How do we look back on the financial markets of the past year?

Just like in 2020, bond markets ended the year in negative territory. Incidentally, this was not accompanied by significant interest rate hikes. But with the high interest rate sensitivity of most bond markets, it takes very little to get this asset class into the red. The global index (hedged to the Euro) fell by 2.2% whereas the Dutch bond index lost 3.6%. And this while we are still at the early stages of interest rate hikes. Although the Norwegian, Canadian, English and New Zealand Central Banks already preceded us, things only really get serious when the Federal Reserve takes action, perhaps already in March. The ECB, you already know, does not take inflation at all serious and is not inclined to act at all for the moment. Just like Japan, for that matter.

And without headwind from the most important Central Banks, equities continued to rise. The number one performer was the energy sector at +37%, then technology at +31% and then banks at +28% (all excluding dividends). In addition, value stocks barely lagged growth stocks. But the latter category contains the largest stocks by market cap. See below how the top 10 stocks within the S&P dominated the market.

Top 10 US stocks versus rest of US and rest of the world

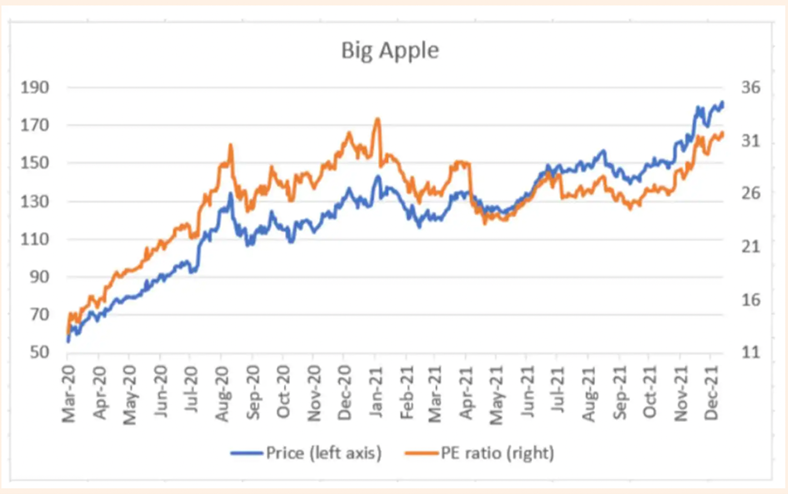

In concrete terms: take Apple, which just hit a market value of 3 trillion dollars: its price increase last year was mainly an increase in its price-earnings ratio. Beautiful in itself, but not really reassuring.

The United States again performed best, partly due to the dollar which rose by almost 9% against the euro. Anyway, only currencies in some Emerging Markets underperformed vis à vis the euro. Because unfortunately, we miss someone who is really ‘en Garde’ to defend our common currency…

And about those EM countries: the star that China had been in the EM equity markets in recent years faded: with a fall of about 20%, this country slowed down the growth of the EM index to only 4%. Increasing state intervention in what we briefly thought would become a market economy created a scare, especially among the major Chinese tech companies. And meanwhile, the overproduction of housing started to hurt more and more and large project developers were no longer able to keep it up financially. Which was also felt a bit in the EM portfolio of some international bond managers.

At the end of this often speculative year, the fastest-rising markets saw a correction, after the Fed signalled that the period of unbridled money growth and super-low interest rates would soon be over. Investors then quickly withdrew from the riskiest market segments: venture cap tech companies, as well as small caps, crypto and meme stocks in December. Cathy Wood’s well-known ARK Innovation EFT is perhaps a good indicator of these market segments: below is her performance in 2020, which was great, and 2021, which gradually became more difficult.

Performance ARK Innovation EFT in U$ period 2020-2021

For Frontier Markets (where companies are predominantly smaller) this setback hardly applied. In any case, they had one of their best years ever with +28% for the index, and our own FM selection even well above this. But despite the restless month of December, it was and remained a very good year for equities overall.

You know how often I wrote about inflation this past year and the interest rate measures that Central Banks normally take. The world’s major Central Banks did almost nothing 2021 so my concern for stock market corrections turned out to be premature.

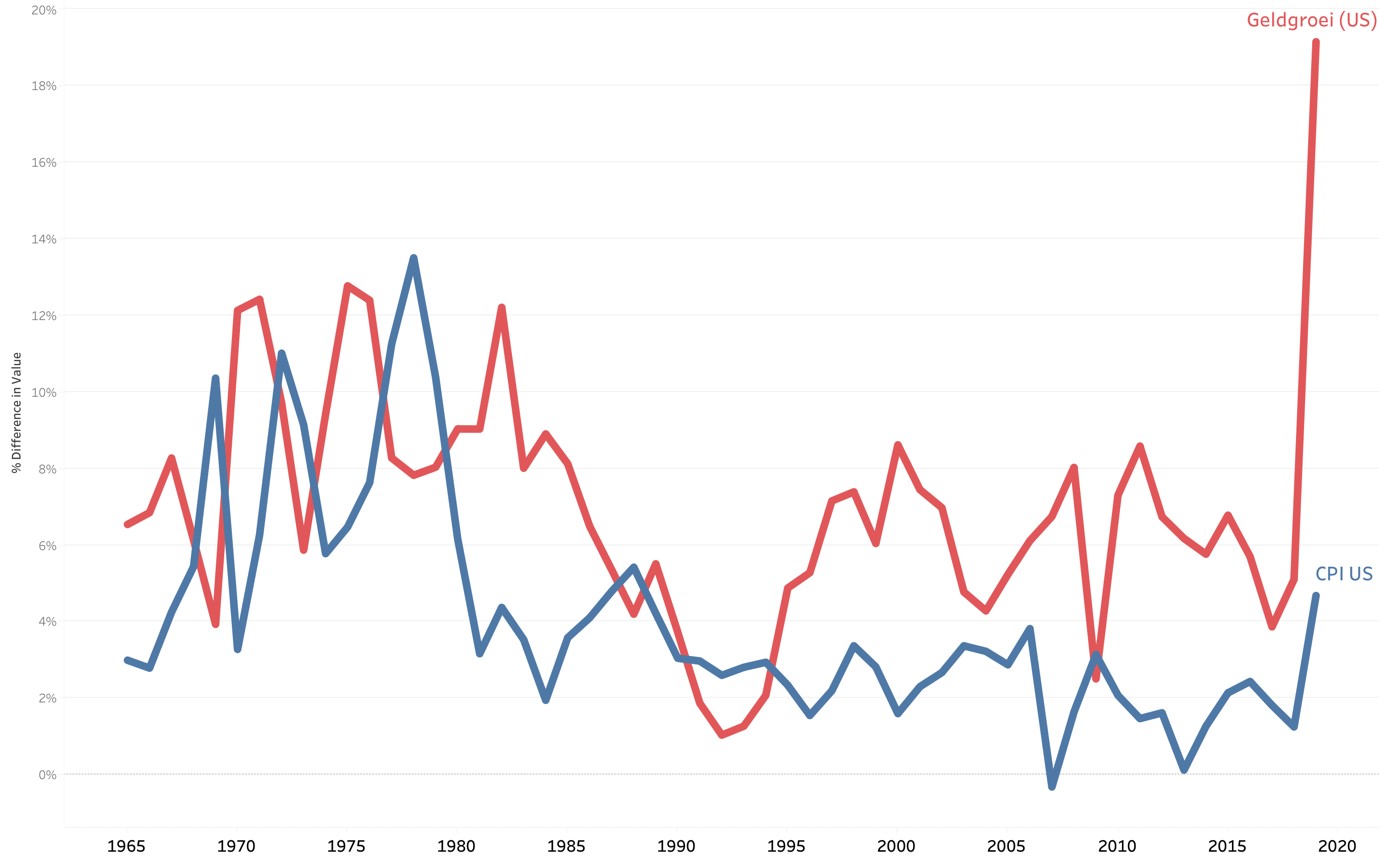

2021 will go down in history as the year of soaring inflation, which central bankers said they did not expect. Below is a chart showing the growth of the money supply and inflation in the following years in the US since 1965.

Money growth (M3) and inflation US

This classic relationship between growth and inflation is literally the textbook example that an economics student is taught. If a lot more money is being pumped into an economy than is needed to make goods, growing inflation is the result. The 1970s are a good example, as this graph shows. And if a huge mountain of money is added to the economy as happened in 2020, – in the middle of a pandemic, where world trade is already seriously disrupted (it still is, by the way) – one should not at all be surprised that inflation will start to derail.

However, central bankers were surprised: Fed Chairman Jerome Powell stated that this was ‘not in his models’ and also Klaas Knot (Dutch CB) said that he ‘did not see this coming’. Christine Lagarde made matters worse by simply ignoring inflation: “the lady is not in for tapering” was her mantra. Just keep on buying up government debt and create more money.

There are other economists who argue that especially in times of high money growth and inflation, one should take risks and invest more in shares. People sometimes point to the 1970s, which is astonishing. It was precisely during this period of growing inflation and money-growth that the stock market was trumped by poverty: the Dow Jones Index zigzagged enormously and stood at both the beginning and the end of that decade still around 1000 points. The major bull market only occurred thereafter, when inflation and interest rates started to fall.

Perhaps this 60-ties period also explains the concerns of one of the best-known strategists from my younger years, Byron Wien. This former Morgan Stanley star is now 88, but still popular among analysts on Wall Street. Byron Wien thinks the market underestimates the impact of the Fed tightening on the stock market and predicts a correction of about 20%. Anyway, he lived through the 1970s. I only saw the tail end: after those 10 years, pension funds were so tired of their bad results that they sold their shares one by one. And the last one (so I was told) did so in the early 1980s, when I first took office.

I write on purpose about the sad sentiment at that time, because it is precisely now that ‘sentiment’ is playing up again, with all the speculative aspects that go with it. Soon the money tap will be turned off and money will no longer be (almost) for free. That will take some getting used to, also in stock markets, because for years free money was the norm: it formed the basis for high valuations and the eagerness of the investor to be fully invested as a result.

We are not, neither in equities nor in bonds. Perhaps I had and still have too much faith in central bankers that they will eventually do what they were hired to do in the first place, which is to preserve the purchasing power of the money they have put into circulation.

If they do not act, stock prices will continue to rise, but the disruptive effect of inflation will also increase in strength. It is not only for the rich that central bankers bear the greatest responsibility, but especially for the less wealthy part of the population that suffers relatively most from rising inflation. You only have to glance at your gas bill or at Turkey or Kazakhstan to understand this. Without an adequate interest rate policy there will be no currency stability and inflation will not be fought. So let’s hope that we have now seen the worst of energy price increases and of corona and of the still blocked-up ports on the coasts of China and the US.

The peak of the inflation wave might then be near, but companies are likely to pass on all the increased costs to the end consumer. At the same time, employees will ask to be compensated in their salaries. Perhaps it will mark the start of a price/wage spiral…

In this new year, we will continue to make your investment portfolio more sustainable and thus further shape our responsible investment policy. We will continue to develop alternatives to traditional low-yield bond investments. For 2022, Consumer Loans are on the agenda, with which fairly stable yields of 6-8% should be achievable. And in our Private Debt program, our fifth feeder is planned this year.

Last, but not least, we will take steps in the field of theme-investing: responding to mega trends in all kinds of innovations and changes, be it technology, climate, energy transition or demographics, to name just a few examples.

With that perspective, I wish you a prosperous and healthy New Year.

BY: WOUTER WEIJAND, Chief Investment Officer