Things have become more unsettled in financial markets. Stock markets showed their sunny side in the first months of the new year, but there have since been some thunderstorms. Markets are not so upbeat on inflation and interest rates. The fall in inflation stalled and so did interest rates, which rose and – in turn – constrained equity valuations. Unless earnings growth was convincing enough to justify those increased P/E ratios. This explains why share price spreads after earnings releases have been larger than average recently.

Is AI already making money?

Particular attention was paid to earnings via AI, the theme that has dominated the stock market for some time. Companies that almost exclusively invested money in AI but seemed to be making little from it yet, such as Meta/Facebook, had to take a big hit. Conversely, there were companies like Microsoft and Google, and to a lesser extent Amazon, with growing profits from cloud services and associated data centre profits. Although earnings from AI are hardly visible here either, the market apparently believes they are forthcoming. Yet 70 of Google’s 80 billion profit still comes from traditional sources, such as ad revenue from its Google search engine. Things are not much different at Microsoft: although since November you can get a subscription for $30 a month, which gives you some AI features when using Word, Excel and PowerPoint etc., it has not yet generated spectacular revenues. Ordinary earnings growth already proved enough to reassure the market. Heighting fears were among chips-related companies, many of which had already experienced a solid spurt. Even slightly disappointing earnings figures were already leading to relatively hefty price declines.

Recovery Emerging Markets

In that turmoil, it was striking how regions, which had been depressed for a long time, could suddenly rebound. The recovery of Emerging Markets (EM), and China in particular, was particularly striking last month. Was it the hesitation of Western stock markets, which caused investors to divert to lagging stock markets? Or did the Chinese state’s buyout fund, which can spend a few hundred million every day on the stock market, also help here? In any case, the fact is that the MSCI China index recovered almost 9% last month, while the S&P500 index was down more than 4%. Nevertheless, this US index is still miles ahead of China if you look at the 5-year results. That difference won’t be erased overnight. Below is the chart comparing the stock market indices of the world’s first and second largest economies.

So, has this finally set the stage for Emerging Markets to catch up with developed markets? Frontier Markets already did, which was the subject of the previous newsletter. Among Emerging Markets, after China, Taiwan, India, Korea, Indonesia, and Brazil are also important. Let’s put the stock markets of those countries together in a chart.

Performance last 5 years of important EM Exchange

As you can see, most stock markets in EM have been doing quite well, for a long time already. Only China threw a spanner in the works in recent years. As the world’s second largest economy after the US, and with a substantial weight in the EM index (around 35% 5 years ago, now around 25%), it defined the picture of EM lagging behind developed countries. Now suddenly there was that spurt, that catch-up, we had been hoping to see for some time. One swallow does not make summer, but rather this one bird in the hand than 10 in the sky. It is fair to say, though, that no one has a good grip on China. It is not a market economy; it is mostly centrally run and market mechanism does not guide the distribution of capital across various economic sectors as much as it does in our economies.

China is boycotted in many areas for trade policy reasons, as with computer chips, but it nevertheless does not stop it from making its own progress in that area. It is also conquering the world with electric cars. In the number of cars made, BYD (Build your Dreams), has already substantially surpassed Tesla. With phones, Huawei also appears to have passed Apple in China. Its own market is of course huge in this regard, with more than 1 billion inhabitants. After a few years of business-unfriendly policies and deterring investors, the Chinese government seems to have come to its senses in recent months. Large foreign companies are being spawned again and red carpets are being rolled out left, right and centre.

Chinese stock market lagging far behind

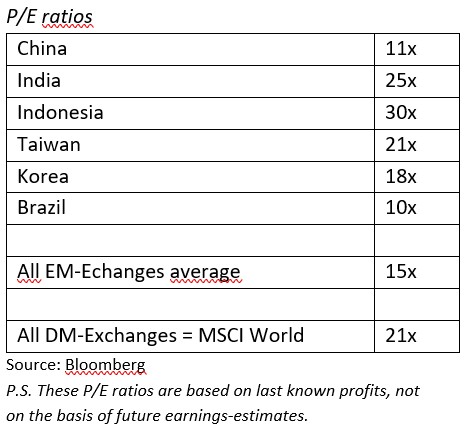

Further bright spots are the cautiously recovering economic growth and a stock market, which dares to look ahead again. Moreover, of all the EM countries mentioned above, China is the country with almost the lowest stock market valuation.

P/A ratios

Growth versus Value

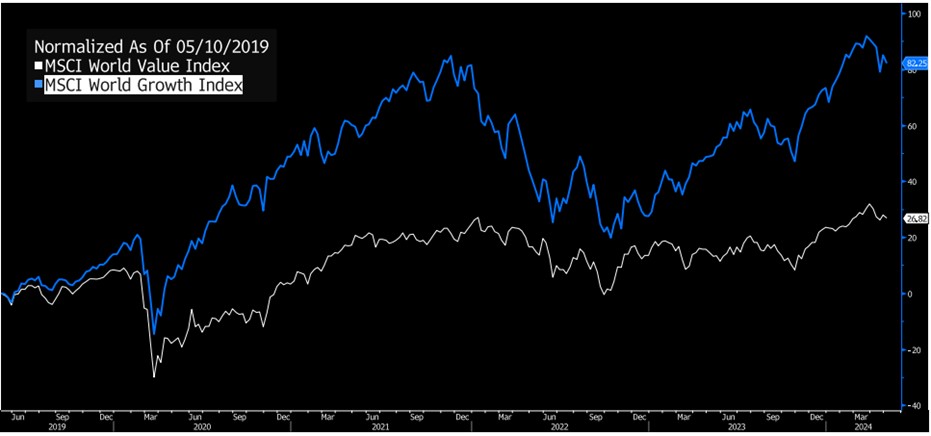

Furthermore, now that stock markets are a bit more turbulent, it might be worth looking at how Growth stocks have behaved recently compared to Value stocks? Again, Growth equities will only then pass when the investment environment becomes more turbulent, sensitive as they also are to interest rate fluctuations. For the somewhat longer term, Value still lags significantly behind Growth. Again, it is precisely these technology stocks, which continue to disprove the age-old thesis that the cheaper Value stocks should always win out over Growth stocks in the long run.

MSCI Value vs MSCI Growth in the past 5 year

All in all, it seems to be time again for the somewhat duller investments, the train, quietly humming along: Infrastructure, Private Debt, as well as alternative loan structures in Factoring. It is mainly this wider diversification that ensures, that there are always a few asset classes, where the clouds have no hold and where the sun continues to shine calmly.

BY: WOUTER WEIJAND, Chief Investment Officer