Do elections really matter for financial markets, for the slightly longer term? This remains to be seen. Of course there is election fever, in- and outside America. It’s a fever that could persist for weeks after the election, especially if we get another few rounds of recounts and lawsuits. But I am not going to wait for that nor speculate about it. After all, financial markets already do enough of that.

For instance, bond market has been suffering from hefty increases for a while now, up about 0.7% for 10-year rates, following speculation that Trump would win, and government spending would remain too generous. Not that Harris would step heavily on the spending brake, but at least she promised to raise the sharply lower corporate tax rate (reduced from 35% to 21% under Trump) to 28%. Trump wants to cut it even further, to 15%. You will understand that such choices can make quite a difference to the net profits of US businesses.

But you don’t have to live in the US to watch these elections feverishly. For Ukraine and its European allies, whether Harris or Trump is elected, it could make a difference of night and day. Trump says he will arrange a peace treaty with Russia himself. In that case, the Ukrainian land conquered by Russia seems to become permanently occupied territory. And if we don’t want that? OK, but then we can pay for this war all by ourselves, and Trump will leave us financially on our own. At least, that’s what he says. Just when Europe is not in great shape economically and seems politically divided. I’ll just mention the words ‘German car malaise’ and ‘French national debt’ and then I won’t have to explain anything else.

These elections are also important for China: with Europe, there is still a chance to reach an agreement on import tariffs on cars and all the retaliatory measures that would follow. In the US, people are wielding the blunt axe much more and it is mainly the China’s strategic geopolitical threat, which they want to curb.

In that respect, China could look forward to Trump, who seems reluctant to defend Taiwan, should China ever want to annex it again.

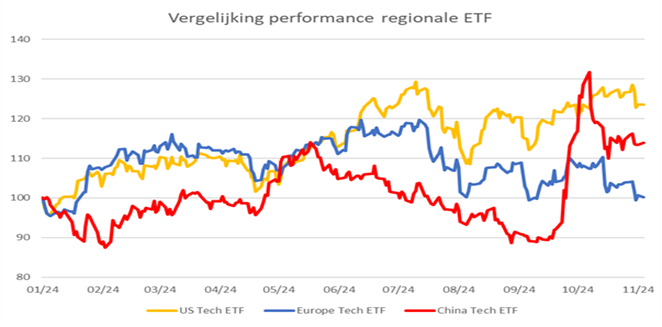

But wars and elections, do they really affect financial markets, now and soon? The fever around Artificial Intelligence (AI) had far more impact on markets than all that sad gun talk in the Middle East and Ukraine, which was virtually ignored. The technology sector has been excited all year about the gains AI will bring.

But just like in late July, it received another warning from investors at the end of October, after the quarterly earnings announcement: earnings growth was there, but it was again not easy to attribute it to AI. And that pushed the Magnificent 7 and global stock markets back again, with a giant like ASML in the Netherlands also becoming increasingly geopolitically trapped.

China is trying to get out of the doldrums, it made a catch-up sprint at the end of September, but its backlog from the years before is huge. Still: do we really think we will hold the country back economically later when it regains steam? In green technology (solar panels, electric cars), it is moving much faster than any other country in the world, with or without state support, no matter how high the tariff walls the US and Europe want to erect against it will become.

The US election says something about the big bad world that is elusive to so many Americans, but equally encourages European politicians to bury their heads in the sand. What kind of world order do we want? An open world, with respect for each other’s borders but also for everyone’s talents and competitive advantages? Let us hope that the fever will soon pass, and we will have recovered from the astonishment that this is the democracy of the most powerful country in the world.

And that we will then look again soberly at what markets and economies brought us: more growth in the US than in Europe and Asia, and therefore stronger rising interest rates in the US and a higher dollar. It was the higher interest rates and fever that started nibbling away at the high valuation levels. China also took a step back after its huge jump in September. As a result, October was on balance a negative month for both equities and bonds.

Meanwhile, our infrastructure investments remained generously on track: the AI data centres in the US were taking large amounts of power from the power companies and solar and wind farms in the portfolio. Of concern, however, is the huge amounts of cooling water consumed by these AI data centres. AI is not that environmentally friendly, we really need chips that are much more energy efficient and require much less cooling water. Otherwise, there will soon be a water shortage in the US, something the largest bank in the US, JP Morgan, has been warning about for some time.

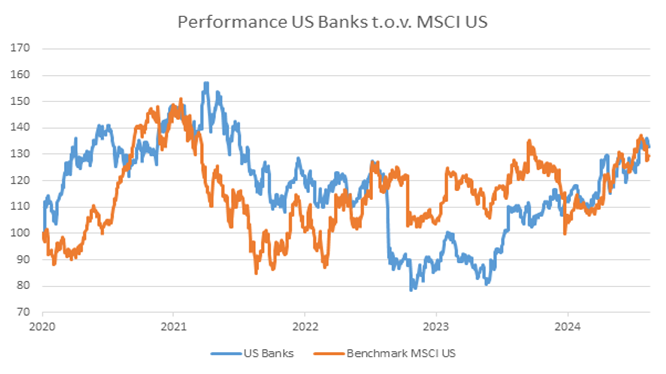

And speaking of US banks, financial markets have worried a lot about the US banking system in recent years. Whether that was not a bit excessive, time will tell. Below is the price of the US Banks ETF over the past 3 years, compared to the MSCI index for US equities.

Slowly, hardly anyone writes about this market segment anymore. The delusion of the day is over again. Now we just must wait until the US elections too are over again and we can move on fever free.

Epilogue: as we put the finishing touches to the newsletter, Trump has almost certainly won the election. Fever drops and stock markets and the dollar rise. But so are interest rates, because Trump likes tax cuts and does not greatly care about a higher national debt.

This is that very short-term, today’s delusion. Both inside and outside America, this political turn will be strongly felt in the coming years. A less open world (trade), with more ‘own people’ first, is a challenge not only for politicians, but also for businesses. It is not going to be boring, but let’s not get too attached to mountains of gold, which are promised to us from today onwards. Some sobriety seems called for here.

BY: WOUTER WEIJAND, Chief Investment Officer