Economic complaints are raining down from all sides, often with increased interest rates as the deeper background. And yet this monthly report is titled: interest rate happy? Was this perhaps a typo? After all, who gets happy about higher interest rates? In fact, it acts like a grindstone, slowing down economic growth. Everything just goes a tad harder and becomes more expensive above all. Investment slows down, demand decreases, inventories actually increase, and prices come under pressure.

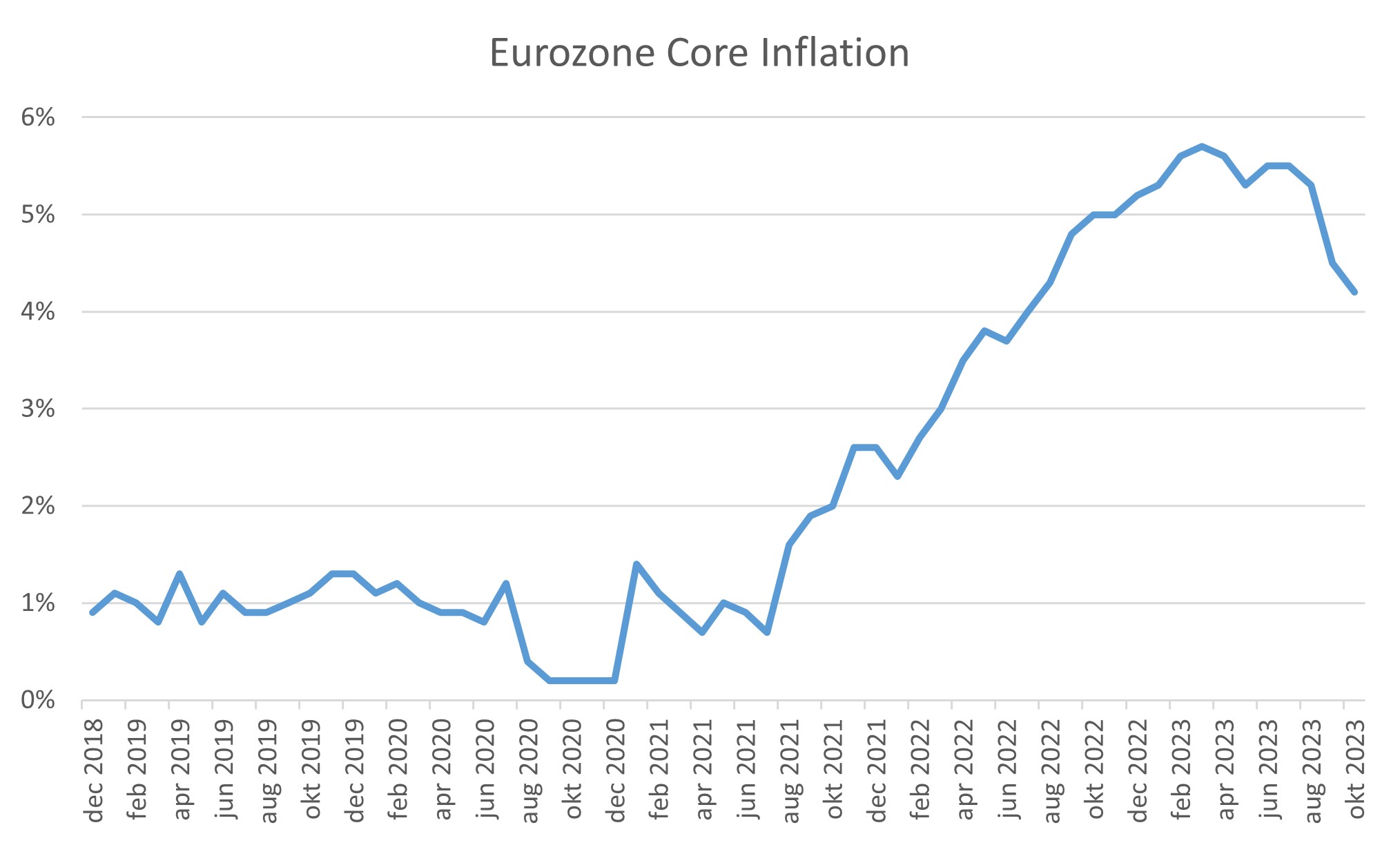

Core inflation in Europe

These developments, by the way, are exactly, as central banks wanted them to be. For companies, which already have to pay much higher wages as well, this is not very pleasant. Particularly in the most cyclical sectors, such as chemicals, paper and the temping industry, turnover is now disappointing. Meanwhile, a good part of the European economy has pretty much ground to a halt. This was also visible on the stock market. There, people have been less than happy for a few months now.

End of interest rate hikes now in sight?

For bonds, however, the worst may be behind us. Inflation is falling and central banks seem to be nearing the end of their interest rate hikes. For years, we have been very cautious with (government) bonds. The price risks were high, but the interest return on the other hand was usually lacking. That has really changed now. After interest rate hikes of 4-5%, investors are finally being rewarded for the inflation and price risk, which they have been harshly exposed to in recent years. In any case, we have decided to gradually move our strategic underweighting of interest rate risk in the portfolios towards neutral.

In practice, this means that we convert cash and short-term bonds into (medium and) long-term government bonds. For now, we choose trackers of US Treasury bonds (with the dollar risk hedged into euro), as this is where interest rates have risen the most. In the US, long-term interest rates are around 5%, in Germany and the Netherlands around 3%. At the same time, we realise that hedging that US$ currency risk also costs something. But we estimate the chances of recovery of US bonds to be somewhat higher.

Focus on government bonds

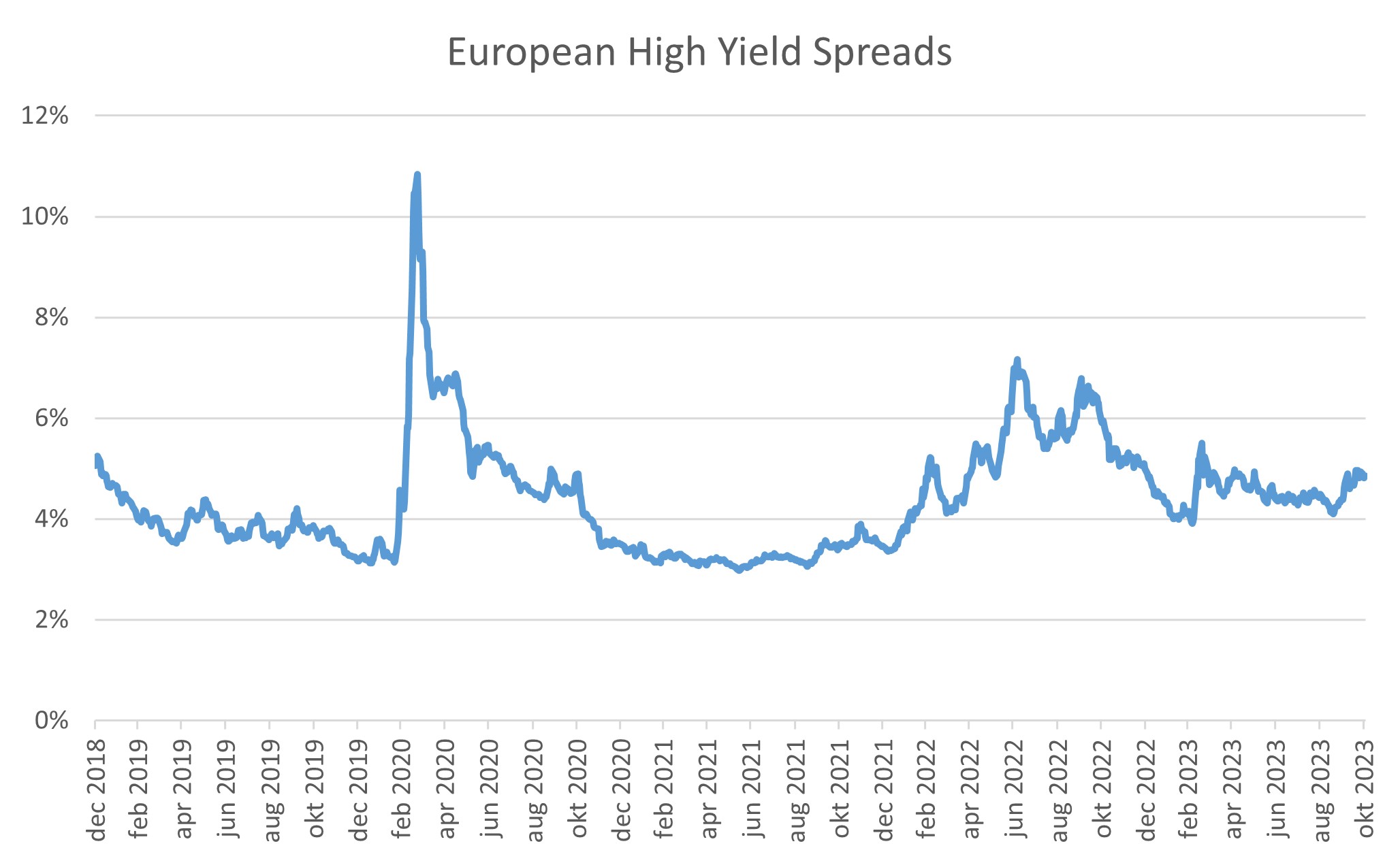

So we are making a move, for which we have been waiting for years, but only in government bonds. The additional interest rate (the spread) on corporate bonds is still quite low. There is a risk that this spread will widen if the economic climate worsens. In High Yield bonds, we already see signs of this:

Spread development on High Yield bonds in Europe

Corporate bonds with longer maturities are then especially vulnerable. For that reason, we have predominantly short-term and/or defensively positioned corporate bonds in our portfolio. Longer-term investments are therefore in government bonds. All in all, the chosen portfolio rebalancing is taking place these days.

Another major conflict

Meanwhile, many companies reported mediocre earnings figures and we found ourselves in sad geopolitical circumstances. In addition to the hopeless conflict between Russia and Ukraine, the explosive conflict between Israel and Hamas has now been added. With a risk of a regional escalation. Especially for risk assets, such as equities, this seemed like bad news to us. We therefore decided to sell 4-5% of the equity weighting and convert these to government bonds, as far as portfolios allowed. Added to the underweight position in equities already taken earlier, we are now about 12.5% underweight, mainly in the US and Europe.

And so, there were not very many things that really made us happy last month. Our consolation is that in relative terms we were rewarded for our caution: our balanced portfolios mostly fell less in value than the market. But falling markets are rarely fun, fascinating on the other hand they are. Volatility often rises sharply. We sometimes had days when interest rates rose by 0.2% but dropped just as much again. This often means that a turning point is near. An additional factor is that during wars, investors are more likely to resort to government bonds.

Bonds regain their role in asset allocation

From the broader perspective of asset allocation, it is also good to note that bonds have become more attractive. Now they can again play a role as an alternative to equities when these are struggling. After all, from the moment interest rates started rising, both bonds and equities went down, and bonds the most. As of now, (government) bonds may be able to offer more comfort. While equities recovered as well as bonds in recent days, peace and reconstruction are the best ingredients for a sustainable recovery. These seem far away now.

Does the rise in interest rates bode well for pension funds?

Here’s a side note on interest rate joy for pension funds. Hundreds of billions have already gone up in smoke in bonds and other interest rate products. Yet each time, they cheerfully report that the increased interest rates have reduced benefit obligations and thus the funding ratio went up. And so, they can increase pension benefits. However, do not be fooled by this. Those losses are real, but the coverage ratio is just a calculation method, which, with low interest rates, also ensured that pensions were hardly increased in times of prosperity. If we had suffered such colossal losses for our clients, we would not be raising the interest rate flag or throwing a party. Losses are ultimately just losses, and that realisation hardly went down in the pension industry. More stable interest rates can bring peace of mind to this sector too. By the way, pension reserves in our country are still huge compared to almost all other countries.

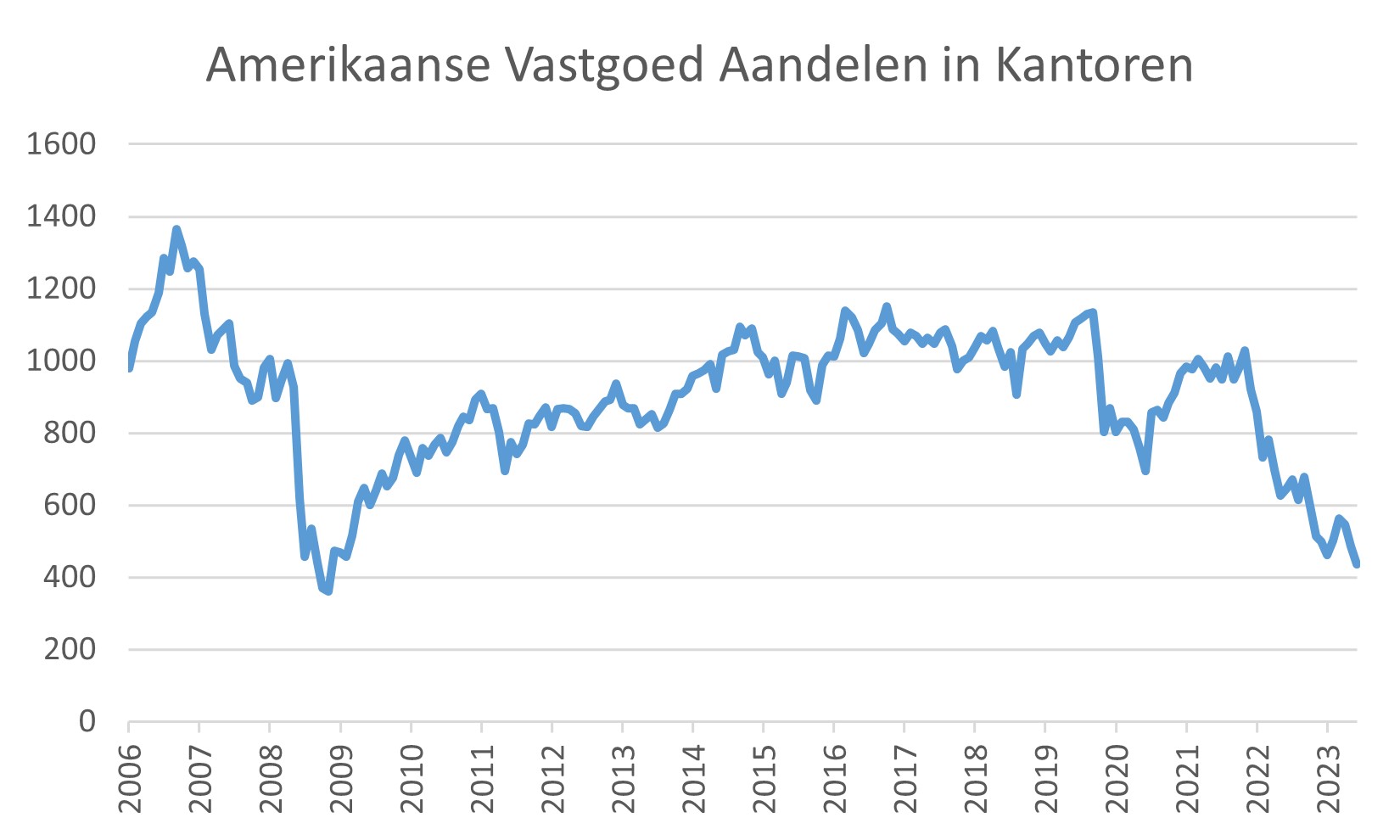

Real estate interest rate pain

Finally, a word on the real estate sector, which has undoubtedly been hit hardest by the rise in interest rates. Will we be able to breathe easy again here any time soon? I fear not. The rise in interest rates hurt especially those who had taken on too much debt. Often overenthusiastic project developers were the first to fall. Especially expensive houses suddenly attracted less interest. Try any mortgage calculator and calculate the effect on your maximum mortgage when rates go from 1 to 5%.

From an investor’s perspective, things have not become easier either. Charges on residential landlords are rising sharply and rental income is under pressure from stricter regulations. Shopping centres have been suffering from competition from online shopping for years. And then, when the office market also tilts, after the pandemic, when working from home becomes more and more normal, things suddenly go fast. The value of offices at the Zuidas (Amsterdam’s business district) fell by as much as 32% in 2022. Major brokerage firms already laid off many staff this year. Elsewhere, things are not much different.

Below, a graph with American real estate shares, investing in office space.

Remarkably, we have fallen so far here that the price level of 2009 (the last major stock market crisis) is back in sight. Glad we did not have to experience in this decline, but when does one get back in? When interest rates start falling? Or when all those (semi-)empty offices are converted into homes? Even for this hazardous investment, opportunities will surely come again.

On that cheery note, I promise you that I will do my best to write a happier story again next month.

BY: WOUTER WEIJAND, Chief Investment Officer