It seems simple: the government orders money, the central bank supplies it, keeps the interest at around 0% and you get it transferred. Then a few more mouse clicks and your order is on its way to the store. And they click your order through to the factory. Will that work? Probably if we only do that in one country, preferably ours of course… and do not reveal anything to others.

But if we would do this all at the same time, globally, the world would of course come to a grinding halt. Because if factories are down, the first few thousand billion in emergency aid will get them going again. But then, like in the US, there will be many more plans, for thousands of billions, well before we put our European billions of corona support to work.

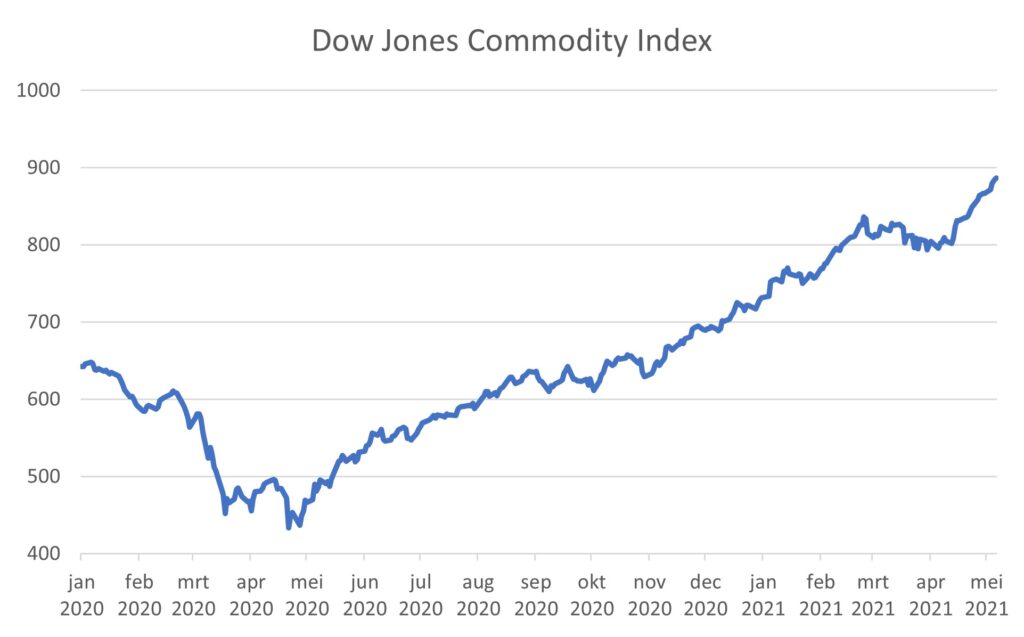

In the meantime, many production processes (chips) and transport lines (container transport) have already stalled worldwide. Commodity prices continue to rise happily (see graph), employment is recovering faster than expected and personal income in the US rose from February to March by 21%(!). Personal spending increased by 4.2%, not on an annual, but on a monthly basis. Thanks to those checks, of course.

Central bankers are saying out loud that inflation expectations will certainly not increase, oh no! But this mainly seems like “wishful thinking”: for the time being there are already quite a few surveys that indicate significant price increases. Cyclical companies can still pass on price increases relatively easily: think of chemicals, oil, raw materials, wood, building materials, which everyone understands. This is a lot more difficult for the services sector, but prices will soon start to rise here too.

Recently, growth figures of the US economy for the first quarter were announced: with 6.4% on an annual basis, the output gap is closing slightly faster than initially expected. The Fed can be satisfied, but it may now have to raise interest rates as early as 2022, and even former Fed chairman Yellen, who is now Secretary of the Treasury, thinks so. But the current Fed Chairman Powell (a lawyer…) promises in advance that they will not be concerned about any higher inflation and will not raise interest rates for the time being… and the dollar has already fallen 3 cents last month.

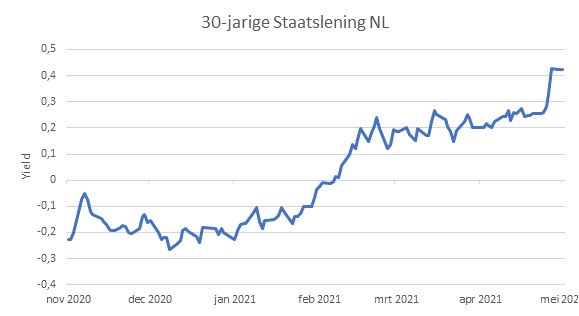

At first, term US$ interest rates rose, but in the meantime the 10- and especially 30-year German (towards +0.40%) and Dutch interest rates (even higher) are catching up, which the ECB apparently cannot or will no longer try(?) to tame. See the graph below for this. Mortgage margins will tighten this way, but who dares to increase the mortgage interest first? Dutch Central Bank Governor Klaas Knot would really like this: I would not be surprised if he reached a deal within the ECB, with Lagarde getting her way for the ongoing bond purchases, but sparing the 10-30 year segment from being overstrained and put the brake on the hectic housing market in Northern Europe.

In the meantime, it is pretty ironic that a funeral company (Yarden) is the first to die, because of the losses on its bond portfolio. That is the result when the regulator only allows one to invest in “risk-averse” long bonds.

Anyway, everyone wants to let go: whether it concerns a shop visit or holidays (count on the digital corona vaccination passport): every country tries to get society off the lock as pragmatically as possible. And at the same time stimulate and reform growth (Draghi in Italy). It all continues to go too slowly, but Europe is gradually taking over some of the pace of the USA in terms of growth. The survey of European Purchasing Managers speaks volumes about this: this index just recorded the highest level since its introduction in 1997. Selling prices have also risen fastest in 25 years.

So growth will continue, as will government spending, tax increases, inflation and interest rate increases.

Yet there may also be a desire on the part of the Fed to skim off the “excess liquidity” (it is estimated to be $ 1,600 billion) that was made available to banks a year ago. It now seems that much of this enormous amount of money – meant to keep the economy going and to solve bottlenecks in banks – has ended up in financial markets. Especially the enormous growth of “margin debt”, the buying of shares with borrowed money, is said to be the result. Recently, not only a mega speculator (Archeagos) drowned, but nearly also the lending banks that came on board with it. The Fed will now want to reclaim this liquidity to prevent further speculative misery of this kind.

Finally, on our investment policy: we hold cyclical/value stocks and remain underweight bonds and interest rate sensitivity. And we reduced our equity weighting a little further at the end of April, to around 5% underweight. That was not an easy decision, because there is a lot of growth on the way, including profit growth. But markets have been ahead of that for many months. And had a lot of support from the low interest rates and low inflation, which increasingly threatens to be a thing of the past.

Although I would rather have been able to do magic and provide the whole world with vaccines and free money, and then buy stuff endlessly, without causing any price increases….

BY: WOUTER WEIJAND, Chief Investment Officer