This could be an account of a first boring summer-month. Do I hear ‘’summer”? When I step into the municipal outdoor pool early in the morning, it turns out to have cooled down considerably due to the rain, to about 19 degrees. I would have been better off stepping into the North Sea at around 22 degrees. Or just the North Atlantic at 24 degrees. Off the coast of Ireland alone, the water is already 5 degrees warmer than normal. At the Med, you dip into a hot 28 degrees, but that is nothing compared to the sea off Florida, at 38 degrees, 7 degrees more than its normal maximum. With these temperatures, virtually all climate deniers are silenced. We can no longer look away. At the same time, some holidaymakers have to flee from areas which are ravaged by extreme weather. We all gladly accept a few extra weeks of rain at home.

The climate is changing much faster than we ever thought, the records are staggering, but the earth just keeps spinning and financial markets had a good month, however trivial this may sound. Inflation figures were not too bad at first, especially in the US, but later became slightly disappointing, this time in Europe. Both the Fed and the ECB raised money market rates by 0.25%. Both added that another 0.25% might be added. No certainty here. Their monetary tightening is now largely behind us, though. Equities reacted positively to this, but what did bonds do? For this, please note the chart below, showing how yield curves of German government bonds changed in July.

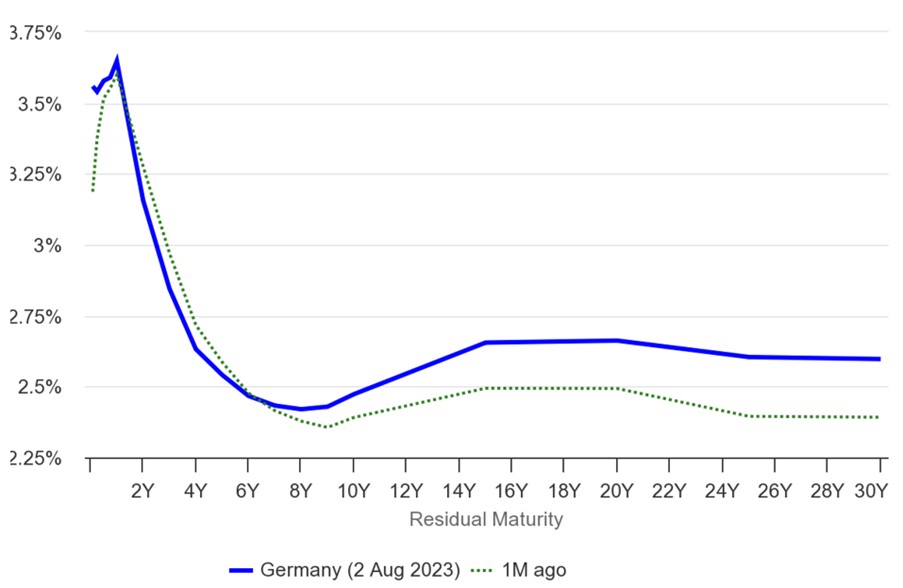

Yield curves Bunds on 1 July and 1 August 2023

While short-term rates were raised by Central Banks, interest rates on 2-5-year bonds fell slightly, but interest rates rose on bonds with maturities of 10-30 years. So, you made a little money on the short side, but collected price losses, rising to 4% for the longest-dated bonds. The yield curve became slightly less inverse, but at 3.7%, the shortest yield was still over 1% higher than the longest yield. You will understand our reluctance to exchange short-term bonds for long-term ones. Not only is the immediate yield a lot lower but should the yield curve return to a more normal, steeper shape and short rates stay at this elevated level for longer, substantial price losses await us on the long end. But then we are well positioned for that.

There were also two other developments, which played into our hands last month. Not the slight underweight in equities, as the market remained positive, but the recovery in US banking stocks. Most of the concerns surrounding the US banking system are now behind us. Profitability also turned out to be better than expected when second-quarter figures were released. As might be expected, interest margins (globally) rose on rising rates. At the same time, the banking sector did become a bit more cautious in its lending.

The second factor that helped us last month was the recovery of Emerging Markets and especially the Chinese stock market. Not that we are crying hosanna here, as economically things are certainly not yet going crescendo in China. However, hope springs eternal and it is that hope of government stimulus that brightened the market. China’s housing market is still a problem. How the government intends to turn the tide here is not yet clear, although it would like to lift the investment climate around housing a bit.

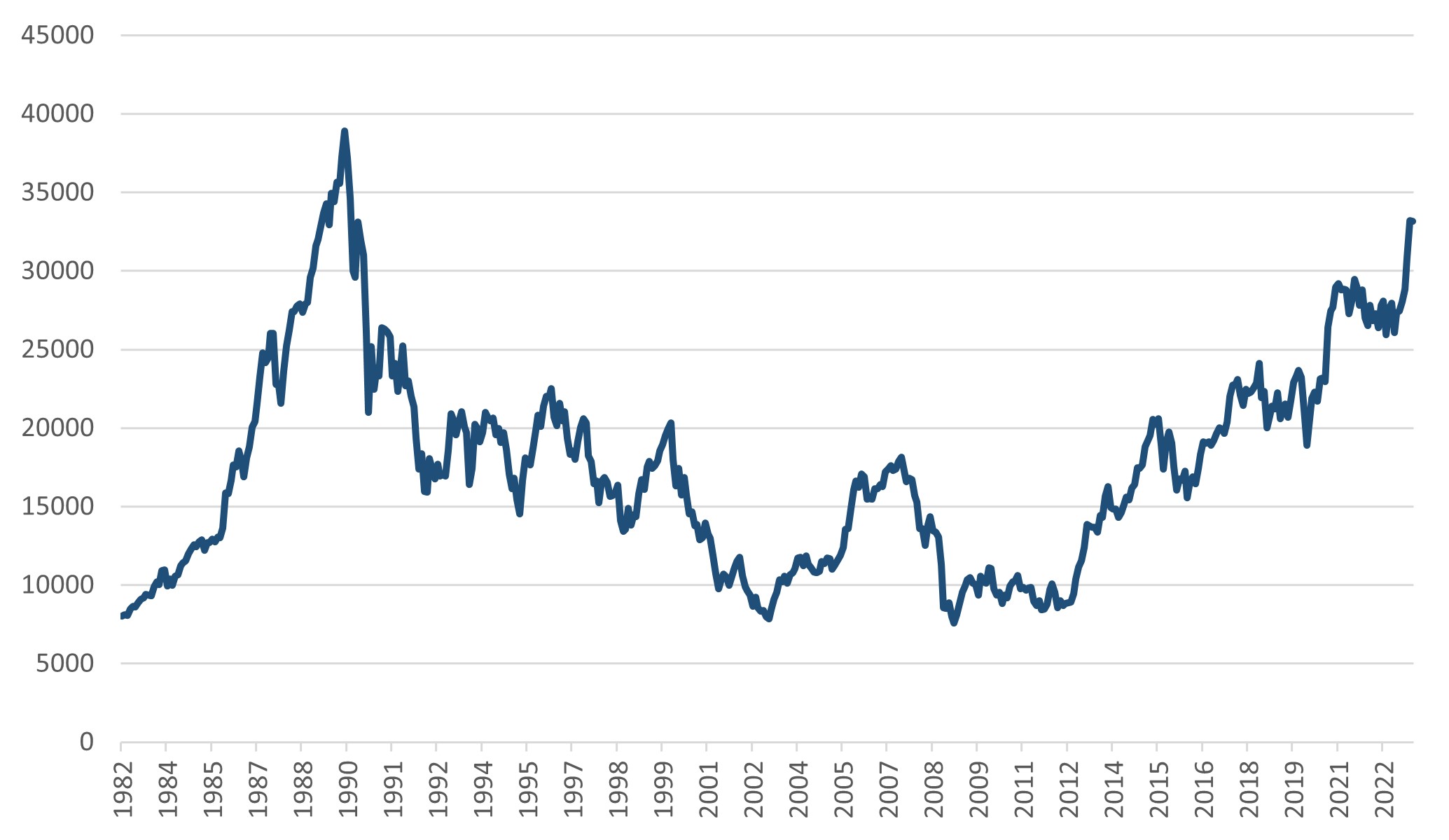

And then there is the land of the rising sun, Japan, which finally wants to let interest rates rise. Bit by bit but abandoning a fixed rate of 0.5% on 10 year government bonds already feels like a minor revolution. The new limit now comes in at 1%, still too low, I suspect, for the weakened yen to recover. But a step in the right direction to gradually halt inflation (now around 4%). For that, money market rates will have to be raised anyway, as they are still just below 0%. As with many things in Japan, this will require a bit more patience. Patience, which, by the way, proved to be a virtue in the Japanese stock market. Below is the chart of the Nikkei index in long-term perspective. We are still not back to 1989 levels, but the recovery in recent years has been impressive. With a separate position in a Japanese index tracker, above the weighting Japan has in world index trackers, we also participated in this.

Nikkei index 1983-2023

With that, the drama of Japan, whose stock market value in the 1989 bubble accounted for about 45% of all global equities combined, seems just about over after a lot of patience. Perhaps that is also the lesson for China: property-based bubbles take longer to recover than one often thinks.

Finally, I look at our illiquid investments, which are gently chugging along. On the fixed-income side, they are keeping up with government and corporate bonds; on the equity side, things are not so smooth. Here, it is the US stock market, the Nasdaq in particular, that is dwarfing private market results. It seems that despite further interest rate hikes, the Federal Reserve has yet to get a grip on the US economy. In Europe, the economy is already slowing down considerably, but in the US, consumer confidence is growing again with a tight labour market and rising wages, and even the housing market regained some optimism. Should we be happy about that or will the Fed soon feel the need to tighten even more? It is questions like these, which do not yet make us completely enthusiastic about this stock market. So, we are not yet giving full throttle.

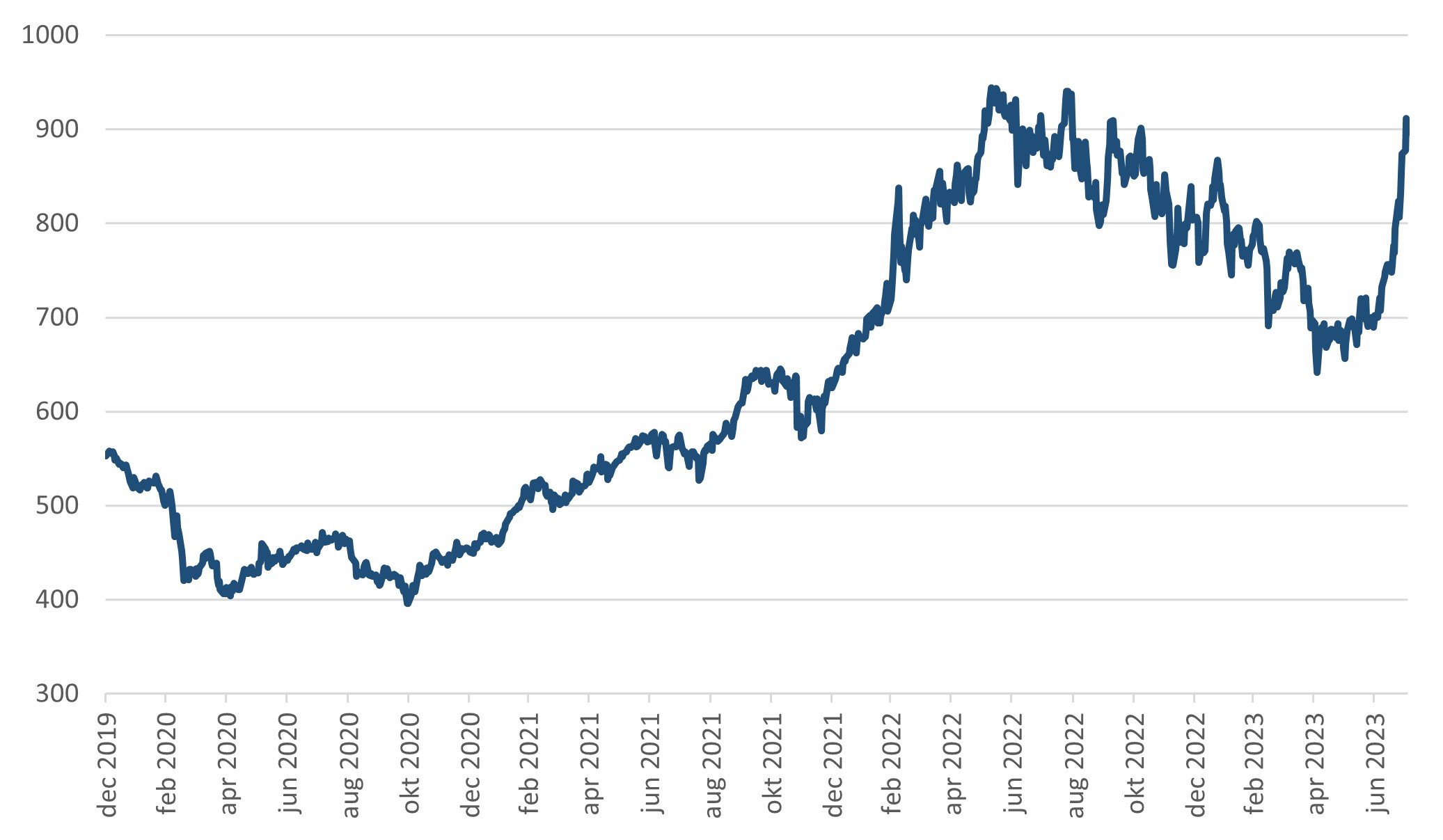

By the way, below is a chart of what it costs to throttle up: internationally, petrol prices are surging again: oil prices are rising, but there is also a lack of refining capacity. Soon, the figures below will also resurface in inflation figures, as the year-on-year comparison has now turned positive again.

Petrol prices US 2020-2023

Of course, this is only child’s play compared to gas prices that first went up tenfold and then went down 90%. This contributed significantly to the drop in inflation. Meanwhile, European gas stocks have also replenished considerably.

Now some rest in the supermarket, where prices are still increasing by 10% a year. The question is whether unions will continue to play leapfrog again and make corresponding wage demands. For now, all we know is that central banks will not budge and keep interest rates high. They will probably complain about it in the coming year, but they have been in tougher spots before.

Not us, for that matter: every year the wildfires get hotter, the seas warmer and the storms wilder. Officially, we have climate targets to meet by 2030, 2040 or 2050. But Mother Nature ‘naturally’ does not care about that. We have acted too late, it feels, and we are being punished for it. The climate is changing before our very eyes, at a pace that can by now be called spectacular.

Whether and how this may start to affect the climate in financial markets is a question we will have to think about more.

BY: WOUTER WEIJAND, Chief Investment Officer