It is of all times, this battle in financial markets, but now it is even more topical: the fight between Hawks and Doves. The Hawks want a strict monetary policy, the doves allow things to be a bit milder. Last year, investors joined the Hawks: central bankers had remained Doves for too long. They had kept interest rates too low for far too long. Inflation was completely out of control. So they had to intervene firmly. We all know by now where that led us. Not quite okay. Everything of value turned out to be defenceless: shares, bonds, houses, you name it. The price of almost everything went down.

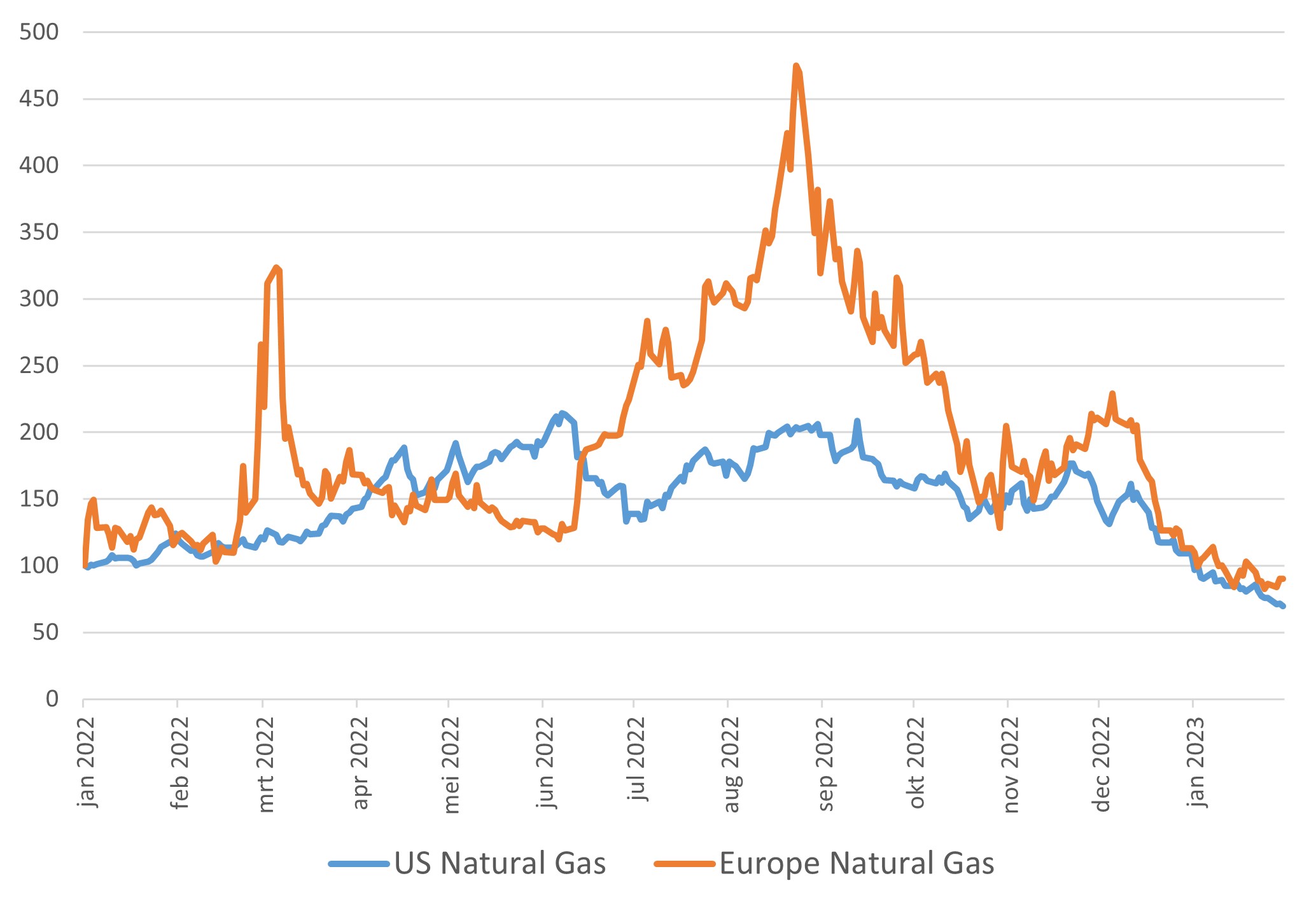

The fall in energy prices seems to have turned the tide of inflation. Investors have now suddenly become predominantly Doves, yelling at central banks that enough is enough with the interest rate hikes.

Prices European gas and US LNG (indexed)

Central bankers remain Hawks for now: far from believing that the inflation beast has been tamed, they are continuing to raise interest rates, albeit at a slower pace than before. In early February, for instance, the Fed raised interest rates by just 0.25% (instead of 0.5%), while the ECB had already cut its rate hikes from 0.75% to 0.5%. Meanwhile, the Doves, who now dominate the investor landscape, were mainly trying to push down long-term interest rates. They also speculated on an interest rate cut by central bankers in the second half of the year.

Who will win this race? In answering that question, let us look mainly at the battle in the rear end. That is being waged between employers and employees or rather, between companies and consumers. Who has the longest breath and who has to give in? Both employers and employees are coming out of the hefty but short-lived pandemic recession. Employers were often given substantial subsidies as workers were not allowed to become unemployed. Thus, both came out of something that should have been a crisis but wasn’t in fact, with well-filled coffers. Moreover, interest rates had been cut even further and the money tap was wide open. This led to wild scenes in housing markets worldwide, as well as in stock markets.

So has the consumer been defeated? No, but they have been hit. Consumer confidence took a hit, especially as a result of the energy price hikes, but subsidies were also introduced in this area. Furthermore, the fall in house prices is starting to bite. Yet consumers still sit on considerable savings. In addition, most labour markets remain tight. January non-farm payrolls grew by an astonishing 517.000 in the US. Employers are therefore hesitant to make large rounds of layoffs to save costs. Moreover, the ageing population structurally limits supply of labour. On top of that, workers are still able to command decent wage increases. Don’t forget that the minimum wage and old-age pension have already been raised substantially in many countries recently. With that, cost savings among employers hardly get off the ground. To protect profit margins, they will therefore continue to raise prices even when raw material and energy prices rise less. So one has to ask oneself the question if inflation will really fall back to 2% soon. I suspect we will have to live with 4%+ inflation for some time to come. The Doves may have the edge here and the Hawks could remain justifiably concerned.

The Hawks know that ‘soft healers make smelly wounds’ (as we say in Dutch…). Because that’s what one can call the 8% inflation levels in the US and 11% in Europe last year. They inflicted deep wounds in the confidence of citizens that their ‘Government’ would protect them from this kind of misery. Investors can now cry very loudly that inflation is over and the reins should be loosened again, but central bankers are horrified by the result of the too-low interest rates. Added to this is the memory of the mistakes made in the 1970s, when easing was done too early and a second wave of inflation came on top. Central bankers do not want to make that embarrassing mistake again. So the Doves must resign themselves to their fate and be patient. Perhaps there could be some easing of interest rate conditions in late 2023, early 2024, but for now, central bankers will raise interest rates further and then hold their ground for a while.

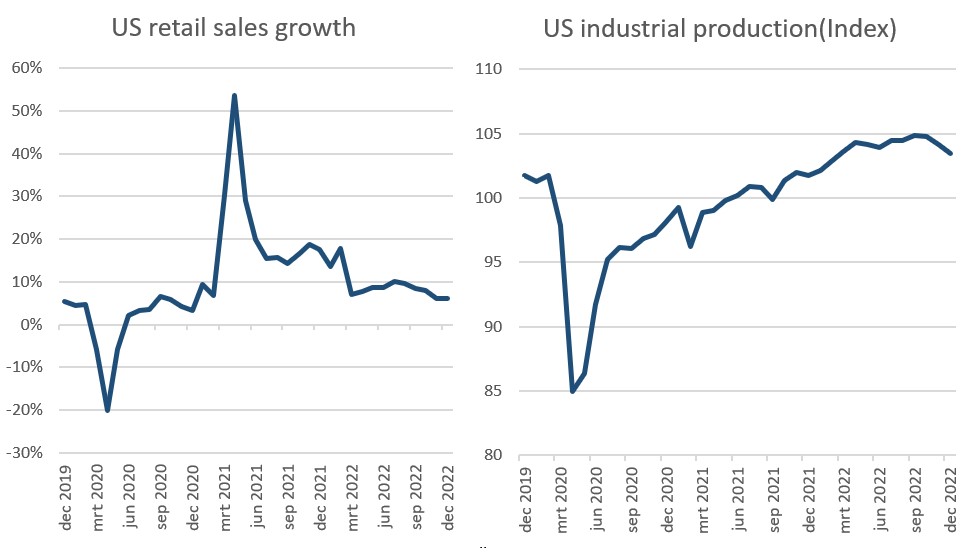

That the likelihood of a sizeable recession, especially in Europe, has now diminished somewhat suits the Hawks. You see, they will say, it wasn’t all that bad. We don’t need to cut interest rates either. In the US, though, the recession probability is a lot higher: consumer spending seems to be falling sand employers, especially in the tech sector, have cut more jobs than in Europe.

If there will be downtime anywhere, it will be in manufacturing. We ordered too much globally, afraid as we were that it would not be delivered. And now many companies have too much stock. There is no need to produce too much for a while. First, the old stock has to be sold (often at a discount). We call this an inventory recession and it can lead to profit erosion. Something like this seems more likely in the US than in Europe, but as yet not strong enough to win over the Hawks at the Federal Reserve.

Added to this is an interesting development in the world’s 2nd largest economy: China wants to shake off the corona ghost and has ‘opened up’. Consumer spending in particular is being boosted quite a bit; interest rates have been falling here for some time. Chinese citizens want to travel ‘en masse’ again. Consequently, they have a lot of catching up to do. China was locked down for years. Our position in Chinese equities, which we built up in a few tranches last year, made a sharp recovery during the fourth quarter. I suspect the Doves underestimate this boost to the global economy (and to commodity prices soon), even if China’s real estate sector remains in a worry some state for now. Just as housing markets across the Western world are under pressure. Not because of overproduction as in China, but simply because of interest rate hikes.

So we do not join the Doves. We remain cautious on bonds, also because those same central bankers are no longer buying more, but instead are winding down some of their bought-up bonds. January was a volatile month for bonds. First, interest rates fell sharply, also because institutional investors put their cash positions to work. Later, interest rates rose again. In equities, which recovered in January from the December decline, we are positioned between Hawks and Doves. We acknowledge the risks of an earnings downturn in a recession, but think many a company will still try to pass off its cost increases in price increases. In such a stagflationary climate, we neither want to be overweight nor underweight in equities.

One segment where we do want to remain for the time being is Private Debt. Here, the supply of funding has lagged behind demand for some time, leading to historically high interest rates: for senior secured loans, interest rates rose from around 7.5% to 10% last year. Subordinated/enterprise loans even saw interest rates rise from around 10% to 14-15%. These are interest rate levels, which did not occur even in the 2008/09 crisis. We therefore hope to launch our 5th Private Debt Feeder this year to benefit from higher interest rates. Incidentally, the previous feeders are not all fully invested yet either. So here we will still be able to take partial advantage of the higher market interest rates.

Then another asset class, with which we achieved a positive result last year: Infrastructure. Final figures are not yet available, but a result of 7-8% seems likely. For this year, we expect a somewhat flattening result, also because a fall in the dollar could limit value growth. Incidentally, part of the income here is indexed to inflation.

Last, but not least, there is still the war where Hawks face Hawks. The status quo in recent months played into the hands of the Doves in the stock market. But that war sentiment could just turn around, especially as the arms race intensifies. Neither side seems to be able to win or want to lose the war. Let’s hope that the Doves here in the form of a UN peacekeeping force will eventually prevail and we can put this sad war behind us.

BY: WOUTER WEIJAND, Chief Investment Officer