June was an unusual month. Both in Europe and in the US, the political centre seemed to be losing its grip on things, although officially nothing is happening yet. The electorate shifted to the right, but the European centre parties shifted along in that direction in time, maintaining their dominant position and thus their top political positions. So far, so good. But in France, surely one of Europe’s core countries, things are different. Here, Macron took a gamble by calling early elections. A gamble, which the French answered with a big shift to the right in the firsts round and another big shift to the left in the second round. A new cabinet requires coalitions, either from left to center or from center to the right. There is no telling how much of the 100+ billion in promised tax cuts by left and right will be delivered, but hopefully, some compromise with Macron’s center party will resolve some of those fears.

French financial markets were not at ease. France, which makes up 40% of the EuroStoxx50 index in terms of stock market alone, already has enough budgetary problems. Its public debt increased from € 2,200 billion to € 3,000 billion during Macron’s rule alone, generously above the European frameworks agreed beforehand. The interest rate differential with Germany rose 0.4% this month for 10-year bonds. Interest rates in Italy also rose. The good news here is that, according to insiders, Prime Minister Meloni is being coached by Super Mario (Draghi). So far, she has made remarkably few lousy financial decisions. Now let’s hope that a new French government can restrain itself as well.

In America, which on average is already a lot more conservative than Europe, Biden seems to be losing his grip on the presidential election. In a direct debate with Trump, he failed gaudily. The world may be spinning, but Biden fell completely silent. Within the Democratic ranks, panic must be rife. Can they put forward another candidate, perhaps California governor Newsom? Biden may be the official winner of the primaries, but if they do nothing, the Republicans could be incorporating footage of the debate into their TV ads for months to come. That is not a nice prospect for Biden, nor for Europe, which would become more isolated from Putin with Trump.

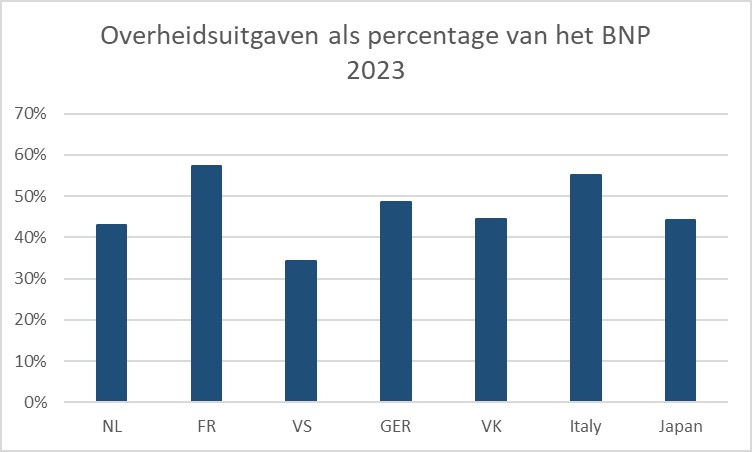

For neither presidential candidate, US state finances have been a success. Biden was too generous to citizens and Trump was instead tax-friendly for business. Perhaps some on Wall Street are already cheering if Trump wins, but how long can you sustain budget deficits of 7-8% now that interest rates are no longer 1-2%, but 4-5%? Government spending is not the real problem. Compared to most developed countries, America simply taxes too little.

Trump is certainly not going to fix that. A Democratic president is more likely to raise taxes, although that chance seems to have become very slim for Biden. Americans are masters of living on credit, but one day financial markets will force them to put their house in order. That won’t take Artificial Intelligence…

And speaking of AI, Nvidia, now crowned king of AI in all the media, had to shed a little of its lustre at the end of June. After a spectacular rise to become the world’s largest stock, with a market capitalisation well above $ 3,000 billion (exactly yes, as big as the entire French national debt), profit-taking took off about $ 400 billion from that. The rest of the chip producers also saw price corrections. That said, US stock markets still had a good month and would not budge. Growth investors have been handsomely rewarded this year. Where Nvidia fell back, Apple, Google and Amazon steamed back up, so that the Nasdaq, the stock market of technology stocks, rose as much as 6% further in June. You see, whatever political problems there are, the world and the stock market just kept spinning. Or have they now turned on?

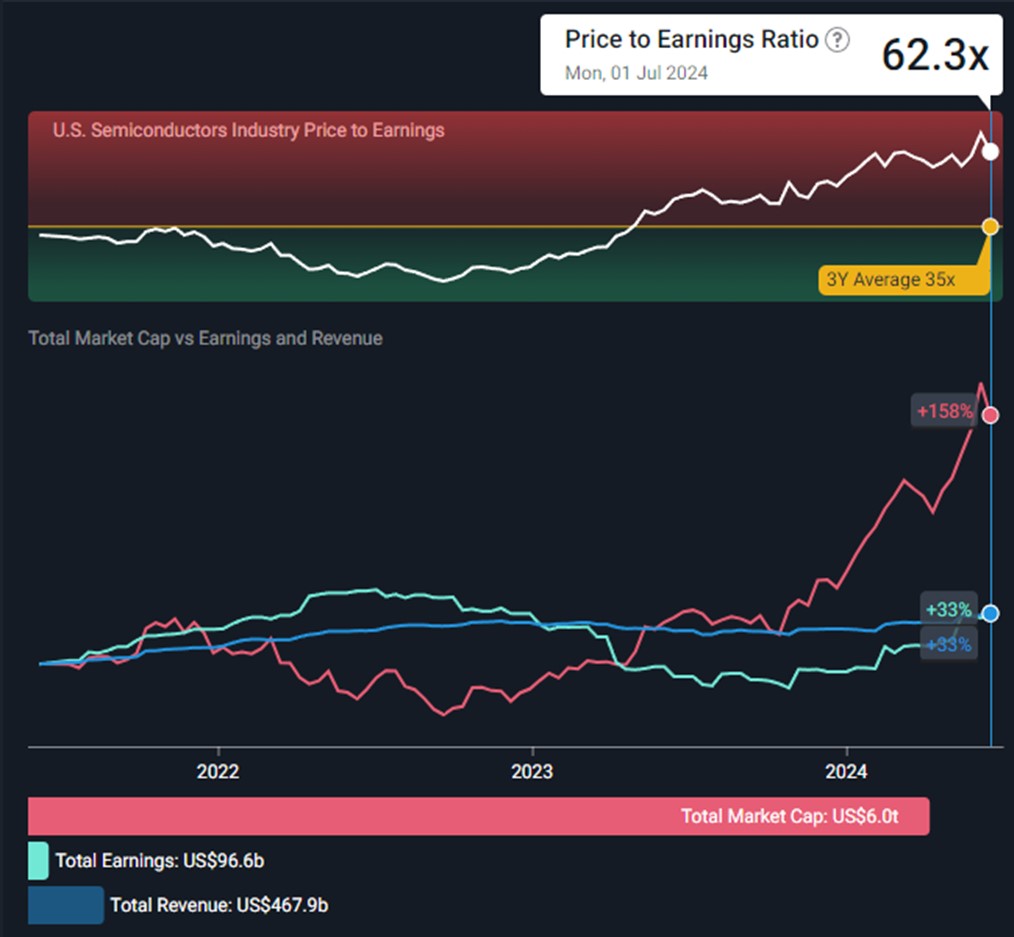

Below is the index of a basket of 113 US chip producers. Both sales and profits grew a total of 33% over the past 3 years, or 9.7% a year. However, the market capitalisation of all those producers rose 158% to $ 6,000 billion, of which Nvidia accounts for half. The P/E ratio is now 62x, up from 19x at the beginning of this year, while the 3-year average was 35x. So, this is what optimism looks like, but let’s remain humble: perhaps it is justified. Perhaps the market is not artificial, but truly intelligent. AI is real, there are more and more applications coming, the demand for all those chips is not made up, but how much you are willing to pay for it in the stock market is another thing. There is no simple truth about that. Except that of the market itself…

Are we betting your chips on this?

Against these optimistic producers were many cautious US consumers: still high mortgage rates (around 7%) are hurting, the jobless rate is rising slightly, consumer confidence is becoming more fragile and growth in spending is slowing. A rate cut would be welcome, although it does not seem imminent until September or December. The Fed says it will wait for inflation to fall to 2%, but perhaps something with a 2 before it will do? In Europe, the market is hoping for 2 more 0.25% rate cuts this year.

Maybe the economy is turning a little slower, but the world is just spinning, and the holidays are coming back into view. Hopefully, the climate is spinning a little less than in recent summers, so that you and we can keep our cool and avoid overheating.

BY: WOUTER WEIJAND, Chief Investment Officer