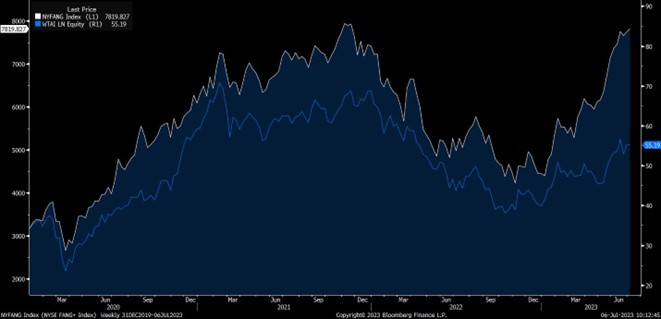

It is starting to get a bit boring: interest rates, rising further as core inflation remains high, especially in Europe (around 5.5%). Energy prices do help ‘headline inflation’ to come down, except in Germany and the Netherlands (+6.8%) but sticky inflation remains sticky. The goods industry is slowing or stagnant while the service sector continues to pick up. And that along with an equity market, which cares little about rising interest rates and high valuations (yawn)… See below the chart of the FANG+ index*, which leaves even a tracker of AI stocks well behind this year. Note especially the performance difference in the second quarter.

* The FANG+ index is composed of Alphabet (Google), Amazon, Apple, Snowflake, META (previous Facebook), Tesla, Microsoft, Netflix, Advanced Micro Devices and NVIDIA. The tracker with AI-shares is Wisdom Tree.

How many times have I written the above? So, was there some news last month after all? Yes, not only did short-term interest rates rise because the ECB, the Bank of England and the Norwegian central bank, among others, raised them too, but long-term interest rates in the bond market also went up. The idea, that interest rates will stay high for longer, is gaining support. It helped that both the Fed and the ECB indicated that they might raise interest rates twice more. That too was new. And then it might take until the middle or end of 2024 before interest rates can go down again.

Hard cash

Which brings me to the renewed role of a long-forgotten asset class: cash! For a long time, more than a decade, cash yielded virtually nothing. Banks raised their savings rates very slowly, but in a short time, money market rates shot up globally. Ranging from 3.5% in Europe and 5% or more in the UK and the US, the money market has become a serious competitor to the bond market, where interest rates are easily a full percent point lower. So, cash will get a significant role again in the asset allocation. Especially if short-term interest rates rise further and stay higher for longer.

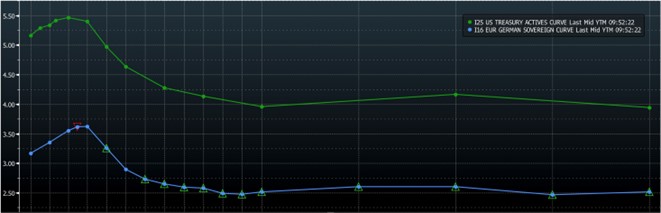

We also see this reflected in our interest rate policy. We parked a relatively large amount of money in funds with short-term bonds. That includes both government bonds and corporate bonds, including High Yield. Why would we invest for a return of 3.75% in 10-year US bonds and for 2.75% in 10-year Dutch government bonds when short-term rates are so much higher? This inverse interest rate structure, where long-term rates are lower than short-term rates, is shown below. With US government bonds in green, and those of Germany in blue.

Inverse interest rate structure in the US, the UK and in the Netherlands

This inverse yield curve rarely occurs, usually only on the eve of a recession. If a recession then occurs and the central bank cuts interest rates, short-term interest rates will again fall below long-term interest rates. More exciting is whether long-term interest rates will then also fall, as they may already be too low. These are some of the questions that concern us. From our interest rate policy, as described above, you will notice that we have serious doubts about this. Perhaps long-term interest rates will remain flat or even rise when central banks start easing their monetary policy. For now, that leaves investors better off with short-term loans.

Doubts about recession

Meanwhile we have our doubts about a recession. In Europe, factories are often already running at a slower pace. Housing markets suffer from rising interest rates. But in the US? Look at new home sales below. Quite remarkable, this recovery, although in the US they will never have heard of nitrogen problems and buying out farmers near nature reserves, before building is allowed again… Importantly for the Fed, homebuyers are not yet very impressed by rising mortgage rates. Also notable are a falling unemployment and still growing employment rate. It is true that wages are rising a little slower in the US (still at +4,4% though), but the tight labor market and enthusiastic homebuyers will not make the Fed really happy.

US new home sales

Illiquid investments

Finally, some news about our illiquid investments: within our infrastructure feeder, we decided to switch to the euro-hedged share class following the recent recovery of the dollar. The dollar-asset exposure in this fund is now over 40% and for the somewhat longer term, the dollar seems overvalued.

In addition, our first Private Debt feeder, denominated in US dollars, has redeemed about 20% of its portfolio. Full repayment of the investments is a process that will take 2-3 years. We hope to reinvest these funds as interest rates rise. By the way, we have exchanged the cash dollars into euro. Perhaps this euro cash may soon be just a little more ‘King’ than the dollar cash.

BY: WOUTER WEIJAND, Chief Investment Officer