The world is getting back on track, especially in the US, where nearly 1 million jobs were added in the past month and the services sector also appears to be recovering. Both the vaccination and the emergency plan got off to a flying start. But perhaps another few thousand billion dollars in stimulus will be added. Is that really necessary? And aren’t we forgetting the necessary tax increases needed to pay for this?

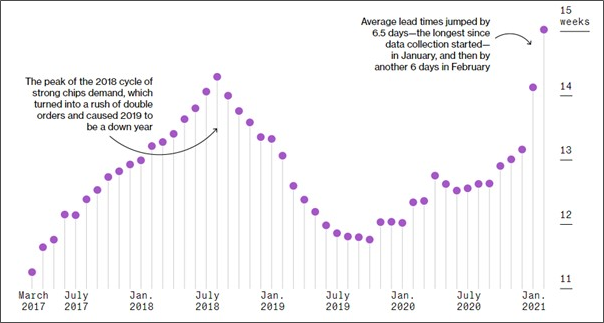

Meanwhile, raw material prices are rising rapidly, as are transportation costs. Delayed delivery times for computer chips (see chart 1) are hampering the industry, especially in car production.

Chart 1: Delivery time for computer chips is increasing significantly

Source: Bloomberg

Merchant shipping also reports a striking number of bottlenecks, both in ports and in container transport (see chart 2). The costs of container transport have now quadrupled since a year ago. It seems that (catch-up) demand is barely able to cope, which points to price increases, which are still in the pipeline.

Chart 2: Bottlenecks for shipping have increased significantly

Long-term interest rates rose globally on higher inflation expectations and US Treasuries had their worst quarter in 40 years. Mortgage rates were raised there for a seventh time last week.

Growth stocks suffered from the interest rate hike, but recovered at the end of March. But not before a large speculator (Archegos) had gone belly up on a massively leveraged position in growth stocks. Cyclical stocks, especially banks, were the big winners: for them, a higher interest rate offers the prospect of better margins. Eventually, stock exchanges in the US and the Netherlands reached new records. But in China, stocks fell due to fears of higher interest rates, as well as government intervention at major tech companies.

In the meantime, mainland Europe seems to have lost the vaccination battle. Brussels lacks the central authority and the decisiveness of individual countries to be able to purchase vaccines independently. There is also a sad debate about the distribution of vaccines among member states. While the US and UK reopen, mainland Europe is still in lockdown.

In Europe, we are also still waiting for the approval by 27-country parliaments for the corona debt emergency support plan. Remember this great plan from last fall? For which all countries had to submit their proposals to Brussels, which till date have often been rejected? And which the Bundesverfassungsgericht in Germany also briefly (temporarily) dismissed last week, because it would not be in line with the German constitution (especially the common debt issue)? It once will become reality, but not really very fast.

All in all, it did not help the euro and the US dollar rebounded to 1.17, hitting 1.23 only a few months ago. Interest rates will also have contributed, as these rose more in the US than here in Europe. If we catch up later, the euro will probably also recover. At the same time, the recent rise in both the US dollar and interest rates, created a headwind for Emerging Market equities and EM Debt.

Back to inflation: all kind of price rises are on the way, which will only become manifest in the coming months. The trend here “does not seem to be our friend”. A low weighting in bonds, plus low interest rate sensitivity remains our motto. In the meantime, we are continuing to build on our Private Debt feeders: version IV will be launched mid-year. Given the low interest rate sensitivity and relatively high coupons that Private Debt offers , we are foreseeing slow, but steadily increasing positive results in this sector. Even if we take into account incidental write-offs for credit risks.

Another question is how stock markets will behave under more interest rate hikes? This seems to be the biggest point of discussion at the moment, but value stocks can handle it better than growth stocks. But if interest rates would continue to rise, valuation levels of markets will be affected. For that reason we are slightly underweight, as we are aware that equity markets have so far mainly responded to the forthcoming earnings recovery.

And now for the biggest news worldwide(!)… the Dutch AEX index has finally broken its record dating back to the year 2000. Hurrah, and this with a completely different index nowadays, in which the smallest market cap losers (exit ABN AMRO this time) made way for the most expensive and largest newcomers…. No wonder why it took such a long time before the record was finally broken. But it worked and the AEX has now, not coincidentally, become more of a tech index: a sign of the times or a ‘writing on the wall’?

From the series of geopolitical news flashes: there are more and more rumours that China wants to take over Taiwan after Hong Kong, if necessary by force. And preferably before the Americans have sufficiently armed Taiwan. This would be a very daring operation/conflict, which America and Japan might stay out of, but one can never be sure they will. Hence this would be a very risky situation. What we do know for sure is that China has a lot of geopolitical ambitions, especially in what it sees as its own region or as apostate provinces. China remains a huge growth story, but not in the form one would always like to see it….

Our growth profile is probably a bit less flashy: take for example Infrastructure, often with an income profile that is protected against inflation. That theme – investments which are somewhat protected against higher inflation – could well remain en vogue for a long time to come.

BY: WOUTER WEIJAND, Chief Investment Officer