We are now two months into the new year: 1 month of interest rate optimism and 1 month of interest rate realism. Because inflation will not be chased away that easily, as the recent figures in France, Spain and Germany showed. These did not fall, they rose! It is sticky stuff, something like: if you raise prices, I will do it too. In January, many investors thought the worst of inflation would be over: bonds had to be had and, lo and behold, interest rates fell, as billions of investment money flowed into the bond market. But in late February came the reality check: core inflation, excluding food and energy, say sticky inflation, turned out to have risen further in both the US and Europe. And on top of that, food prices in particular rose rapidly.

Below you can see the development of European inflation: note before all the further rising red line of core inflation: “But then I also want a wage increase”, and so on.

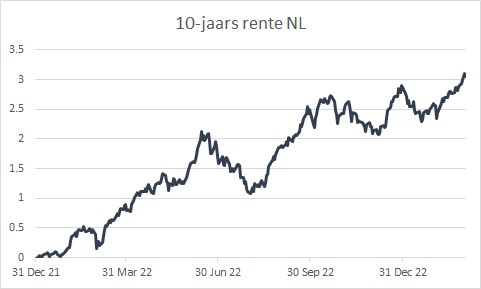

So central bankers might have to raise interest rates further and then keep them high for longer. ‘Higher for longer’ soon became the new mantra. Bond markets quickly turned right around, to even above the high interest rate levels at which we had started the year. Meanwhile, 10-year government bonds in the Netherlands yielded above 3%.

The historical performance of bonds

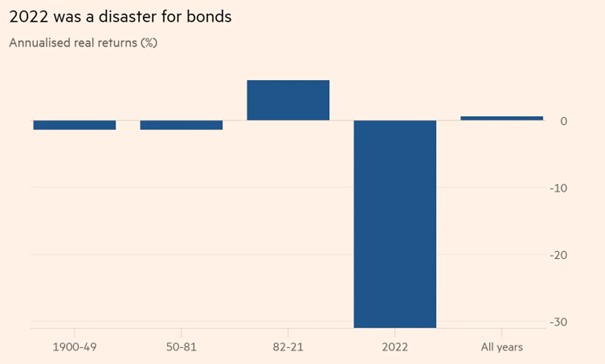

But where does this enthusiasm for bond investing comes from, even when interest rates are still, only around 2-3% and core inflation is over 5%? So that real interest rates are still negative? To that end let’s look back over 100 years, at the inflation-adjusted performance of the world bond index.

What was the return on bonds since 1900, on average, after inflation? Less than 1% only, against 5% for equities. This is why last year was so disappointing, with a loss after inflation of around 30% for bonds! The only ‘golden age for bonds’ in recent history was during the period 1982-2021. But we then started with sky-high interest rates that kept sinking, as did inflation, until interest rates even turned negative. An exceptional period with major price gains on bonds and equities combined, which does not look like coming back anytime soon, this average annual result, in real terms, of +6.3% for bonds. To achieve this again would require long-term interest rates to move rapidly towards 1% again, and I would forget about that scenario to take place any time soon. We are not going back to those ultra-low interest rates for the time being.

This history seems to teach us that we need positive real interest rates to actually achieve such a positive real result in the medium term. For that, however, we need significantly higher interest rates than we have now… or a lot lower inflation. However, more patience seems to be needed for that… or further interest rate hikes by central banks! You get the message: we are not yet optimistic about government bonds and investment grade corporate bonds and maintain our cautious stand in choosing interest rate sensitivity here.

Equities and bonds in historical perspective

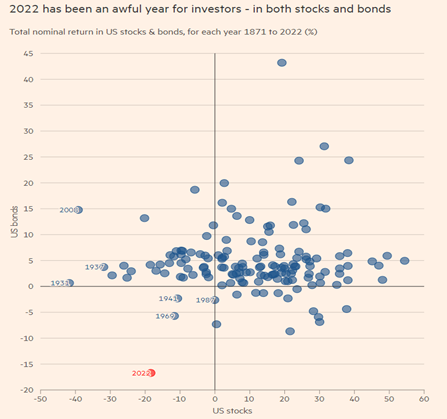

But now that we have delved into history: how did stocks versus bonds perform? The chart below on US stocks and bonds goes back as far as 1871. The results are nominal, i.e. unadjusted for inflation.

Most of the little balls in this chart are in the upper right quadrant, where equities and bonds both score positive (nominally). Equities score positive more often and higher, but when they score negative, bonds usually offer comfort. Even in a horror year like 1931. Note also the Great Financial Crisis from 2008: almost -40% for equities, but as much as +15% for bonds. Now you can also see at a glance, just how exceptionally bad 2022 was.

This chart makes it easier to see that we need to move to higher interest rates first, before bonds will come out on top. And that bonds can actually be an alternative to equities. Patience is not necessarily a positive in this regard, as we will have to suffer some interest rate pain for it to happen.

Therefore, 2023 could also be a year in which Private Debt (with mostly floating interest rates) and Infrastructure (partly contractually protected against inflation) continue to do well. As will alternative forms of fixed income, where short maturities and relatively high coupons are paramount. We are therefore well positioned here for many clients.

For equities, the crux lies in earnings development on the one hand and valuation on the other. Whose market position is strong enough to pass on price increases to customers?

And how strong is the downward effect on equity valuations in the event of a further rise in interest rates? In any case, let us note that equities look a stronger proposition than bonds in this respect and that explains our underweight position in bonds versus a neutral position in equities.

As interest rates continue to rise again in Europe, there is some hope that equities may also have something of an inflation hedge in them after all. Many companies, especially in the food sector, seem to have taken the opportunity to raise prices substantially (Unilever, Ahold/Delhaize). Their profit increases often already speak for themselves. Of course, profit declines sometimes lurk at the more cyclical companies, but for that to happen, economic growth really needs to slow further. So far, we have had a few quarters of stagflation, but a real recession, which many feared, has not yet occurred. If we had been comfortable with that scenario, we might have had an overweight position in equities. But we have not. The chance of higher interest rates, of ‘higher for longer’, remains significant. Central bankers really want to get the wage-price spiral down and this could hurt economically. And therefore we remain, on balance, positioned neutrally.

BY: WOUTER WEIJAND, Chief Investment Officer