Finally, after nearly a year of excruciatingly soaring inflation rates, Fed Chairman Powell threw in the towel. The ‘temporary’ aspect of inflation was the confusing issue and probably not entirely true. Also the labour market had become so much tighter that continuous liquidity support for financial markets had to be phased out more rapidly. Officially the inflation target is 2%+, but inflation soared to 3%, 4%, 5% and recently even over 6%. US politicians also began to worry, including Treasury Secretary and former Fed Chairman Yellen. Continue to still pump many billions a month into the market? Money for which there is and has been insufficient production of goods for a long time? That would only make inflation worse and that realization has finally sunk in.

The Fed will therefore reduce liquidity support more quickly, so that it can also introduce an interest rate hike sooner. The market has to get used to this, after all, it was quite nice, borrowing money almost for free… in fact, what I am arguing is that, given the recent inflation rate increase, you have been borrowing for a while at a real interest rate of -4% or even more. So now we need to get out of this bubble and away from the bubbles blown by central banks and over-generous governments.

Does the ECB see it this way too, with screeching inflation in Germany of 6%, now 5.6% in The Netherlands and an European figure of 4.9%? Do not count on it for the time being. Currency markets judged imminent interest rate hikes unlikely and so the euro fell sharply against the dollar last month. The again increasing number of Covid infections did not help Europe’s cause either.

Corona variants come and go and whether they have a major economic impact or whether they result in a smooth adaptation of the vaccine, cannot be judged directly. But it does not cheer us up as the virus travels quickly all over the world and locks up countries again.

Super stimulative monetary policy is over

In any case, what remains is a different monetary policy, that is what the Fed has now indicated and thus it is more important to markets than the virus. Perhaps the easy money-making, the speculative character which had crept into parts of financial markets, is now a thing of the past.

Last month we lowered our equity weighting again, fortunately just before the recent price corrections. But at the same time we realize that our caution came too early this year. After all, we were counting on much more action from central banks to fight inflation. Normally, these should occur at the earliest possible stage to prevent inflation. But action is only now starting, slowly. And only at a rate of inflation which may well be at its peak right now, given the recent decline in commodity prices? It would not surprise me, because there are already some traders who seem to have thrown in the towel. But at the same time, previous price increases have long since made their way through semi-finished and finished products to the consumer.

And how are consumers reacting to this substantially rising inflation rate? Exactly, by sometimes throwing in the towel when purchasing expensive things. Strong inflation affects consumer confidence: figures in the US and Europe point to this. Ever-widening price hikes really hurt the wallet. The risk of stagflation, i.e. stagnating spending with rising prices, is still there. The new virus variant also plays a role in this. After all, various markets and ports are sometimes locked for a while, so that the backlogs in goods deliveries are still not resolved.

This uncertainty is reflected in the increased volatility in financial markets: there are relatively large price fluctuations in the bond market, the equity and currency markets, and certainly also in the commodity markets. Could that spike also indicate slowing growth in China as largest consumer of commodities?

Development of commodity prices

Flight to safety

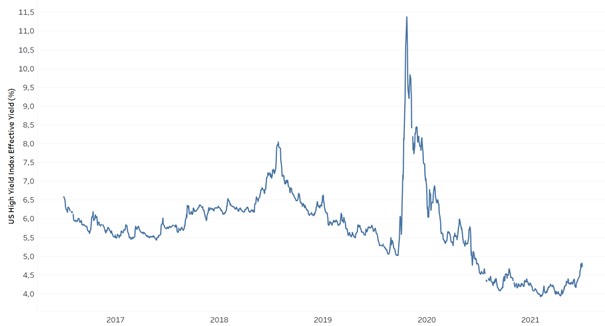

Credit risk, which was recently estimated to be low in the High Yield market, has increased and interest rates on these corporate bonds have risen, albeit from a low level. We are also defensively positioned here, with short maturities.

Interest rates on High Yield bonds (US)

Likewise, there are indications in stock markets that over-optimistic hedge funds have seen their positions turn against them and have had to close them suddenly in favour of government bonds. Another example: central banks in Emerging Markets have already implemented many interest rate hikes recently. The market thus shifts from “risk on” to more “risk off”. The long-standing safe havens, such as the yen and the Swiss franc, were also in demand on foreign exchange markets.

Investors have become more nervous and are either side-lining or looking for safe havens, where some measure of inflation protection is offered. Infrastructure is a good example of this, an area in which we are also invested. It is not spectacular, but at 6-7% per year in normal years, we made the right choice… you can still come home with it. Markets will have to adjust to a new phase, in which free money will gradually become a thing of the past and in which excessive risk, leverage and speculative behaviour will no longer be automatically rewarded.

So is it up to us to throw in the towel? No, definitely not. We are careful with stocks, but always look for opportunities. Likewise with (we see that again these days in) Private Debt investments. We also see attractive opportunities to invest in Consumer Loans and we are the process to select the best candidates. With 6-8%+ net returns combined with an enormous diversification in credit risks and flow interest rate risks, we see good opportunities for the somewhat longer term. Because these kinds of returns are not readily available in every asset class.

For now we wish you already a Happy Festive Season and hope that in spite of the many restrictions, you can all still get together, surrounded by family and friends.

BY: WOUTER WEIJAND, Chief Investment Officer