Recession fear?

While this should have been a July newsletter, that whole (for us) relatively friendly month of July has long since been overshadowed by the wild start of August. In short order, equities fell 10% and investors fled to government bonds, especially US ones. Was it the fear of a recession in America, as some newspapers wrote? Would employment growth of 112,000 jobs in July, instead of the hoped-for 160,000, really bring a recession closer? In a labour market that is still robust? Of course, credit growth, especially among consumers, has been declining for a while. The Fed is keeping interest rates high and that hurts some. But do equities suddenly drop 10% because of that? No, there is something more going on here.

Too much optimism

As we wrote in recent months, valuation levels, especially in the big US Tech names, but also in the semiconductor industry, had risen sharply on high expectations in Artificial Intelligence. But just like a quarter ago, earnings expectations did not materialise. Indeed, several CEOs flatly stated that profits from AI will not materialise for the time being. The message was that the cost goes before the benefit and that investments in AI will be stepped up in the coming quarters. This was a major setback for the stock market, where the prices of the Magnificent 7 – Apple, Google, Amazon, Microsoft, Tesla, Nvidia and Meta – had already come under pressure in late July. And this while large speculative positions in favour of these stocks had been built up for some time, especially by hedge funds.

Hedge funds lowering risk

How do hedge funds finance these speculative positions? By borrowing money as cheaply as possible. Often this was done by borrowing in Japanese yen, whose interest rate is very low (0-1%). So, people sold yen and bought other currencies for it, e.g. dollars and benefitted from a high interest rate (5%). People also used it to buy, for example, these big US stocks. This so-called “carry trade” has been one of the most popular strategies among hedge funds for a few years now and billions are involved. It was also a boost for Japanese equities, as the falling yen made Japanese business more competitive. In the process, every euro or dollar earned abroad brought in more and more yen.

So, until market sentiment turned, and people started selling these big Tech stocks in the US. In a turning market sentiment, the yen is often a sought-after currency to shelter from. So, the yen rises and this carry trade, the cheap financing of many speculative positions, goes awry. Soon, one gets margin calls from banks, who helped finance these positions, and one must sell more shares and buy back more yen. This is what played out in rapid succession in early August. Shares fell around 11% globally and stood -8% at the time of this writing.

We buy

What do we do in this situation? We were underweight in equities, especially in the big, expensive technology companies. We considered them as too expensive, but they are a bit less expensive now. This also applies to banks globally, to Emerging Markets, but really everything except the very defensive sectors, like consumer products and utilities, has become a lot cheaper. Meanwhile, what had become a lot more expensive? Bonds, especially the longest-dated loans had shot up in recent weeks, in the expectation, or rather, with the fear, that a recession was imminent and interest rates needed to fall fast.

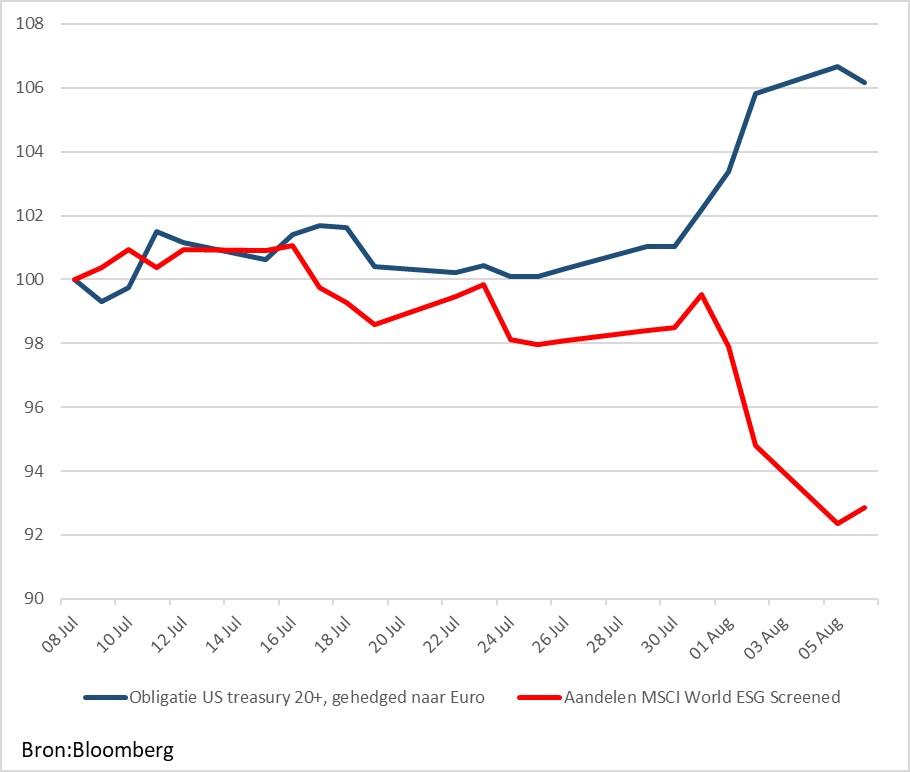

Performance US long Maturity bonds versus global equities last month

You will understand our actions: we took some profits in bonds and bought discounted equities (globally) in return. We reduced our underweight position in equities, which we still think are a bit expensive. We do think the same about bonds now: would you put your money in the German state for 10 years at just over 2% a year? With inflation above 3%? And a wage growth of 4-5%? Now you also understand why the housing market has become ‘hot’ again. Wages have gone up, but mortgage rates have fallen a bit. No, here the bargains are hard to find.

How long the sale lasts, we don’t know

Whether this was really the summer sale or whether it will last much longer, we dare not say at this stage. But that we took away at least something from this offer, is certain. In the end, it’s about what we think an item is worth, not what sticker price is stuck on it: -10% still doesn’t have to be very cheap, after all. We remain attentive in these sometimes heated summer conditions and promise, as we did last month, to keep our head cool.

We wish you another relaxing summer (holiday).

BY: WOUTER WEIJAND, Chief Investment Officer