager. Six years ago, we chose 2 fund managers with a long track record, who dare to make those sharp choices. Below you can see their results, with the performance of the MSCI Frontier Markets index below. Besides the managers’ good results, it is notable that the Frontier Markets index has been performing moderately to poorly for 20 years. Nevertheless, our managers managed to select the most promising countries and companies with often high earnings growth. That high earnings growth systematically keeps the valuation of their portfolios 20% or more below that of the benchmark.

Onze FM-managers vergeleken met de MSCI FM-index en de gewone MSCI EM-index

As you can see, Emerging Markets (EM) have been disappointing for some time. Of course, China’s downturn plays an important role in this. By spreading our investments in developing countries more widely, including through Frontier Markets, we were able to partially offset the damage of that downturn. Meanwhile, we do not kid ourselves that an investment in Frontier Markets is comparable to the US or Europe. Of course, the political risks are higher, and the liquidity of such exchanges is low. On the other hand, the price for those stocks comes at deep discounts, with attractive dividends and earnings growth on top.

Making the right choices in difficult countries like these is not for everyone. We could not have done it ourselves. We spent most of our time selecting the managers, who do nothing, but study Frontier Markets all day and travel town and country worldwide. Their remuneration depends heavily on the results, which they achieve with their fund.

Good advice is never cheap, but in this case, it seems cheaper than most other stock markets, as long as we realise that cheap stocks do not guarantee better performance. For that, better-than-average choices need to be made systematically. Our managers are working hard on that.

With that ongoing challenge, we remain yours,

WOUTER WEIJAND, Chief Investment Officer