There are increasing signs of a recession in the goods sector: during the pandemic, parcels were flying around our ears. Then we were stuck and could not even go out or on holiday either. We are now catching up, but we have had enough of buying stuff for a while now. That is why many factories are now running at a slower pace. The housing market declined, so there is no need to move for a while. Furniture factories and all their suppliers notice this. So, the interest rate hike is working just by the book, after some 12-18 months. The German engine, the most important in Europe, has been showing red figures for 2 quarters now. Officially, it is called a recession, only it does not feel that way yet. After all, the labour market is tight, unemployment is super low at around 3% and wages are rising sharply. But global goods production is really in its lowest gear. We have produced too much, first we need to get rid of excess stocks and the excess(!) of jobs before we crank up the engine again.

Please note that inventories grew some 40% larger than sales (1,4x). Part from the fluctuations during the pandemic, that is about the same level as the recession in 2008.

Besides, export orders for industrial countries like Korea, Taiwan and Sweden feel back. Hence their manufacturing industries can switch into lower gear.

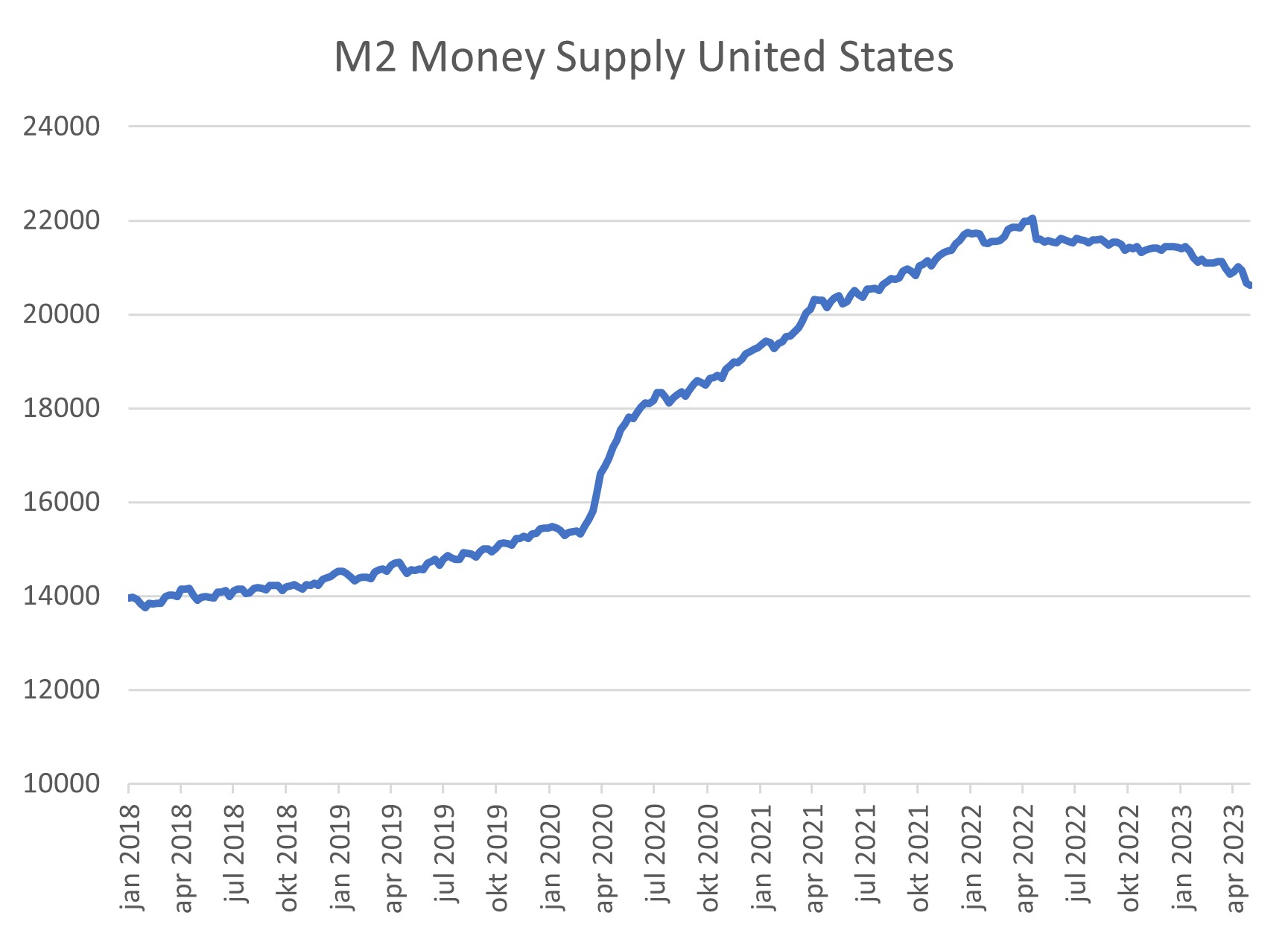

Another telling sign is the slowing money growth. Late 2021, I pointed out to you the exorbitant money growth, which stimulated inflation; now credit stalls at the current higher interest rates. Look at the chart below. Financing all this output growth in recent years required a lot of money growth. During the pandemic central banks turned the tabs wide open, but with the recent downturn in economic activity, money supply has declined..

This will also help limit inflation, especially cyclically sensitive energy prices have been falling for a while. Headline inflation in Europe fell from 7% in April to 6.1% in May. A fall in ‘sticky inflation’ will require more patience: it fell from 5.6% to 5.3%, but that was still higher than the ECB had hoped for. Especially price increases in supermarkets remain impressive at 15-20%.

Does this decline in economic and monetary activity mean that the ECB is now done with its tight monetary policy? After all, wasn’t that part of a recession, this consolation prize in the form of an interest rate cut? No, the ECB really wants to see a decent fall in core inflation first. Which is currently still above 5%. We therefore expect it to raise interest rates by 0.25% to 3.75% twice more this summer.

The Federal Reserve is in a similar situation. Here, too, money growth is falling or is already negative. The money market rate of over 5% is pulling liquidity out of the market (which is tightening), which might otherwise be spent or invested. This is the most literal meaning of tight monetary policy!

And again, core inflation is still too high for interest rate reins to be loosened already. We think interest rates could stay at this high level until spring 2024, with a chance of an additional 0.25% in between.

In both the US and Europe, citizens, unions, and companies appear to be increasingly anchoring their inflation expectations in wage demands and price adjustments. This wage-price spiral needs to be broken first, and this can be best done if the labour market becomes less tight. Continued tight monetary policy helps slow economic growth and will (unfortunately) encourage companies to shed jobs or further automate and robotize.

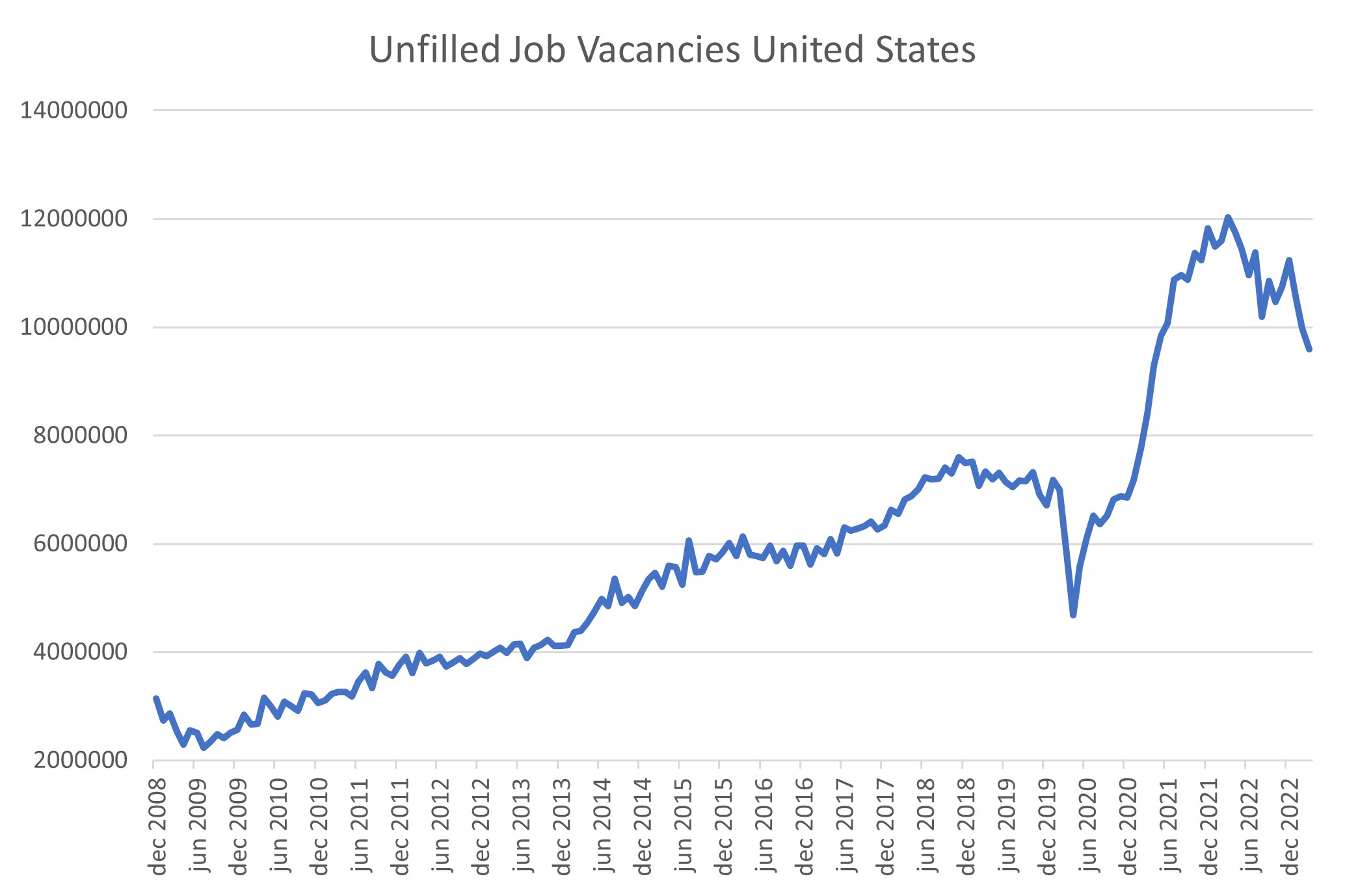

But are we shedding jobs at this point? Not really. Last Friday we learned that the US added 339.000 job in May, with numbers for March and April revised upwards by a combined 93.000. What’s more, vacancies grew again to over 10 mln, although that is not yet reflected in the chart below.

Now you will understand that the Fed’s concerns about a lengthening wage-price spiral have not vanished. Wage growth may have slowed to 4-5% recently, but with so many open positions, employees may be able to squeeze out higher wages still.

So the economic picture is mixed. But even when we’d be moving towards a recession we won’t even get an interest rate cut soon. This is not fair. And won’t we also get a fall in share prices? That would be a much nicer consolation prize. Equities, especially the big Tech names in the US, have already shown quite a recovery thanks to the hype in AI (Artificial Intelligence). Unfortunately, there is no AI system yet, which teaches us whether the P/E ratio at, say, NVIDEA should be 20x, 50x, 100x or 175x. But you already feared the right answer: NVIDEA is indeed quoting close to 175x earnings. At least now. So no, this is not what a recession looks like. Usually, P/E ratios or profits or both decline.

In China, unfortunately, it does go by the book: economic activity slows, earnings expectations fall and share prices fall equally. Ultimately, it is also a matter of sentiment. For instance, for a long time, European stock markets were blazing with enthusiasm for luxury fashion houses LMVH and Hermès: demand for their goods and shares seemed unstoppable. Until last month, when it became clear that the economy could be in a downward spiral: their share price fell significantly in a few days. Something you would not have understood using AI. Stock markets are fickle, they are after all the playing field of human behavior.

The bottom line is that one usually only sees a recession when you are already in it. We had already unwound some equity positions, also because we did not find the mess around the US debt ceiling very confidence inspiring. While this now seems to be ending well, a boom is not yet in sight. We remain defensively positioned through Infrastructure, Private Debt, Factoring, Consumer Loans and short-term corporate bonds. And hope to take some more interest rate risk at higher interest rate levels.

Finally, I did a little AI test on the Shutterstock photo site: what does a recession look like, I asked the AI function? This was the photo, which I was presented with:

Quite original, I find, an empty car park, but not necessarily really fitting. But we too are delving into AI and how it can benefit you and us. Without too high expectations, by the way. Investing alone is hard enough.

BY: WOUTER WEIJAND, Chief Investment Officer