The saying goes that all beginnings are difficult. Yet for now, I can honestly say that I have made a good start at Providence. With the generously given and much appreciated help of my predecessor Wouter Weijand, I have been able to rapidly familiarise myself with all facets of our investment portfolio. On a personal level too, I have been impressed by the warm welcome from my colleagues and the good atmosphere. Everything breathes asset management as it should, with deep knowledge, attention to detail and tailor-made solutions for the client.

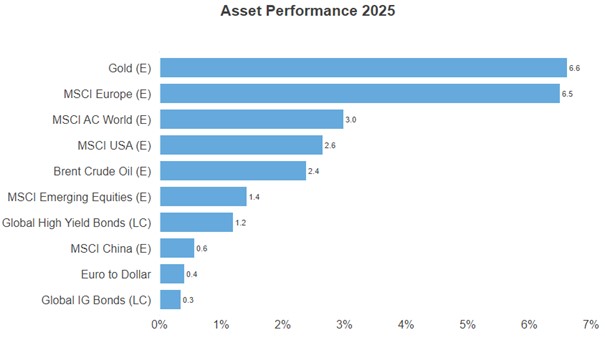

Speaking of good starts, financial markets have started 2025 well, with strong returns in equities and even a small plus in bonds. One of the drivers behind this move is that the markets perceive the risk of a renewed surge in inflation to be slightly lower. Not only because the latest inflation figures in Europe, the US and China were better than expected, but also because of a cooling economy and the associated downward trend in wage growth.

This positive development is, of course, more than welcome. At the same time, it also makes it clear that inflation risk is still a major market risk. Future setbacks, for instance because of Trump’s trade war launched this weekend, could hit markets hard. We take this risk into account in our asset allocation and have reduced our exposure to emerging market equities and bonds in favour of cash and US equities. As a result, we have a little less direct exposure to a country like China that is in Trump’s crosshairs, and instead invested a little more in US dollars and the protection that currency offers in times of stress. Cash combined with a preference for short-term over long-term government bonds also helps when inflation risk increases and interest rates rise. In addition, it allows us to respond quickly and efficiently to substantial market movements.

It is important to stress that taking into account a market risk is not the same as fully positioning oneself for that outcome. Our central scenario for 2025 is still that global economic growth cools slightly without going into recession, accompanied by slowdown in inflation. In that environment, central banks like the Fed (at 0.25% – 0.75%) and the ECB (at 0.75% – 1.25%) can cut interest rates further, and corporate profits will show healthy growth. That combination will allow financial markets to maintain their positive sentiment with returns in line with historical averages (5-10% for equities). A repeat of 2023 and 2024 has unfortunately become less likely given current valuations, as well as a cautious turn in leadership in equity markets.

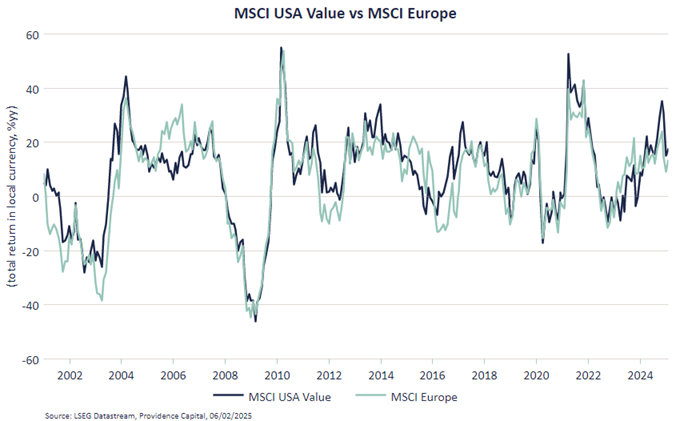

That turn in leadership is well reflected in the relative returns of Europe and the US this year. Whereas the US has been the clear winner in recent years because of its high weighting in growth stocks (technology, communication services) this year, Europe is the region that is doing better for now. Europe’s stock market is much more oriented towards value stocks (consumer goods, banks, industrials) and thus somewhat more defensively positioned. Indeed, the chart below clearly shows that Europe is showing almost the same return pattern as the US ‘value index’.

Of course, it is far too early to assume that this trend will continue for the rest of the year, but as a signal from the market that it is looking at the winners of recent years (especially the Magnificent 7) with a bit more caution, it does make the market slightly less likely to go into a euphoric mood.

A first newsletter titled ‘Start’ obviously cannot ignore the start of Trump’s second term as president. He has big plans and is trying, with a veritable cascade of ‘executive orders’, to erase Biden’s legacy as quickly as possible and introduce his own policies. From the perspective of the financial markets, a lot of those policies are not that relevant. The market does not do morality and is an ice-cold discounting mechanism. So, we should ignore much of the noise and try to focus on the signals that do matter. In doing so, we make a clear distinction between the potentially negative and positive policy choices.

On the negative side, there is the risk that a large-scale expulsion of illegal migrants could lead to labour shortages in certain economic sectors such as construction and agriculture. This has the potential to slow economic growth and increase inflation. A trade war with China, Mexico and Canada and, of course, Europe is also a risk. It seemed for a while that Trump would start cautiously on this very issue, using trade tariffs as a threat to force various concessions (as with Columbia). But last weekend, this changed when he declared 25% tariffs against Mexico and Canada and 10% against China. The situation is very fluid and the tariffs against Mexico and Canada have been delayed by 30 days. However, the risk of an as-yet escalating trade war is clearly high for financial markets. Not to mention Trump’s comments on Panama and Greenland.

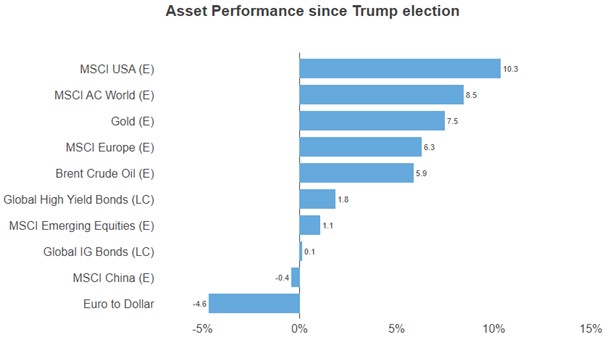

On the positive side, of course, positive outcomes of Trump’s policies are also possible. His desired deregulation may support corporate profits and improve their willingness to invest, albeit with the risk of mishaps down the road. Furthermore, his desire to cut taxes will positively affect markets when implemented. Looking at returns since his election win on 5 November, these signals have prevailed.

Hopefully, my first newsletter is also off to a good start. I look forward to exchanging views with many of you over the coming period and I do hope that my monthly attempt to share our market interpretation as well as our vision for the future will be welcome. For questions and comments, I am always available.

BY: WOUTER STURKENBOOM, Chief Investment Officer