Inflation rates fell, while interest rates rose sharply in September. The explanation is possibly because statistics look back, but markets look forward. The oil market, which is important for inflation, looked tight and prices rose sharply. That price rise has yet to feed through to the rest of the economy. And even if inflation now falls a little, central banks will persevere and keep interest rates firm for a long time in their attempt to curb inflation. 10 and 30 year government bonds rose over 0.4% in the US, and it was not much different in our case. This rise will affect mortgage rates (I already briefly saw 6% for 30 year in the Netherlands and 7.75% in the US) and house prices, which seemed to recover for a while. The rise in interest rates will also slow down construction and generally cool the economy further.

But what does it do to the value of different asset classes? Bonds and equities both lost 2% last month. Real Estate stocks – which we did not own by the way – sank 4% globally. In addition, the effect of a rise in interest rates on illiquid markets shows a mixed picture: private debt has mainly floating rates, so here the coupon receivable rises along with the underlying money market rates. In private equity, rising interest rates make the financing costs of an acquisition or buyout deal more expensive. Thus, it reduces the value of the private equity. In Infrastructure, investments become more expensive because of the higher interest rates whether they are wind farms or power plants. Yet these higher costs can often be partly passed on in higher sales prices of energy carriers.

Ultimately, higher interest rates are fun for almost no one, except savers and short-term bond holders, who will soon be able to put their money away at higher interest rates. Certainly, that includes our clients. But this happens mostly in an already struggling investment environment. Was there panic last month, with parties insisting on getting rid of their investments? No way, it was a gradual, quiet sell-off with some exceptions. Oil stocks being the exception to the upside.

Perhaps the most striking development last month was the decline in support for climate plans in Europe. While we ourselves are having internal discussions on how to shape a greener footprint of investments, European leaders are taking their foot off their climate-friendly accelerator. With Frans Timmermans gone from Brussels, other parties are smelling an opportunity. After us the deluge?

Moreover, elections are approaching in a number of countries, with citizens’ favour being sought, often with lower petrol taxes (the Netherlands and Sweden) or a later phase-out of petrol and diesel cars (UK). People have also suddenly become a lot milder about farmers and the desired nitrogen transition. Or are state finances now lacking to implement all these ambitious plans?

After the hottest summer of all time, the worst fires worldwide and a series of impressive storms and floods, climate change denial no longer seems possible to me. Neither delay nor postponement of sometimes painful measures therefore look unwise and implausible.

In any case, we will continue to make your investments more sustainable, also because by doing so we want to reduce the risk of stranded assets (e.g. oil refineries, coke-fired blast furnaces) and the associated capital loss over time. Over the next 12 months, we will start informing you more frequently about the steps which we will take to broaden our responsible investment policy. Reducing CO2 emissions to combat climate change is an obvious objective here. Without losing sight of your financial objectives.

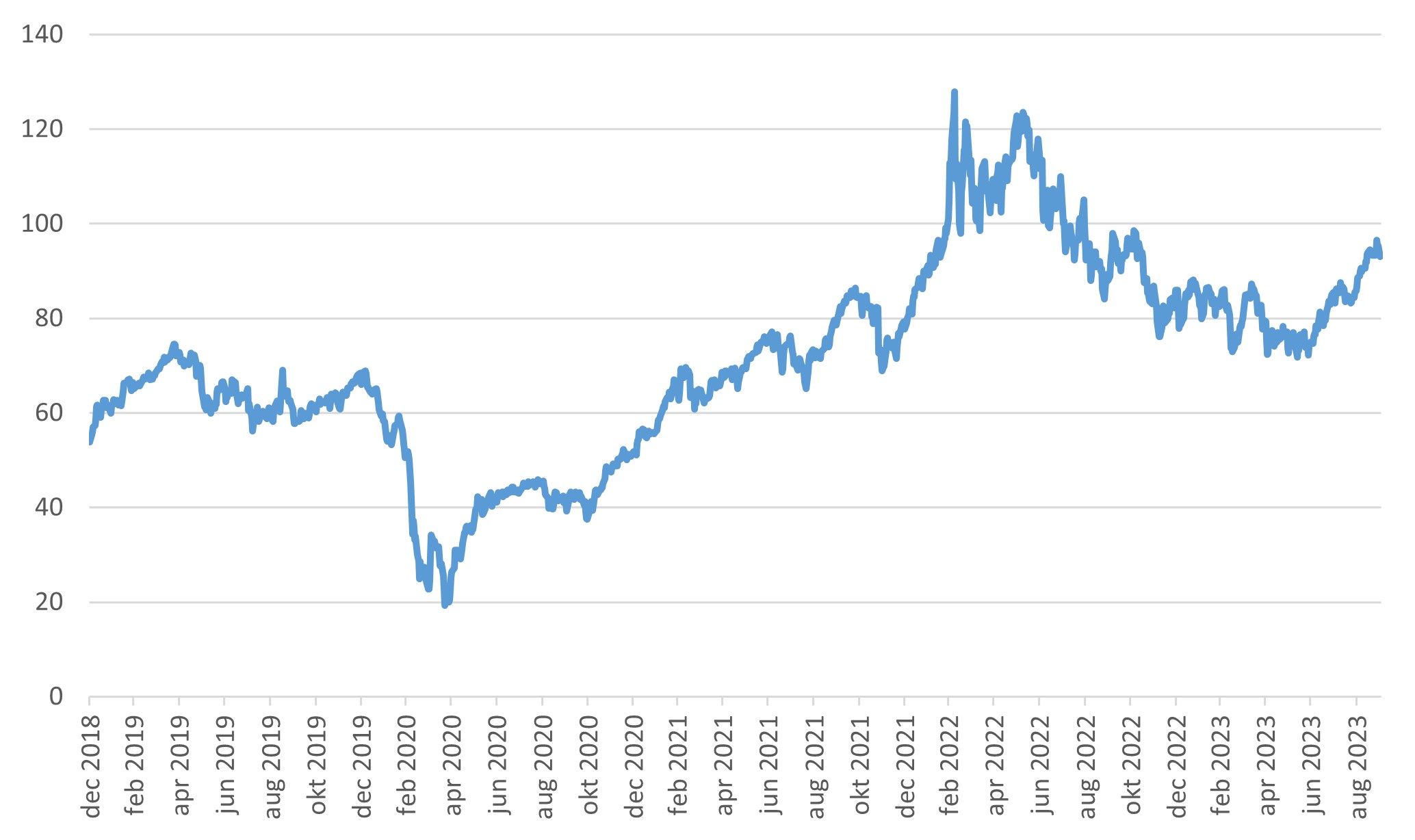

Oil prices (Brent), in US$, since 1 January 2019

But in doing so, is it not paradoxical that just now the oil price and thus oil shares are soaring again? Oil stocks are too low in the face of (disappointingly!) high demand and OPEC’s tightened supply, precisely to boost the oil price. However, from an investor point of view, let’s take that as a windfall, so we may soon be able to reduce or unwind climate-unfriendly investments at better rates.

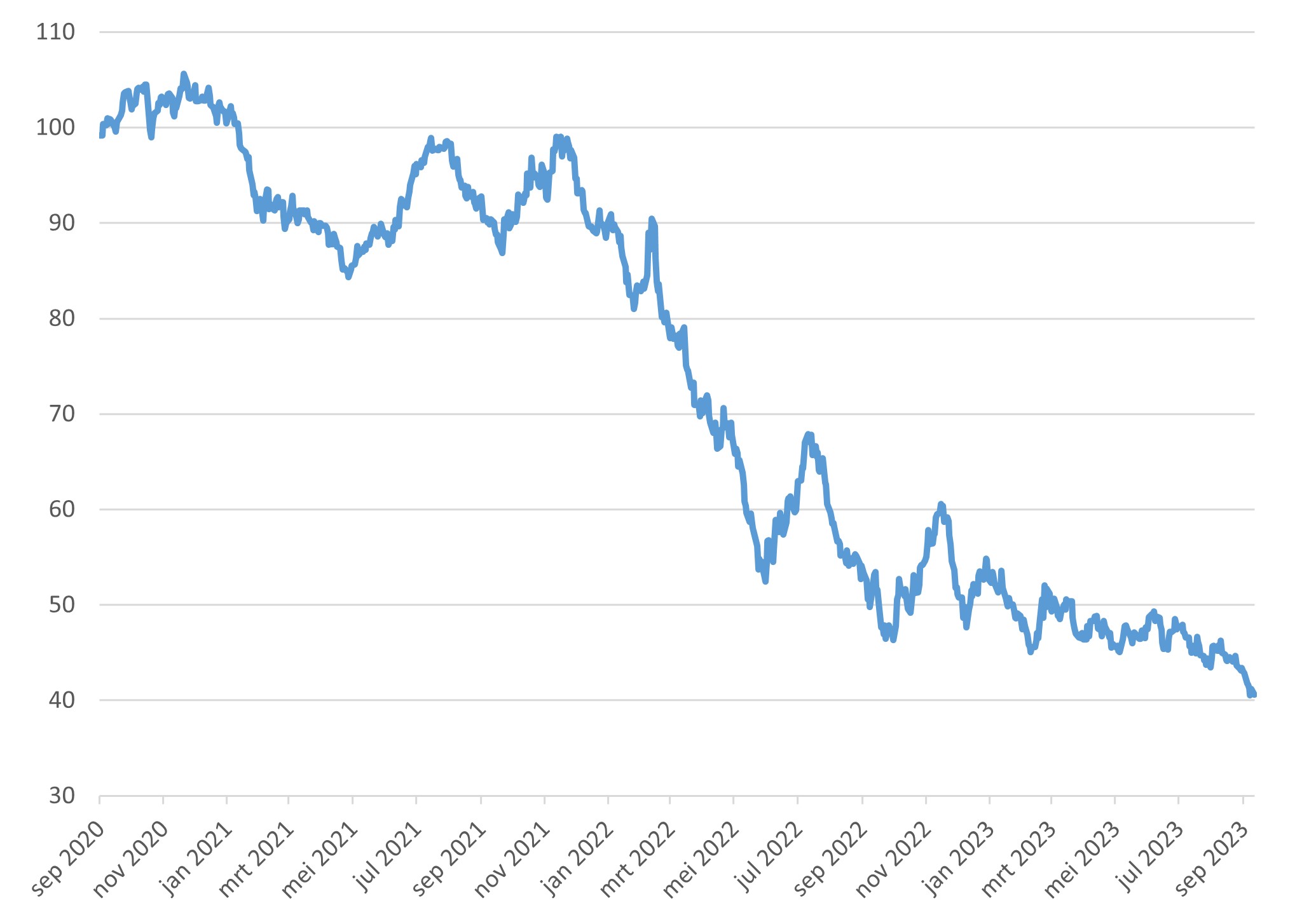

So far, we have mostly reduced financially risky investments, such as long-term bonds. For instance, I would call the 30 year Dutch government bond with a 0% coupon a ‘stranded asset’. Washed up on a deserted beach after another deluge of interest rate hikes in September. Of its price of 100 about 3 years ago, 40 now remains. With the only consolation being that, despite further interest rate storms, you will get that 100 back in 2052, but all the while without interest.

Price development 0% Dutch government bond as of 15 Jan 2052, since issuance in late 2020

Wars, epidemics, stock market crashes, they are rare events, but all man-made. As a matter of fact, so is the risk of a deluge, since humans are, after all, responsible for the warming of our climate. In any case, let’s make sure your wallet stays above water.

With warm regards, from the safely dry first floor of our elevated office villa in Bussum.

BY: WOUTER WEIJAND, Chief Investment Officer