On the threshold of the new year, several changes of guard are imminent: economic, political and financial, but more on that in a moment. First, I would like to inform you about my own changing of the guard, as on 1 January I passed the baton to my successor Wouter Sturkenboom.

At this ‘turn of the year’, you will immediately gain a lot of years, down from 66 to 44, without having to get used to a different first name. In addition, you will also receive a wealth of practical experience from the US. Wouter Sturkenboom worked for a long time as (chief) investment strategist at Kempen in the Netherlands and at leading US asset managers such as Russell and Northern Trust. He and his family have been back in the Netherlands for a few years now.

I have already spent the past 2 months with him and will do so for the next 2 months as well, until my contract ends automatically in March due to reaching the age of 67. From next month, other Wouter will also start writing this newsletter. I wish him every success in his new role!

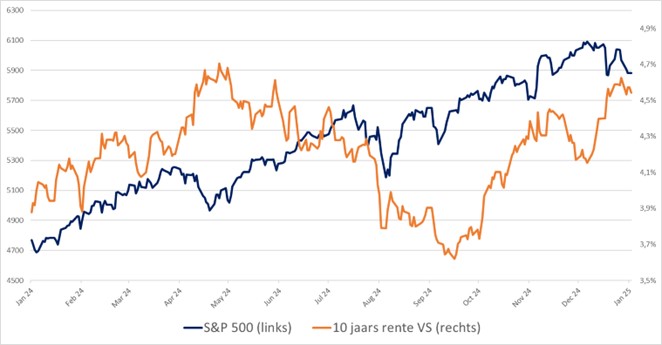

But now back to those other changes of the guard. Or perhaps it would be better to write: changes of power? Will America remain that all-powerful country in financial markets, even or just again when Trump takes power in a few weeks’ time? Or will he overplay it with overly aggressive fiscal and trade policy plans that will put pressure on inflation and interest rates? In any case, the stock market is a lot more optimistic about his arrival than the bond market. The stock market (left y-axis) rose further, but the fall in interest rates (right y-axis) gave way to a rise in yields in q4.

Optimism dominated in 2024

Amid all the geopolitical turbulence, financial markets, especially those in the US, remained remarkably positive. Although some profit-taking took place across the board in December.

Which sectors performed best globally in 2024? Was it technology again? No, with a plus of 38% (including dollar appreciation) they did outperform almost all other sectors, but defence stocks, mostly in the US by the way, did even better, with a plus of 44%. That says something about the times in which we live. And as many institutional investors have excluded this sector from investment, one wonders how long this can be sustained politically…

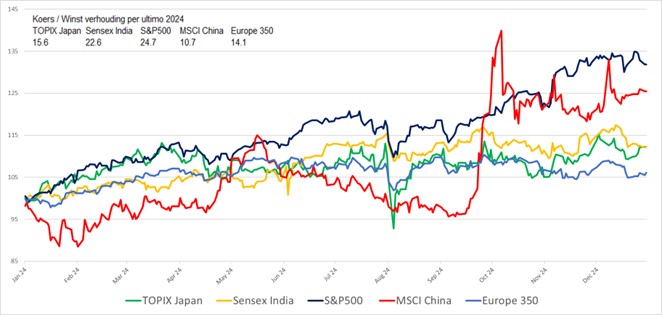

Of course, there are always countries eager to take over the leading role of the US. India came close in terms of performance and stock market valuation last year. Japan has been catching up for some time but is doing so mainly by making the yen cheaper. China, thwarted on all sides by import tariffs and corporate boycotts, seems to be pulling through economically (laboriously, but still…). The country is making great strides in its energy transition and on the electric car front it is increasingly conquering the world.

In terms of stock market performance, China finally made good on its long-hoped-for catch-up in 2024: our MSCI China tracker narrowly beat the S&P500, but thanks to the dollar’s rise and the renminbi’s decline, the US still turned in a better result. Nevertheless, does this promise more such recovery years? After all, the valuation of Chinese stocks is still historically low with a P/E ratio of over 10x. Or is Trump going to silence China economically? And will Musk (America’s new shadow president?) really dare to shout anti-Chinese slogans just as loudly? After all, he has a large Tesla factory in Shanghai and may not want to argue with China as much as Trump does.

Share prices and P/E ratios in the US, China, Japan, India and Europe

And speaking of changes of the guard: in Japan it has just happened, in India Modi has perpetuated his power and in China no power changes are planned for the time being.

Things are different in our politically volatile Europe. I am not going to give a swan song about that, all the economic and political malaise in the biggest member-countries (Germany and France) is well known. Let me look at it from a different perspective, that of Trump: suppose he manages to silence the weapons in Ukraine, however unjust that peace may be for the country. Of course, that will not stop the rearmament of Europe, also a demand of Trump by the way. It will also require a lot of money to rebuild Ukraine. But that is many times better than endlessly transferring money for battlefield weapons that destroy people and land. It need not immediately lead to euphoria in European financial markets, but I can imagine at least to some relief.

I have asked several questions but answered only a few. It is up to the new Wouter and the rest of the investment team to answer those questions and take you through their story in the coming period.

Finally, a moment of perspective on the death of President Carter at the age of 100: listen again to his speeches, as governor of Georgia and as president at his ‘State of the Union’ in 1977. You will than realise once again how the political atmosphere in the US and the world has changed profoundly.

All the best and hopefully we’ll meet again!

With best wishes for the new year,

Wouter Weijand, Chief Investment Officer