We fought many plagues

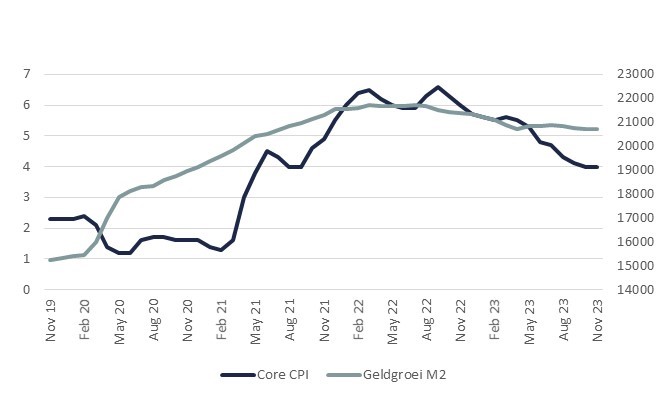

Of course, first we had to fight the pandemic. We did that spending a lot of money. Many millions of people, in the US, in Europe, in all kinds of countries, were given money without having a job. Nor were they in a position or even allowed to work. The huge growth in money, which accompanied this, made its way to factories via online shopping. However, they had major problems in supplying goods. Prices shot up, creating the monster of monetary devaluation.

After a period of hesitation and disbelief, we tackled that too, with sharp interest rate hikes. The package-insert for the prescription did state that it would take 1-2 years for the drug to work. And most important, that we had to expect some nasty side effects. And they came….

First of all, any interest rate hike is above all an expensive medicine. Buying and building houses becomes more expensive, investing becomes more expensive, all sorts of things literally fail to get off the ground. After the period of sharp price – and interest rate increases and initially lagging wages – we all became more cautious about major purchases. Thus, stocks of many products became abundant. Warehouses in ports like Hong Kong, Rotterdam, meanwhile, were overflowing. For a long time, companies could finance these stocks for a trifle, but by now interest rates have risen sharply and it is now expensive to hold stocks. So production is being scaled down. Together with the declining consumer demand, global trade is slowing down.

Only saving will (someday) become more attractive, but then you should not have other plans with your money. In fact, this is a recipe for stagnation. We tie up the money we created in abundance. We put it in the bank, do nothing with it and thus banish inflation.

Core CPI (%, left) and development Money supply M2 in the US (in trillion US$, right Core CPI)

Even the US economy is starting to cool down

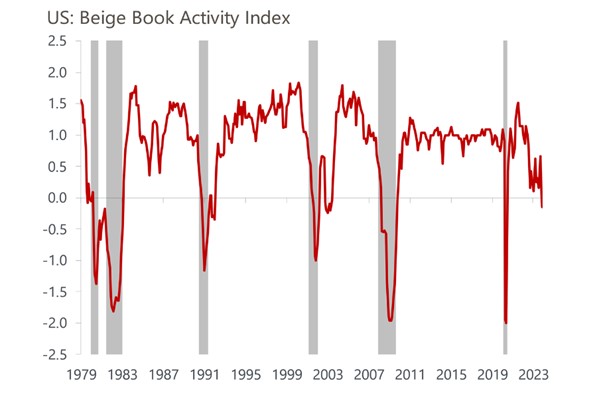

Less demand, more inventories and less production: Germany, the Netherlands, France and Sweden are now in recession. Indeed, in Europe we have the most open economies, sensitive to the slower global trade and the weakened Chinese economy. By contrast, the US is a more closed economy, more responsive to domestic stimulus. Added to that, Biden’s stimulus plans were the most massive of all. Nowhere in the world did citizens get as much money shoved into their pockets as in the US. Consequently, the US budget deficit has hovered around 7-8% of GDP for years now. In our (Dutch) case, it is usually no more than 3%. US citizens are also finally starting to cut back a bit, but the economy is contracting more slowly than in Europe. So the medicine of higher interest rates is working, but it has to compete with this deluge of free cheques. So inflation is also falling in the US, but more slowly. Soon this mountain of cheques with all its growth impulses will really be exhausted. Consequently, a recession is approaching even in the US, as the chart below also shows.

Too early for interest rate reductions

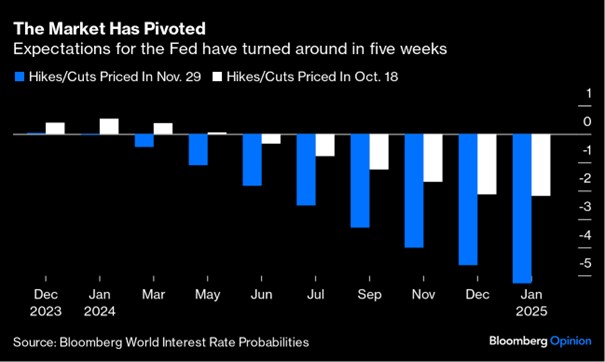

How would we manage to avoid a further downturn? Many investor hopes that the Fed and ECB will cut interest rates again soon to bring about a “soft landing” of the economy. But first of all, weren’t these major central banks much too late with their interest rate hikes? And wouldn’t they now fear being too early again, before the inflation ghost is really chased away? Let’s not kid ourselves in this regard. The main drop in inflation still comes from the decline in oil and gas prices. Supermarket prices in October in the Netherlands were still more than 7% higher than a year ago. Just as wage growth in our country is above 8% this year, more than last year’s 7%. It is not much different in most countries. I don’t see central banks capitulating that quickly yet. Despite market expectation, as shown below, of faster and sizeable interest rate cuts over the next 12 months. Whereas the market still thought in mid-October that there would only be 2-3 US interest rate cuts in a year’s time, by the end of November the market had become doubly optimistic about this.

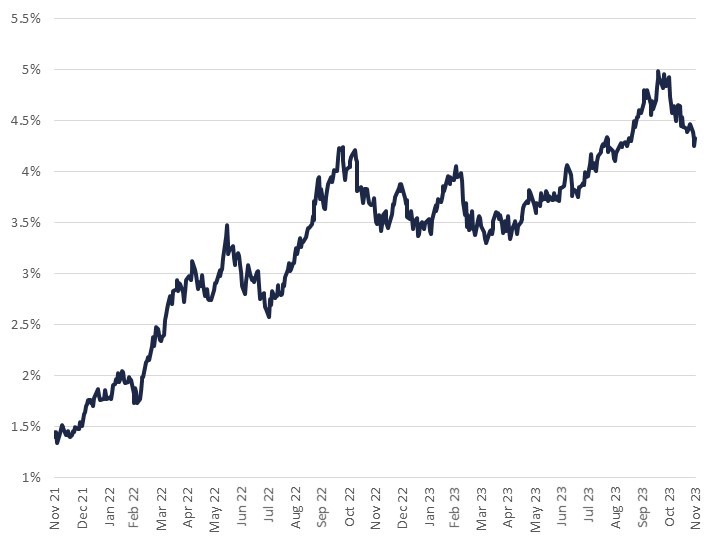

10 Year interest rate US

On top of that, the fall in long-term interest rates in itself equals monetary easing. Just as the rise in long-term interest rates from 4 to 5% in October already contributed significantly to monetary tightening in the US. This was at the time cited by the Fed as a reason to refrain from another rate hike. Conversely, a rate cut is therefore not needed at all at the moment. The bond market has already taken care of this by itself. But will this rate cut be enough to prevent a recession in the US? After all, in Europe we are already in the middle of one.

Yet financial markets cheered in November. After all, the worst inflation seemed to be over and interest rate hikes by Federal Reserve or ECB do not seem to be an issue for the time being. As I wrote to you last month, the sharply higher interest rates made us a lot more positive about the attractiveness of government bonds. We have increased our positions in both the size and maturity considerably. This led to quite a few trades. Then we were served at our beck and call, as – since 2008 – there has not been such a good month for bond investments as last November. In many cases, yields fell 0.50% to 0.75% and the global bond index jumped over 3%. High Yield bonds and Emerging Market debt also rose about 5-6% in value.

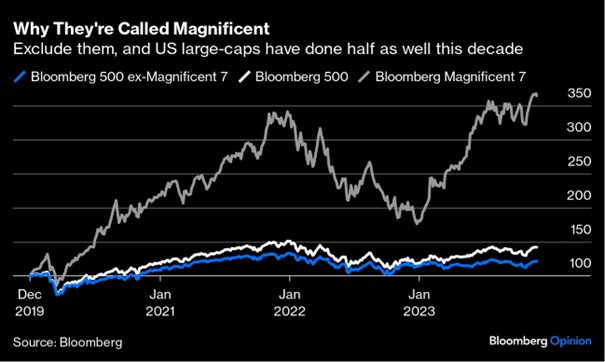

7 stocks stood out again

Only equities managed to top that result (+6%), albeit under the assumption that there will be no imminent recession. As we argued above, we are not so sure about this. Consequently, we did not participate in equity market purchases. As stocks are currently valued, there is very little that can go wrong. In particular, the 7 best-performing stocks are expensive. About as expensive as dotcom shares in 2000 and Nifty Fifty shares over 50 years ago. Apple, Google, Microsoft, Amazon, Nvidia, Tesla, Meta/Facebook were key drivers of share price gains in the US this year and contributed significantly to share price gains globally. They only need to lose a little of their shine to bring down the US stock market. But so far, that has hardly happened. So it could be that we are too cautious and these “Magnificent 7”, as they are also named, continue to rise obediently. Or will the other 493 stocks in the S&P500 take over? We shall see. Below, you can see that these 493 stocks have barely moved from their positions compared to the 7 greats.

In summary, our longstanding fear of a rate hike has given way to confidence that central banks are unlikely to raise interest rates further. We have therefore bought a lot of (long) bonds. But economic growth looks fragile in many countries and therefore we think it is still too early to get very excited about equities, especially those in the US.

On behalf of my colleagues, I wish you already now a Happy Festive Season.

BY: WOUTER WEIJAND, Chief Investment Officer