Last month was quite turbulent in financial markets. There was fear of banks again, just like in 2008, but was this Pavlov reaction justified, this flight out of equities, into government bonds? Suppose you set up the Bank for Bakers and all the bakers come and bank with you. They deposit their savings with you and borrow money from you. For years this goes smoothly, but then suddenly grain and gas become more expensive, and all the bakers withdraw their savings to meet their needs. Then your Bank for Bakers will soon be belly-up. After all, every bank is set up to repay everyone’s savings if we do not all withdraw our funds at the same time. Because our bank-savings are of course tied up in loans, mortgages and other investments.

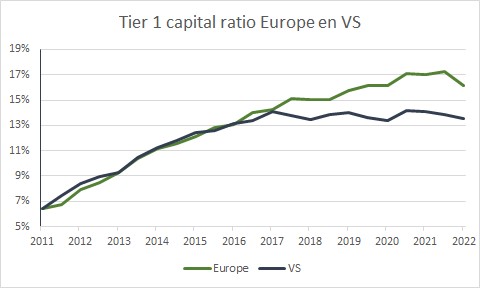

By the same token, it makes no sense to be the bank for all Venture Tech companies in Silicon Valley. Rising interest rates caused this entire sector to run dry financially and withdraw its savings en masse from the eponymous Silicon Valley Bank. Stress and fraud in the crypto world did the same to Silvergate Bank, just about the only crypto bank. At Synergy bank in New York, there appeared to be a criminal investigation going on from the SEC, so that did not help either. On the other side of the ocean, Credit Suisse had been in trouble for years. But does that mean there are structural problems in the banking industry? No, to the contrary as bank balance sheets improved significantly after the 2008 woes at the behest of regulators. See the chart below showing the difference in equity of banks in Europe and the US during the last 12 years. There really are serious buffers in the banking system now.

However, a bank exists by the grace of sound risk management. Especially a well-diversified funding and lending position is crucial. If you concentrate purely on one customer group, you will almost certainly go under one day. Of course, politicians will then call for stricter regulations, but firing a few regulators, as a columnist suggested last week, could make all the difference. It was not all that complicated: it should simply have never happened.

That was the US. In the ensuing turmoil, the weaker brethren elsewhere must suffer. By the way, one should consider this “taking the rap” quite literally: Credit Suisse, the already scandal-plagued bank, was ‘fleeced’ by about 10 billion Francs a day. So much drain on customers deposits took place that the central bank had to intervene and designated UBS as the saviour. As a result, it had a very favourable negotiating position and got Credit Suisse for a trifle, including state guarantees, should any more bodies fall out of the cupboard.

Problem solved?

Was this it then and are we now out of the woods? Not quite yet, although things have calmed down a lot in the meantime. It would help if the US deposit guarantee was raised further. While Treasury Secretary Yellen did indicate that she would do all that was necessary to ensure banking stability, in fact, she still hopes that this far-reaching step will not be necessary. Time will tell. We think the worst is behind us and America will not let its regional banks fall. We have therefore put a few percent of our equity weighting into a tracker of US bank stocks, which had fallen by about 35% since last summer. Confidence comes on foot and goes on horseback, so it may take some time for those share prices to recover.

Flight to safety?

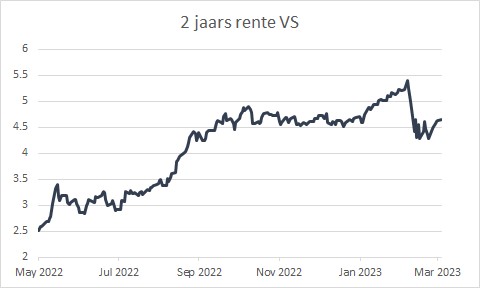

Meanwhile, the turmoil surrounding banks reminded the market, however unfairly perhaps, of the 2008 banking crisis. And that Pavlov reaction led to a (temporary) flight to government bonds worldwide. For instance, some 1.3% went off the 2-year US government bond yield and interest rates fell sharply in Europe as well. But now that the dust has settled, these moves have been corrected somewhat, although an interest rate drop of about 1% still remains. For 10-year government bonds, that drop is only 0.4%.

Core inflation is the worry

Central bankers made it clear that their fight against inflation continued: so they added 0.5% in the eurozone and +0.25% in the US. This led to money market rates of 3 and 4.5% respectively. Perhaps the US will stop at 5% and Europe already at 3.5 – 4%, but the ECB is not quite ready yet. Energy prices have already fallen (though the oil price is back up again), but food prices (+15% here in Europe) keep on rising. Also worrying is the wage growth of around 7% in Europe and around 5-6% in the US, which after all continues to fuel price increases. Even if central banks did not raise interest rates further, I do not see them lowering them any time soon. For this to happen, core inflation, currently still hovering around 5%, will have to fall much further. We therefore keep an emphasis on short-term maturities in our fixed-income investments. After all, real government bond yields, i.e., adjusted for inflation, are still negative.

Buy the dip

As the flight into government bonds reversed, sentiment in equity markets also recovered. “Buy the dip” is perhaps the most famous Pavlov reaction in financial markets. Most losses in equities, outside of banks, were recouped by the end of March. If you only looked at the opening and closing prices of last month, one would almost think it was a boring month.

Yet there are a few other issues at play in the background. Large investors such as pension funds suffered hefty losses on publicly tradable, liquid assets such as stocks as bonds last year. This means that in their asset allocation this year, they have too few stocks and bonds in their portfolios and often too many illiquid, private assets. Newly deposited pension contributions will therefore go mainly to equities and bonds this year, to boost their fallen weight in portfolios. This increases the likelihood of such a “buy the dip” effect.

Self-fulfilling prophecy

Does this mean we are embarking on a new bull market, like the Nasdaq stock market, which is already +20% higher than its December ‘22 bottom? It is possible, but it seems a bit premature to me. While initially there was only talk of layoffs in the Tech sector, we are now reading more and more about reorganizations and rounds of layoffs. Companies are preparing for a more austere economic environment. I suspect investments will often be postponed. The stronger that continues, the more it will be a “self-fulling prophecy”. That way, you take the pressure off the tight labour market and the wage-price spiral can be broken. This is also exactly what central banks have in mind before they want to loosen the interest rate reins again.

Can the downturn in labour demand really go hand in hand with a “soft landing”, as central banks hope and often pronounce? It is possible, but it seems challenging and involves quite a bit of luck. Unemployment will rise, consumer confidence will take a hit and tax revenues will also slow a bit. How much corporate profits will slow is still hard to predict. After all, many companies still seem able to pass on their increased (wage) costs in higher prices. However, let us not forget that it usually takes 12-18 months before higher interest rates and declining money growth make themselves felt in an economy. That period has now arrived. For us, it is reason not to get too excited, but to stay more neutrally positioned in equities.

We will not run after the stock market but hope to continue reacting to markets in a contrarian manner. Pavlov kept his little bell in front of his dog, to which the animal quickly became accustomed. In our case, a bell never rings when the stock market reaches a top or a bottom. Enthusiastic when investors seem too gloomy and cautious when it all goes a bit too fast. That is what we will try to keep doing, across the full breadth of the portfolio.

BY: WOUTER WEIJAND, Chief Investment Officer