August looked like a short-lived rollercoaster for financial markets, with equities first sharply down and then sharply up again. Meanwhile, we are back near the ‘all-time highs’ of mid-July, so has nothing changed at all? Appearances are deceptive, as interest rates have fallen in the meantime, as has the dollar, and there have been major shifts within the equity market. Changes we have been considering for some time.

First, the interest rate, or rather interest rates, because there is a money market rate and there are all kinds of capital market rates. The Federal Reserve (Fed) sets money market rates. It was over 5.25% for a couple of years, to combat inflation, but is likely to be cut by 0.25% in September. Unless the labour market cools even faster. Then it could even be cut by 0.5%. In any case, the Fed seems content with the return of inflation below 3%. Over the next 12-18 months, we are likely to get a series of rate cuts that will gradually move money market rates towards 3%-3.5% by 2026. Capital market rates had already anticipated this, mainly due to fears of a recession last month that we thought were premature. So, when 30-year yields started to approach 4% and equities took a plunge, we took profits in bonds and bought equities in return. We described that action in our previous newsletter.

AI overvalued

The stock market, as mentioned above, was quite unsettled. AI-driven stocks were in particular bound to take a tumble. Not that Artificial Intelligence is a hype, because these developments are real and will be felt for years to come. It was mainly the investments around this theme that looked like a hype, with extreme price-to-earnings ratios, which we have written critically about before. For instance, shares in computer chips quickly rose from 20x earnings to 60x earnings. Within the Magnificent 7, the well-known big Tech companies, there were 6 that ordered the chips and 1 (Nvidia) that made the chips. Those first 6, except for Meta, had to admit that they were not yet making a profit with those huge investments. And Nvidia’s impressive growth path began to show some bumps. All in all, the hype around AI investments cooled last month.

Investors shifted their interests more towards the segments, which had lagged this price growth: small caps, banks and value stocks in general. Below, you can see the catch-up that happened. What these segments have in common is their sensitivity to interest rate changes. Small caps, the smaller companies, do not have access to the bond market, but mostly rely on bank credit. Which will start to get cheaper if the Fed cuts interest rates. We therefore increased our weighting to small caps in August. With the various purchases, we are now positioned roughly neutral.

The property sector is also interest rate sensitive and had been a concern for banks for some time. The rise in interest rates also hit banks, which had often bought too many long-term bonds. In 2023, there was even a mini banking crisis in the US. In that spring sell-off, we bought a banking ETF, a passive mutual fund of bank stocks. That is making an impressive recovery this year because of those lower interest rates, but also because the property market has settled down a bit.

The rotation from the Magnificent 7 stocks

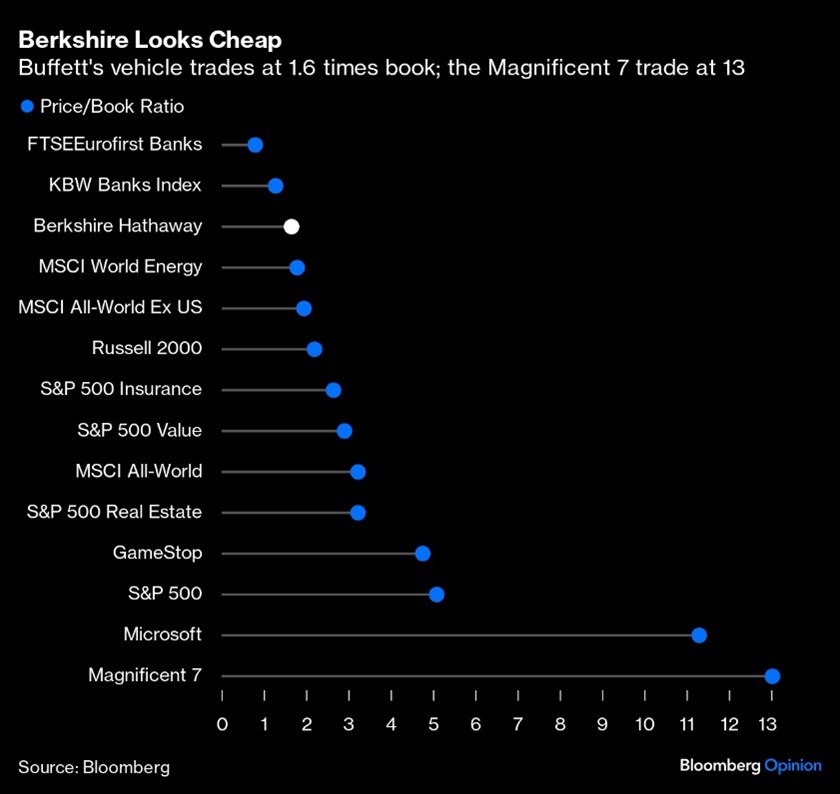

After the price jump earlier this year, the Magnificent 7 are now experiencing a sharp correction. But as you can see, it has not caught up with the big Tech companies suddenly. So, let’s look at valuation differentials. Instead of price-to-earnings ratios, let’s look at another valuation measure, namely the price to book value of the stock. These are not always easy to compare for all investment segments, but still… here too, the differences are fascinating. The columnist who listed this was particularly interested in Warren Buffet’s investment fund Berkshire Hathaway. As a typical value investor, it is not surprising that Buffet did not buy too expensive stocks.

Not far below is the Russell 2000 index: this contains many small companies, whose valuation has lagged behind the big boys, such as the S&P500. The very largest stocks are mainly those Magnificent 7, which as a group are vastly more expensive than the rest of US stocks and even more so than MSCI All-World, the global stocks. Chip giant Nvidia had no place in this picture. Its price-to-earnings ratio was at 63 before it announced its earnings results at the end of August. This chart only goes up to a price-to-book value of 13. Meanwhile, we are writing in early September and shares of chip makers have gone on another rollercoaster ride. It seems that valuations here are heading towards more realistic levels.

Monetary policy, the dollar and the yen

Enough about equities. What else happened strikingly? The dollar slumped a little for the first time in a long time and briefly touched 1.12 against the euro. The Fed’s upcoming rate cut must have played a role here. As did the Bank of Japan’s intention to raise interest rates further in due course. This may make the yen more attractive and the dollar slightly less desirable. Japanese companies mainly benefited from the cheap yen abroad. It ensured a favourable competitive position and strong profit growth. With the stronger yen this era seems to be more behind us now. That is why we reduced our equity weighting in Japan from overweight to neutral in August.

The ECB would also like to cut interest rates further and may do so soon. But steep wage increases made ‘hourly billings’ in the services sector 4% more expensive in July than a year ago. Here, the battle against inflation does not seem to have been won quite yet. Even though it officially stood at only 2.2% in August. Core inflation, i.e. excluding food and energy price movements, was still 2.8%.

Mortgage rates have been falling for some time, 10-year government bond yields are still only 2.5% in the Netherlands. All in all, we have already reduced the interest rate sensitivity of fixed-income portfolios somewhat. These are not super-high interest rates and, despite the rise in interest rates from below 0, they never really became so in recent years anyway. As the ECB cuts money market rates further over the next few years, the likelihood of long-term rates moving higher again increases. However, that is a rollercoaster ride that could be quite some time away.

BY: WOUTER WEIJAND, Chief Investment Officer