We are in a phase of capitulation. That means you do something that you usually don’t want to do and that often turns out wrong: you are or you feel compelled to do it. All kinds of parties are now capitulating, for different reasons. From central bankers, who now want to raise interest rates considerably, to politicians, who now want to buy gas en masse at top-end prices, next to hundreds of billions in defence equipment. Do we really want to surrender to the Qataris or become friends with Turkey again? We have been taken by surprise by a new situation and we capitulate, but we would rather have seen it happen in a different way.

We wanted something peaceful, slowly moving forward in Europe. Watching the good news show with the heater at 22 degrees and the curtains drawn. But there is no good news right now. Putin has framed us and personally operates the gas tap. He now wants to see rubles otherwise he will turn it off. Germany is going to put a ration on gas. Groningen really can’t close yet, just that you know. Because American LNG needs factories that we don’t have yet. Or gas pipes, which the French ‘forgot’ to lay. And Norway is already producing almost at maximum levels.

Holding out

On the battlefield, we don’t want Ukraine to capitulate. Never before have NATO countries sent so many weapons to be used directly against Russia. The humanitarian catastrophe is enormous. Even though Russia says it wants to strive for a peace settlement, the continuous shower of bombs on Ukrainian cities shows otherwise. Giving in is not a verb in Putin’s vocabulary. He is a master of feints. And in terms of reliability, he also has all evidence against him.

Nobody wants to capitulate, but still…. It started in the pandemic: central bankers and politicians were so shocked that they completely capitulated financially and pulled out all the stops to provide companies and citizens with (free) money. We were not allowed to become unemployed, nor financially destitute, so they flooded the world with money. At the same time, the Chinese capitulated to the virus: where the rest of the world remained half open, China went into lockdown. As a result, the world came to a standstill no matter what we tried to do with all that money. Shipping, truckers, everything was stuck. And, of course, then came inflation: all this money for which there were insufficient goods, it quickly got out of control.

Central bankers say sorry

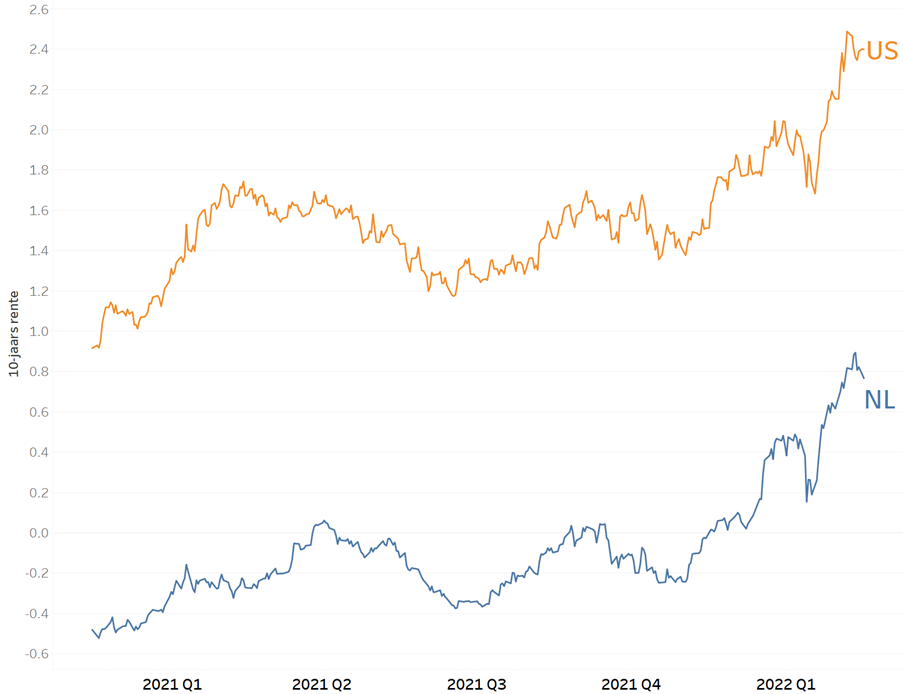

After a year of vehement denials that they, central bankers, had anything to do with this, their capitulation finally came in recent months. First, the Fed’s ‘mea culpa’. The ECB followed. Sorry, sorry, sorry: we didn’t see it coming, but watch out! Now we’ll really going to work it out. As inflation continued to push towards 8% in the US and to 6% in Europe, Fed members smoothly adjusted short-term interest rates expected by the end of next year from 2 to nearly 4%. And so, for the first time in decades, bond markets capitulated. What started as a ‘mild increase’ at the end of November has now developed into a very sick bond market, where significant losses are incurred. This is why we spent years building (illiquid) alternative fixed income solutions such as private debt and factoring funds. The capitulation in the bond market is tangible and visible in just about all maturities. To lose around 6% worldwide on bonds in 1 quarter, is rare. But I’m afraid it doesn’t stop there.

Chart 10-year yields in the Netherlands and the US since January 1, 2021

Going Green or Freezing

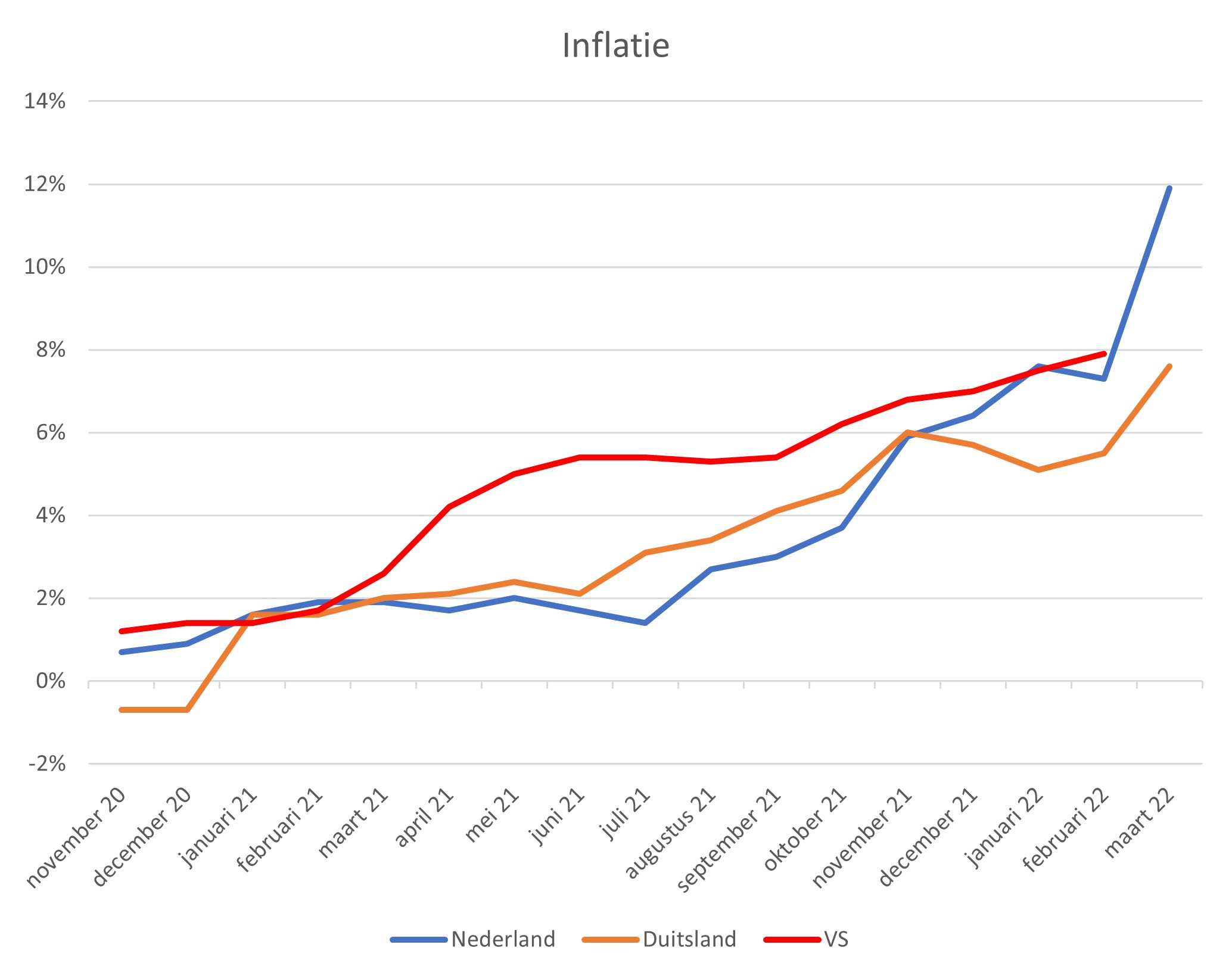

Just in the midst of the interest-rate rainstorm, the bomb shower came. Which suddenly made energy and grain much more expensive. Earlier on, we mainly wanted to make the world greener, but right now we don’t want to freeze. We are going to pay a price for all this, our new energy contracts, individually and collectively as a country. Our grain plus the metals needed for our energy transition. We feel the urgency and capitulate now. Even if it doesn’t feel like the smartest time to do that. Inflation in the US is likely to exceed 8%, while in Europe it stood at 7.5% in March. In Spain inflation is now almost 10% and in the Netherlands the loss of purchasing power is already at 12%! Although this will likely turn out to be an incident, I suspect. But right now politicians want to top up all the empty gas terminals. The determination on the part of central bankers to raise interest rates considerably now seems strong. All in all, the chance of a cooling of the global economy has increased considerably. Consumer and producer confidence also appears to be waning.

Chart inflation the Netherlands, Germany and the US

It will not be the government to blame, having still plenty of plans to grow. But can this still happen within budget? Both individually and collectively there will be pressure: there will be extra individual borrowing against reserves whilst governments’ extra borrowing on the capital market will soon make it a very crowded place. Current collective investment plans are immense. I predict that demand for capital will increase for a long time at these still historically low rates. Interest rates will therefore continue to rise, also because Russia, the cheapest supplier of raw materials, will be boycotted for many more years. And finding alternative suppliers will take time.

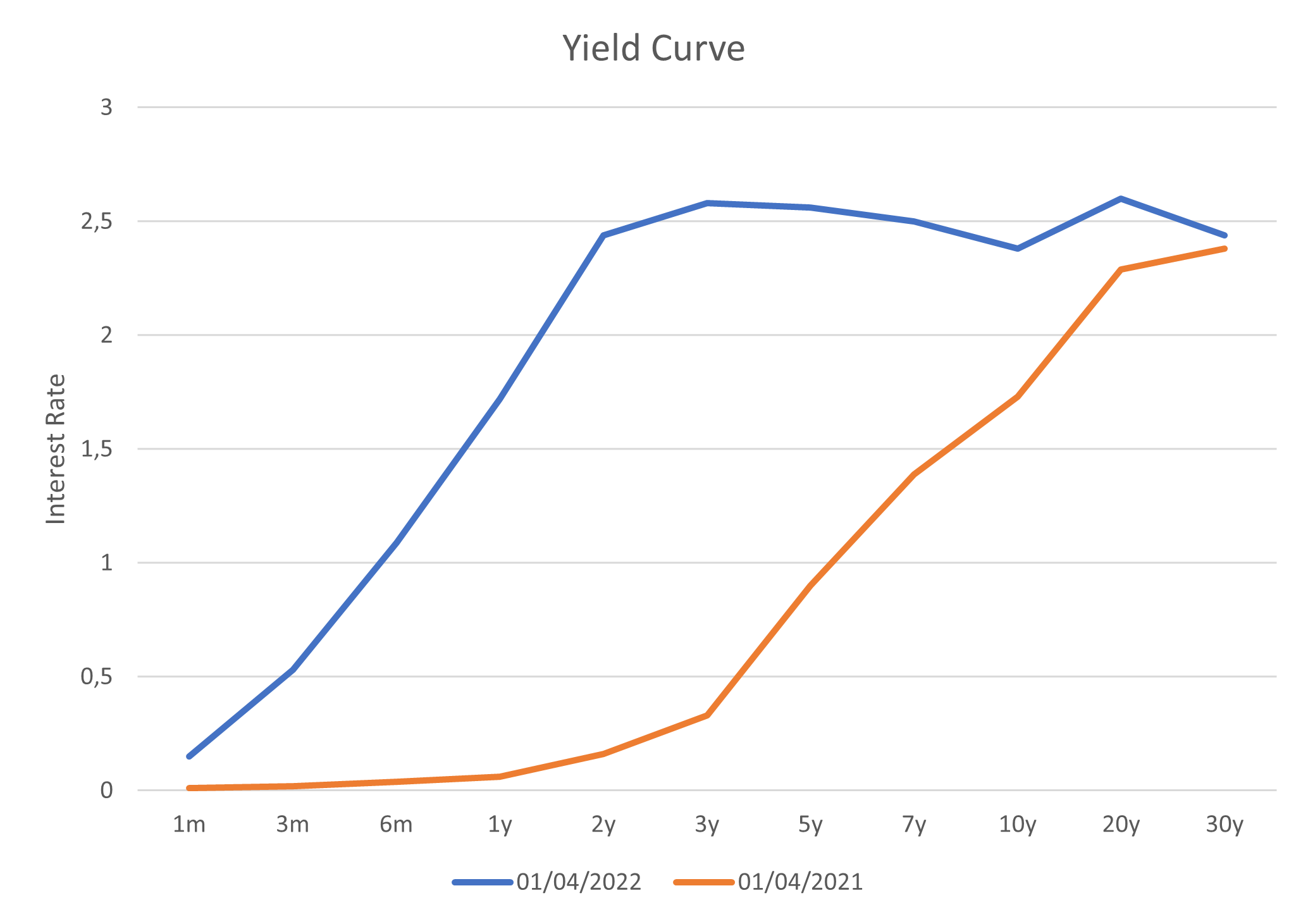

Sacrifices will be demanded from companies and from citizens, we will have to make compromises, also financially. This investment year is not the hosanna of 2021, although stock markets have already recovered strongly in March from the blows in January and February. But what is an American long-term interest rate of 2.5% with an inflation rate of 8% and a German interest rate of 0.5% with an inflation rate of over 7%? Nothing at all yet. The fact that the 2-year yield has already approached long-term interest rates in the US has led some to fear a recession. That still seems premature to me, with such a strong labor market and financially still healthy consumers. But if everyone’s gasoline, – natural gas and electricity bills multiply, one can no longer spend that money on other things. Somewhere it will stop, one capitulates to not spend on that big expense. The risk of a recession has definitely increased, including in poor countries, where hunger will be more prevalent.

Chart of flattened US yield curve at the end of March 2022 versus 1 year ago

Even if soldiers capitulate and peace is restored, inflation will not be over and interest rates will continue to rise. The good news is that the time of penalty interest will soon be over. The bad news, on the other hand, is that this does not lead to raising the flag on financial markets. Though some already seem to do so. However, it is only when the white flag is hoisted that there is reason to become more enthusiastic. That is why we already made cautious purchases at low levels at the beginning of March, in Europe and in China, after we started ‘thematic investing’ worldwide. But as we were not impressed by the recent price recovery, we sold shares again on the last day of the quarter. Result: we have consolidated our defensive position again.

At the same time, we also do not want to lower the flag: we certainly do not capitulate. We are pleased with the energy producers in our infrastructural investments: they benefit from higher prices and deliver with flying colours. Our Private Debt and Alternative Fixed Income investments also stand proud in this interest rate storm. And what is the damage in cash (-1/8% per quarter) if bonds fall that much harder at around -6%? This quarter was not festive, so the results were certainly not royal. Whether that will change much in the near future (except on April 27, our King’s birthday), I dare not say yet. But don’t count on it too much, we remain cautious for the time being.

BY: WOUTER WEIJAND, Chief Investment Officer