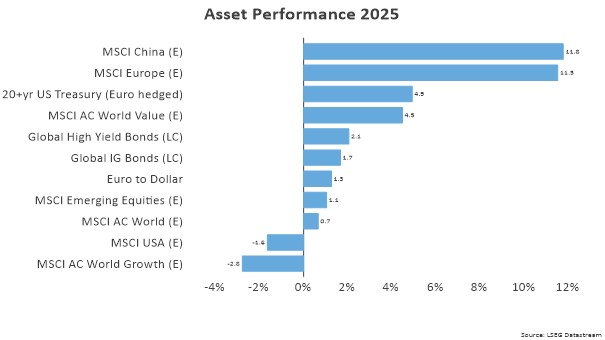

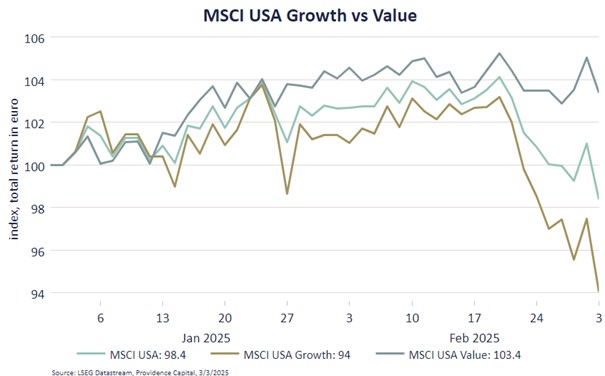

The Roman god Janus, often depicted as a man with two faces, symbolises the beginning and the end. A better metaphor for the transition from Biden to Trump and the corresponding turnaround in geopolitics is hard to find. For now, the new face of US foreign policy is characterised by the unleashing of a global trade war. Not entirely surprisingly, the ‘vibe’ in financial markets has deteriorated considerably as a result. But that ‘vibe’ is not unambiguous and under the bonnet, the stock market is also showing two faces. On the one hand, with positive returns in Europe and China versus negative returns in the US and Japan. And on the other, with positive returns in value stocks versus negative returns in growth stocks. To properly deal with this kind of ambivalence as an investor, it is crucial to focus on your investment process and the resulting outlook.

That outlook has become more cautious due to the latest geopolitical developments. The risk of a global trade war has increased considerably now that Trump has introduced his trade tariffs on Mexico and Canada. Both countries have already announced retaliatory measures, and the risk of a downward spiral is present. The same dynamic is visible in the US-China relationship. Whereas China still reacted cautiously to the first 10% increase, it has immediately announced countermeasures after the second 10% increase. All this, first, is negative for the outlook for economic growth and may also cause higher inflation in the short term.

An additional concern is that it is hard to imagine Trump raising tariffs on Mexico and Canada and not on Europe. Should that indeed be the next step, the trade war can rightly be called global. As we wrote in our previous monthly report, our investment mix takes this risk into account in our allocations to value stocks in the US in particular, but also in Europe

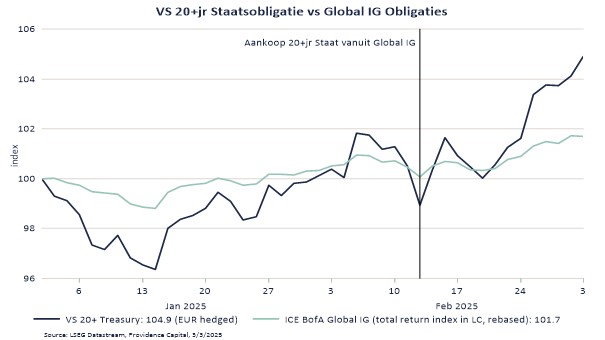

We also took several steps in January to further reduce risk by building up a cash position, among other things. In February, we continued along this road by buying US long-term government bonds. That was done because the risk to economic growth dominates inflation risk and investors flee to the safe haven of government bonds in times of stress. Even more, expectations for future interest rate cuts by central banks increased significantly, driving down bond yields. Given the recent volatility in the European government bond market, it is important to mention that we very deliberately chose to make our investment in US government bonds, of course hedged to euros. Not just because for investors the US is seen as more of a safe haven, but also because Europe faces new fiscal challenges. Indeed, in the short term, it must cope with the US retreat from Ukraine and in the long term, it has to invest heavily in defence and security to reduce its dependence on the US in those areas. The election results in Germany and Merz’s announcements to release the ‘debt brake’ are an important part of this.

So, our view on the risk of geopolitical developments in financial markets has been revised downwards over the past month, and now our positive outlook for US economic growth is under pressure. But before we adjust our view downward on the latter, we want to get more information. Not only because Trump could simply reverse course in his trade war, but also because the US economy has been very robust until recently. Corporate earnings are also still downright strong. The big question is whether all the political turmoil is really going to hit the powerful US consumer, whether from a deterioration in sentiment or because of a faster cooling economy and labour market.

In politics, people often talk about sweet and sour, and how policymakers should implement sour policies first to deliver the sweet at a later stage. Perhaps Trump is thinking along those lines and the sweet is yet to come in the form of tax cuts and/or deregulation. But for now, unfortunately, it is the sour that is having the upper hand.

BY: WOUTER STURKENBOOM, Chief Investment Officer