Inflation can also be profitable

The earnings season has started again. Caution about profits has been trumped up for some time, but it still appears to be unwarranted. Companies in the food sector, such as Unilever, Procter & Gamble, Ahold, Coca Cola and Nestlé almost all managed to increase their sales prices more than expected. As a consequence, their sales also grew faster than expected. Resulting in rising share prices. This was even more the case in the tech sector, where staff cuts were substantial, but sales developed more favourably than the market expected. In particular, FAANG shares (Facebook, Amazon, Apple, Netflix and Google (Alphabet)) recovered strongly. It was more difficult in the chip sector, mainly due to increased competition and trade restrictions towards China. Furthermore, things remained unsettled on the banking front, especially in the US. The larger banks in the US and in Europe showed that higher interest rates (for them, not for you) led to an increase in interest margins, thus improving profits. So, the ‘earnings recession’ that many investors fear has not yet occurred, but it is still too early to really rule out such a downturn.

Choosing the wage-price spiral

In a nutshell, the corporate sector turned out to be quite capable of reducing its own costs or better able to pass on higher costs and charges to consumers. Although the latter strikes back strongly with higher wage demands, which are mostly met, real wages are still falling on average. Meanwhile, the wage-price spiral with all its dilemmas is still in full swing: each party hopes to pass on higher costs to the other. If this continues, inflation can hardly go down. Last month, core PCE, the Fed’s main inflation indicator, rose from 4.2% to 4.9% year-on-year. In Europe, core inflation fell 0.1% to 5.6% in February and thus remains ‘sticky’. ‘Ordinary’ inflation, i.e., including food and energy, rose again slightly to 7%. As for wage growth, it rose in the US in the first quarter from 6.1% to 6.4% year-on-year, according to the Atlanta Fed. In Europe, wage growth was around 7% in March.

Despite this, investors have seemed optimistic about bonds since the beginning of the year. After all, inflation is supposed to start falling soon and central banks will start cutting interest rates again from this summer, is the consensus. But the inflation problem has not been solved that simply. I thought a nice comparison was the view of the football field in a stadium: if people stand in front of you, you must do the same to follow the game, but for that, people higher up above you also have to stand, etc. In the end, no one’s view gets better.

It is hard to stay humble

Commodities get more expensive, companies raise their prices, unions demand wage increases, companies pass them on, and so on. To solve this, everyone must step back and absorb some of the pain. Only when companies are willing not to pass on everything and workers moderate their wage demands and thus also accept a piece of the pain (which sometimes happens already, by the way), only then will we get out of this wage-price spiral. The clumsiest thing the (Dutch) central bank can do here is tell the market that a big wage increase is not a problem, and one does not need to worry about a wage-price spiral. While that, of course, is the core of the problem.

If nobody pitches in, this game will continue for a while, despite the stabilization of energy prices and the electric car price war, which should be beneficial. Central bankers, however, will remain concerned about monetary devaluation for longer than the market now thinks. There is really no sign of an interest rate cut on their part for now. If European real interest rates are sharply negative at around -3% (2.6% for 10-year yields minus core inflation of 5.6%), we continue to find it difficult to get excited about bonds.

The time of free money is over

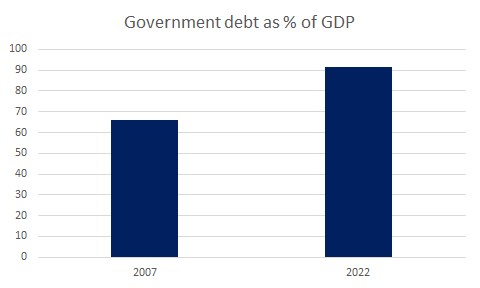

Meanwhile, no government can still throw free money into the wage-price spiral, such as a higher state pension as an income measure or an energy support fund as a consolation for price increases. The party is over, money is no longer free. Even our (Dutch) finance minister now understands this, so we are going to make cuts again. Especially in a European context, this will be exciting. Here, the ropes went off in recent years: thanks to the pandemic and the war in Ukraine, all budgetary rules were temporarily jettisoned. Resulting in a sharp deterioration of public finances. A quick return to the maximum debt of 60% of GDP and a budget deficit of no more than 3% is no longer possible.

Please note the chart below with the average Debt to GDP in the eurozone in 2007 and last year, in 2022.

Figure it out yourself

That is why Brussels has now come up with a luminous plan for new budget rules: each country will figure it our itself but if it does not eliminate debts and deficits in a reasonable time, it is threatened with a fine. Had it not been so serious, I would have laughed at the measure. We already had a system of fines in the eurozone, but despite the many violations, no country has ever been fined, so this is of course not going to happen now either. France, one of the bigger financial sinners, was just downgraded to AA- by Fitch at the end of April, which is the rating level the Czech Republic now has. Incidentally, in the EU, only Germany, the Netherlands and Luxembourg still have AAA ratings. Italy has a BBB rating but is in danger of sliding further down. Greece is even BB, but on the mend. Overall, downgrades prevail in the eurozone. The Netherlands no longer seems so firm on this front, with only Germany still protesting fiscal laxity and opposing the suggested new rule mentioned earlier. This is not a good sign. Fiscally, few countries have been able to make wise choices on their own.

US debt ceiling

Apart from Europe, debt is also a problem in the US. Here, every few years there is a fight over raising the real limit on the national debt. In the process, Republicans hold Biden hostage, just until he makes concessions in the form of spending cuts. Like two cars approaching each other in the dark: “Who blinks first?” One just hopes that both parties make wise choices and do not default on the country this summer. It is a risky game that has gone just right every time so far.

Banking stress not yet over

With JP Morgan’s takeover of First Republic Bank last Sunday night, calm seemed to return (briefly) on the US banking front. The return to stricter rules for regional banks (which Trump had abolished) seems imminent to restore discipline. Hopefully, this will then also apply to investor confidence, which still looks shaky. So far, we have not yet mastered the art of sensible (buying) here, as we were too early in any case.

Global trade bottlenecks largely resolved

But let us also look at the investment world from the sunny side: we still have hardly any countries in recession. China has reopened and global supply bottlenecks seem to have been resolved. Gas prices have now fallen 70% and container prices are back to pre-pandemic levels. In short, despite inflation and sharply higher interest rates, the global economy and business are holding up reasonably well. And even with house prices falling, consumers are keeping a low profile.

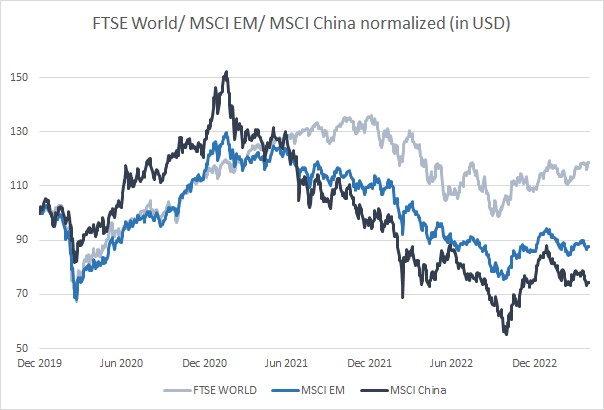

Against that backdrop, the performance of equities, already up 6.4% globally on average this year, is perhaps less surprising. I write on average with emphasis, because the differences between, for instance, developed countries and Emerging Markets (EM) are large.

China in particular, which makes up a sizable part of the EM index, lagged. This hiccup also applied to Hong Kong, India, Korea and Japan for some time, although fortunately there was some recovery last month. The fact is that it did not help our performance, but the mostly low stock market valuations here are encouraging. Let us not forget that the last peak of EM equity markets dates back to 2011 and the chances of a catch-up, however gradual, are increasingly likely with these lower valuations.

Illiquid and alternative investments

In both Private Debt and Infrastructure, our investments are quietly growing. In a falling equity and bond market last year, this is particularly striking. Now these investments are not keeping up with the stock market, partly also because of delays in valuing assets. For alternative investments, such as High Yield, Emerging Market Debt, Factoring and Consumer Loans, the same is true: the results are positive, but less flourishing than the stock market recovery.

We hope to make the right choices for you although there are no guarantees of this. What is remarkable, however, is the reluctance from all kinds of surveys by investors to invest in equities, while enthusiasm for bonds is said to be high. On the contrary, we are less reluctant to equities than bonds. Hopefully that is the wisest choice now, somewhat against the grain.

Conclusion: there is no recession yet, it looks more like stagflation. Profits are holding up reasonably well, perhaps thanks to continued inflation. And interest rates will stay high for longer if we all do not buckle down a bit to limit this wage-price spiral. Economics is ultimately not a physical phenomenon that happens to us. It is a behavioral science, it is choices we make together. Understandable choices, yes, but not always the right ones, especially during a wage-price spiral.

DOOR: WOUTER WEIJAND, Chief Investment Officer