Inflation and interest rates

If there is no inflation, interest rates are low and stocks are likely to be well priced. But if inflation were to increase and thus cause interest rates to rise, it will be a different story for stocks. That is the core of the current discussion in financial markets. But what could trigger higher inflation, after nearly 40 years of falling and very low inflation?

Governments and central banks still have the monetary and fiscal taps wide open to combat the pandemic economically. But won’t they be doing too much ultimately? President Biden’s new emergency bailout package is too big at $ 1,900 billion, said former Fed chairman Larry Summers: give money to those who really need it and spend the rest on infrastructure, he argues. Take a look at electricity supply, at the roads and bridges in the country, and you will agree.

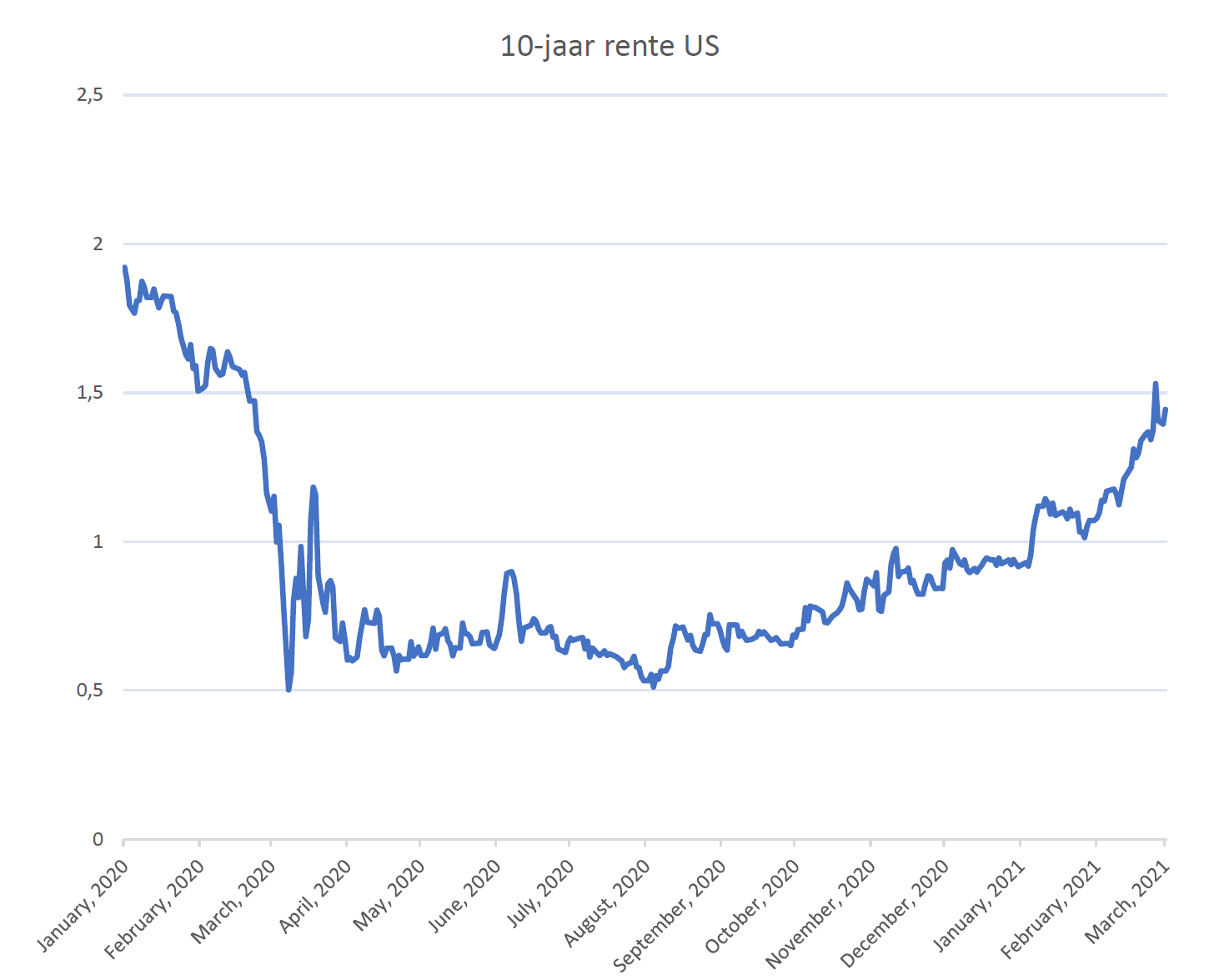

A huge stimulus is upon us, commodity prices have been rising for months and long-term interest rates are rising as well. With the prospect of massive debt issuance, investors in US Treasuries have been increasingly hesitant in recent weeks. Producer prices rose markedly in January. Fed Chairman Powell tried to reassure the market: if inflation were to come at all, it would be temporary and he saw no reason to hike interest rates for the next 2 years. But can the Fed look that far ahead at all, with all those stimuli in which it participates so heavily itself? The market did not trust it. Recent auctions of government paper failed and interest rates suddenly rose sharply.

And how do we discount the value of future cash flows in the stock market? Exactly, with the interest rate on government bonds, the discount factor par excellence. Cash flows that are further out in the future will be hit harder by interest rate rises than those received tomorrow. For those, an interest rate rise no longer matters. The value of growth companies, with larger cash flows in the (distant) future, will therefore be hit harder by this. Highly cyclical companies that may soon be able to show a recovery in earnings due to all the stimuli, will only be affected to a more limited extent by rising interest rates. In addition, banks and insurers can earn more money if interest rates finally rise. But for the market as a whole, sharp and sudden interest rate increases are rarely a cause for celebration.

Low interest rates as a basis for high valuations?

Even after the stock market correction in late February, last month was still a positive one for equities. Bonds fell sharply, though. Fortunately, we held an underweight position here for some time already, with a strong emphasis on shorter-term maturities. A 10-year interest rate around or even below 0% seemed and does not seem sustainable to us in the longer term. In The Netherlands we have only made the step from -0.60% to -0.25%. The 30-year interest rate has only now become really positive at + 0.20%. And yes, something like this will soon have consequences for mortgage rates.

“To be inflated or dis-inflated”, applies to many a balloon that may have been inflated too much thanks to low interest rates. We have to keep a close eye on this. The fact that young, inexperienced investors have flocked to the stock market over the past year resulting in speculative scenes (see my previous newsletters about this) is worrying but not decisive. Ultimately, we will have to conform to the mother of all markets, as she is sometimes called, the US bond market. There, the 10-year interest rate has now peaked at 1.6%… but peaked, really? No, one cannot call it that way after an increase of just 1% from historically low levels.

But you may now understand our enthusiasm for very short-term trade finance/factoring investments. The underlying loans here have a maturity of 60-90 days with a target yield of 4-5% per year. Interest-sensitive, no, but illiquid, yes, by the way. As from the start, one must remain invested for at least 1 year, but 4-5% still sounds different than -0.5% on the cash we are holding. Precisely because we did not want and do not want to carry long-term interest rate risk.

Interest and inflation: we are not getting rid of these major themes for the time being. The pandemic pushed the decades-long interest rate decline further down. But with the growing vaccination, there may be economic light at the end of the tunnel. Perhaps this will also bring us to the end of the interest rate decline and we will have to adjust to a gradual normalization of interest rates. Which will take many more years by the way, but can pop some balloons along the way.

Whilst we considered many asset classes to be already well priced, we could still point to the extremely low interest rate environment to justify that valuation. Central banks are likely to keep short-term interest rates low for longer. If however long-term interest rates continue to rise, combined with increasing inflation expectations, the important justification for high stock prices will disappear.

So when should one take action on this? Soon? when growth recovers, inflation rises and central banks will bravely shout that this is nothing to worry about….? We prefer to rather be “safe than sorry”, so we are now gradually reducing some equity exposure. We may also further shorten the term of our bond exposure. So we are vaccinating the portfolio a bit against inflation and the first shots have been taken through our actions.

In the meantime, we hope that you can enjoy spring in good health, with or without injections!

BY: WOUTER WEIJAND, Chief Investment Officer