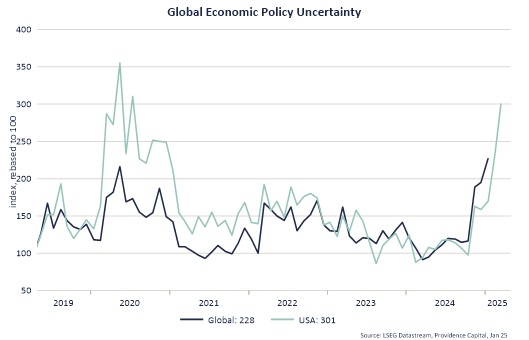

No one likes uncertainty. It makes people doubt, makes them more cautious. People question their prospects and postpone their plans. So the impact of uncertainty on the economy and financial markets is easy to predict: an increase is negative and a decrease is positive. Unfortunately, we have seen a big increase recently due to president Trump’s policies. World trade is facing an unprecedented shock caused by Trump’s much higher-than-expected tariff increases on “liberation day” (2 April), followed by an abrupt 90-day reprieve on 9 April, followed by a series of exorbitant bilateral tariff increases by both the US and China. Not only does this create enormous uncertainty, it disrupts supply chains and procurement programs, and eventually drives up the prices of many goods. While the final impact is still difficult to determine, we are adjusting our view downward and see a high probability of recession in the US this year.

Against the backdrop of global uncertainty, it is not surprising that financial markets struggled in April. The shock on “liberation day” caused global equity markets to fall more than 10%. Only when US government bonds also plunged in price did it become clear to Trump that he needed to de-escalate to avoid a financial crisis. The 9 April postponement of reciprocal tariffs by 90 days for all countries except China provided relief, but not for long. A series of verbal attacks by Trump on the president of the US central bank caused a renewed decline in the stock market and the dollar. Only when Trump de-escalated on this point as well did equity markets manage to recover some of their losses. Nevertheless, partly due to a drop in the dollar of over 5% against the euro, equities ended the month 4% lower.

In the last Newsletter, I wrote about “falling dominoes” in the form of increasing uncertainty and a decline in confidence, leading to less consumption and investment and a downward adjustment in expectations. Events last month only reinforced that view. Trade volumes between China and the US have already fallen sharply, and we know from the covid crisis how long it can take to repair supply chains once they are broken. Fired factory workers in China are not easily found again once orders do pick up. The same goes for dock workers and truckers in the US. Even if tariffs are eliminated tomorrow, it will take 1-2 months to ship goods from China to the US. The “law of unintended consequences” is also going to apply, with many stories of how the trade war is backfiring. We are already seeing this with manufacturers who rely on imported semi-finished goods and are forced to reduce or stop production.

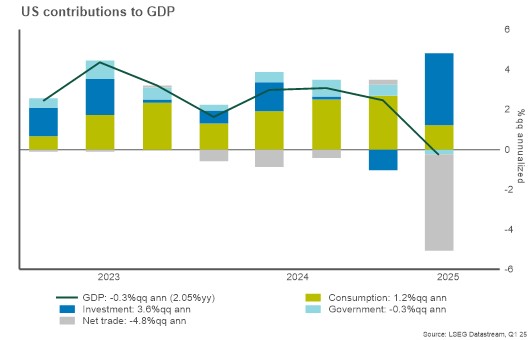

So all of this makes us cautious, but at the same time opportunities may arise for investors. In the coming months, financial markets will have to find a way through a jungle of data and political news. So far, “hard” economic data from the US and China has remained fairly robust, but that is likely to change soon. The first quarter GDP figure from the US showed that the trade war does have a lot of impact. The main question is where Trump’s pain threshold vis-à-vis China lies. He has already had to de-escalate several times and partially exempt several industries (electronics and automobiles) from trade tariffs, but with regard to China, he is stubbornly sticking to his policy so far. If the economic data deteriorate further and prices rise, the pressure on him will increase and, during the market volatility that will then undoubtedly arise, interesting buying opportunities may occur.

To determine if there is a buying opportunity, we follow our investment process that includes an analysis of the fundamental outlook, valuation and sentiment. Because we are currently defensively positioned with our allocation to cash and US value stocks, it is not the case that all signals have to be green for us to conclude there is a buying opportunity, but we do look carefully at the combination of our signals. If the fundamental outlook improves or sentiment drops to panic levels, we could move toward neutral again. For now, however, we think that is premature and prefer to lean on the added value of diversification. European equities, corporate bonds and 20+yr US government bonds are holding up well so far, as are our illiquid investments in infrastructure, private debt and private equity.

I wrote about it in my last monthly letter, but it’s worth repeating: in times of uncertainty, caution is key.

BY: WOUTER STURKENBOOM, Chief Investment Officer