Since taking office in January, Trump has been in the news every day. He keeps issuing ‘executive orders’, announcing abrupt policy changes, and, of course, instituting and repealing new trade tariffs. While most of these actions are irrelevant to an investor, there is unfortunately also more than enough that does worry this calculating group. Those concerns focus primarily on the global trade war unleashed by Trump. Markets are constantly oscillating between hope and fear. Will economic rationality and self-interest prevail or will pure power politics and accompanying mercantilism triumph? So far, unfortunately, it looks like the latter will dominate. But the trade war is not an isolated event, of course, and its indirect impact on confidence is a second source of concern for markets. US consumers are now downright pessimistic, and entrepreneurs are quickly abandoning their initial optimism about Trump. The risk is that these ‘falling dominos’ translate into less consumption and investment, causing economic growth to slow faster and more than markets expect.

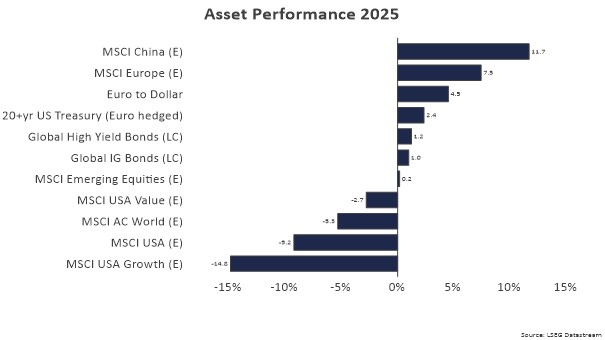

All in all, therefore, the outlook for the US has deteriorated further over the past month and downside risks have increased, resulting in a further downward adjustment in our view. Following previous steps to reduce risk and in line with our investment process, we rebalanced the equity portfolio by selling shares in early March. We also deliberately maintained our underweight to US equities as well as our allocation to value stocks, which are less sensitive to negative news. However, when the world’s largest stock market is struggling, it is difficult for investors to escape completely. Nonetheless, diversification is finally proving again how important it is. European and Chinese equities are doing better this year, and corporate bonds and our 20+yr US government bonds are still in positive territory. We are also seeing a lot of value being added through our illiquid investments in infrastructure, private debt and private equity.

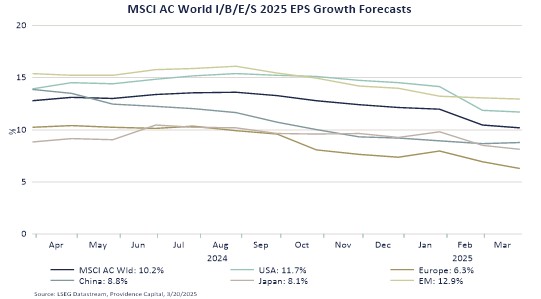

Looking ahead, the focus is first on Trump’s escalating trade war. The announcement at the end of March that a new 25% tariff on imported cars and auto parts would be imposed from 2 April was a shot across the bow in this regard. Knowing that 50% of cars sold in the US are imported as well as 60% of car parts produced domestically, consumers as well as manufacturers will be hit hard. An initial estimate is that the price of a typical car will rise by about US$6,000 and that there will be a snowball effect, as domestic producers will raise their prices, second-hand cars will become more expensive and insurance premiums will rise. In other words, the dominoes are lined up in a circle. But Trump seems unconcerned about this and seemingly wants to assert his power above all else. If he maintains this approach when he finalises the so-called reciprocal tariffs, also on 2 April, the pain will only get worse. The recession scenario will then become dominant, and the markets will have to revise their earnings expectations sharply downwards with all that that entails.

In times of uncertainty, cautiousness is paramount. Considering the fact we have reduced risk in several steps, we are currently awaiting the latest developments and will assess their impact on our outlook. We have built up a cash position, which allows us to respond quickly and efficiently to any major market movements. But before we take a more positive stance as investors we need to see either more fear from other investors or a fundamental improvement in the outlook.

BY: WOUTER STURKENBOOM, Chief Investment Officer