In many ways, Russia’s invasion of Ukraine is a game changer. For starters, the postwar peace in Europe has come to an end. The world order suddenly looks different: Germany, which had been aloof from military conflicts since 1945, is now supplying weapons directly to Ukraine and is also going to invest 100 billion euros in its defense! Numerous other European countries are also supplying weapons, which will be used directly in a war against Russia. Such a thing has never been seen before. Moreover, Russia is threatening to deploy nuclear weapons. In short, we cannot say that the world has become a safer place in the past month.

Less violent, but perhaps just as much of a game changer is the deployment of SWIFT in this conflict. Those who are expelled from this international payment system become almost completely paralyzed, because international payment has become virtually impossible. In fact, it is a weapon of mass destruction of (trade) finance. By also eliminating the Russian central bank in this way (which can now no longer defend the rouble), this is a very drastic reprisal towards Russia. What is remarkable about this is that SWIFT works according to European law and is officially based in Belgium. Its data centres are in the US, Switzerland and… The Netherlands.

China

What would Chinese President Xi have thought about the Russian exclusion of SWIFT? If I attack Taiwan later, will they throw us out too? But with China as the world’s factory floor and the centre of world trade, that would cripple the global economy very quickly. I do not think world leaders would dare do that. Arms deliveries to democratic Taiwan, on the other hand, have become a lot more likely after this debacle in Ukraine.

Gas Tap

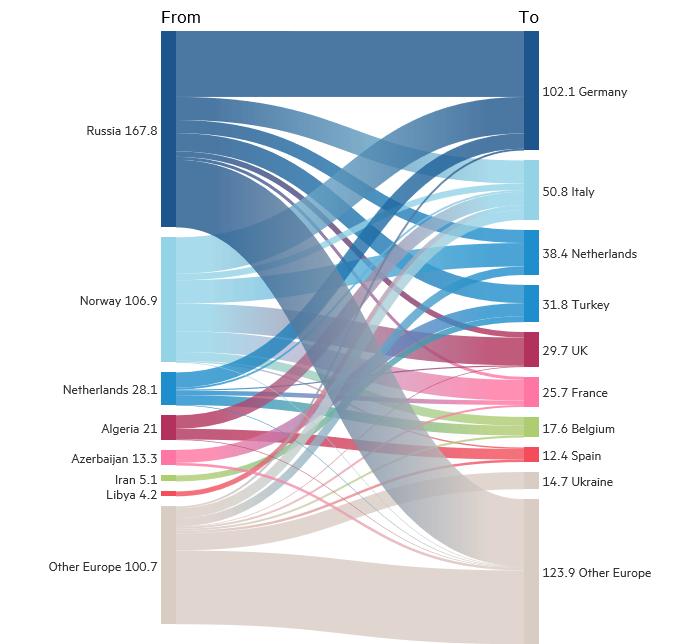

For European energy supplies, this conflict has also become a game changer. After all, Germany sealed the brand new Nordstream 2 gas pipeline even before it was supposed to open. Below is a picture of the gas flows in Europe. Bear in mind the modest role of The Netherlands in this: in 2017 we were still pumping up around 115 billion cubic meters of gas and largely exporting it. Russia’s role as a gas exporter, on the other hand, is supposed to be growing, but in recent months Putin has already turned the tap down substantially. He did this at the very moment when Western European stocks of gas had reached a low level. By the way, we have ourselves entirely to blame for these low stocks. Many countries, including The Netherlands, thought they were being smart by waiting for gas prices to drop again. Germany itself is the biggest loser in this respect: it is unclear how it will manage to secure its energy supply in the short term.

Gas import-export Rusland

From now on we will be more dependent on LNG, from the US, the Middle East and Australia for example. To make this gas suitable for European consumption, however, all kinds of plants still have to be built. The European climate plans are grand, but will take many years and hundreds of billions. However, the energy shortage is today and will not be solved tomorrow. So we will have to live with relatively high prices for years to come before the supply of renewable energy will make up for the lack of fossil energy carriers. Unless we were to fall into a recession, in which case the demand for energy would start to drop significantly. But governments have been in true spending mode for some time.

Government Debt

This brings me to the game changer in the financial field: in rich countries, the ropes are being loosened more and more in government spending: after the enormous pandemic support, climate investments and soon the defence spending boost, government debts will increase sharply. Taxes probably will too, I fear. Money was supposed to be free, as many politicians thought, but central bankers now think very differently, as inflation turned out to be much more persistent than thought. By the way, the rise in interest rates has come to a halt in this stress. Perhaps it will be another year before we get rid of the punitive interest rate on savings.

Investment Policy

What are the implications of all these game changers on the economic environment, on financial markets and on our investment policy? Wars are never good for consumer confidence and world trade. Neither is persistent inflation. The likelihood of stagflation has increased, meaning less smooth growth and longer-lasting inflation. Central bankers remain under pressure to show interest rate discipline, where politicians lack the discipline to keep government spending from getting out of control.

Defense spending, however politically necessary to defend our democracies, is economically a non-productive investment. Unlike windmills, solar panels and all kinds of other infrastructural investments, weapons do not produce anything. These only cost a lot of money and thus put a burden on economic growth. For The Netherlands to follow in Germany’s footsteps, instead of spending an extra EUR 3 billion, it will have to spend an extra EUR 20 billion on defense.

Next to aspiring to spend EUR 35 billion on climate plans. This after having recently provided EUR 70-80 billion in pandemic aid. I foresee that politicians will want to skim off part of the profits of companies and the assets of citizens to finance these ambitious plans. This will not help the investment climate.

What are possible scenarios in our view? Markets were hoping for an early end to the conflict and limited sanctions, with fewer constraints on the global economy. We do not believe in that (yet). Russia has clamped down, the world and especially Ukraine have come out in opposition to the invasion and so it is becoming a longer, even more tragic conflict. With substantial arms support from all parts of Europe for Ukraine. Moreover, a cornered bear can make strange leaps: Putin already made an intimidating gesture by putting the nuclear deterrent force on alert.

Although the first peace talks have now begun, it seems unlikely that they will produce immediate results. Putin will not want to give up now; that would involve too much loss of face. He wants a result, at least the guarantee of an eternally neutral Ukraine without NATO membership. Zelensky wants, above all, peace and security for the Ukrainian people. Perhaps he will take that commitment for granted. But what are Russia’s pledges worth at all? After all, until recently it called all indications of its invasion “pure propaganda from the West”.

With that, the likelihood of a longer-lasting conflict seems high. With risks for consumer, producer and investor confidence. This is not a situation in which we would want to neutralize our underweight in both stocks and bonds already.

Although we were positioned relatively defensively and held quite a bit of cash, in absolute terms most of our clients’ portfolios were quite affected by the downturn in financial markets. Some of last year’s gains have thus been wiped out. For the time being, we remain focused on defensive investments, such as Infrastructure, but also Alternative Fixed Income funds: both categories also offer protection against inflation and/or a rise in interest rates. Diversification within the equity portfolios also helps: Emerging Market funds, where we have invested more than 20% of the shares, fell less this year than equity funds from richer countries.

Last month, by the way, we made our first purchase in the area of Thematic Investing. We talked about this earlier. At the time, we thought the valuations were still too high. This investment is a fund that focuses on climate, the energy transition, digitalization, robotization and wellness, among others. The fund is very diversified, with 150-200 stocks worldwide.

Finally, geopolitics is a factor, sometimes lurking in the background, often for decades. Now it has put Europe and the world on edge. This is really a game changer, with all kinds of possible longer-term consequences, as described above. In that sense, 2022 is already like 9/11, 2001, a marker in our history.

The best game changer, which I wish you and us is a truce and peace for the Ukrainian people. May it soon regain its freedom.

BY: WOUTER WEIJAND, Chief Investment Officer