It was quite a month, as Santa Claus came early this year: especially the US stock market shot up after Trump won the US elections. What thrilled investors so much? Was it the promise of MAGA, Make America Great Again? Something about ‘own people and economy first’? And is Trump going to end inflation and the influx of immigrants? After all, those were the concerns of citizens that would have been the deciding factor in the election results.

MAGA?

Let’s try to assess Trump’s announced plans for the US economy. First, the promise that a few million immigrants will be put back across the border into Mexico. Quite apart from the legal barriers here, both farming and the construction business will come to a grinding halt in many parts of the US. Without the cheap and often illegal immigrants, housing, as well as agricultural and horticultural products, will become more expensive. It is precisely the immigrants who keep the economy going in a tight labour market. Without them, inflation will rise, and I have yet to see if Trump will take such a short-sighted decision. Perhaps he will mainly complain about the opposition of various states to the deportation issue so that he can keep the cheap workforce at work.

And how will Trump prioritise his own economy? By taxing products from other countries with import tariffs, making them a lot more expensive. But it is the American citizen, who will pay for that. Trump doesn’t tell them this. He pretends that these taxes are coughed up by foreign companies.

Of course, demand for Chinese and European goods will decline if they are made much more expensive in the US. But don’t think China and Europe will sit still. First, they will hit back with all kinds of tariff increases on US exports, such as steel, grain or soybeans. That has happened before, and after much bluffing from various sides, negotiations usually followed. This does not really get festive, but usually the trade soup is not eaten as hot as Trump serves it.

At least as interesting will be Trump’s role as Santa Claus: as during his first term, he wants to cut taxes, especially for corporations. He had already cut the profit tax from 35% to 28% and later to 21%. Soon this (temporary) tax cut would expire, so Trump must put it on the table again. Moreover, he wants to cut the rate even to 15%! Of course, US stock markets would love to see that happen, but who is going to pay for it?

MEGA

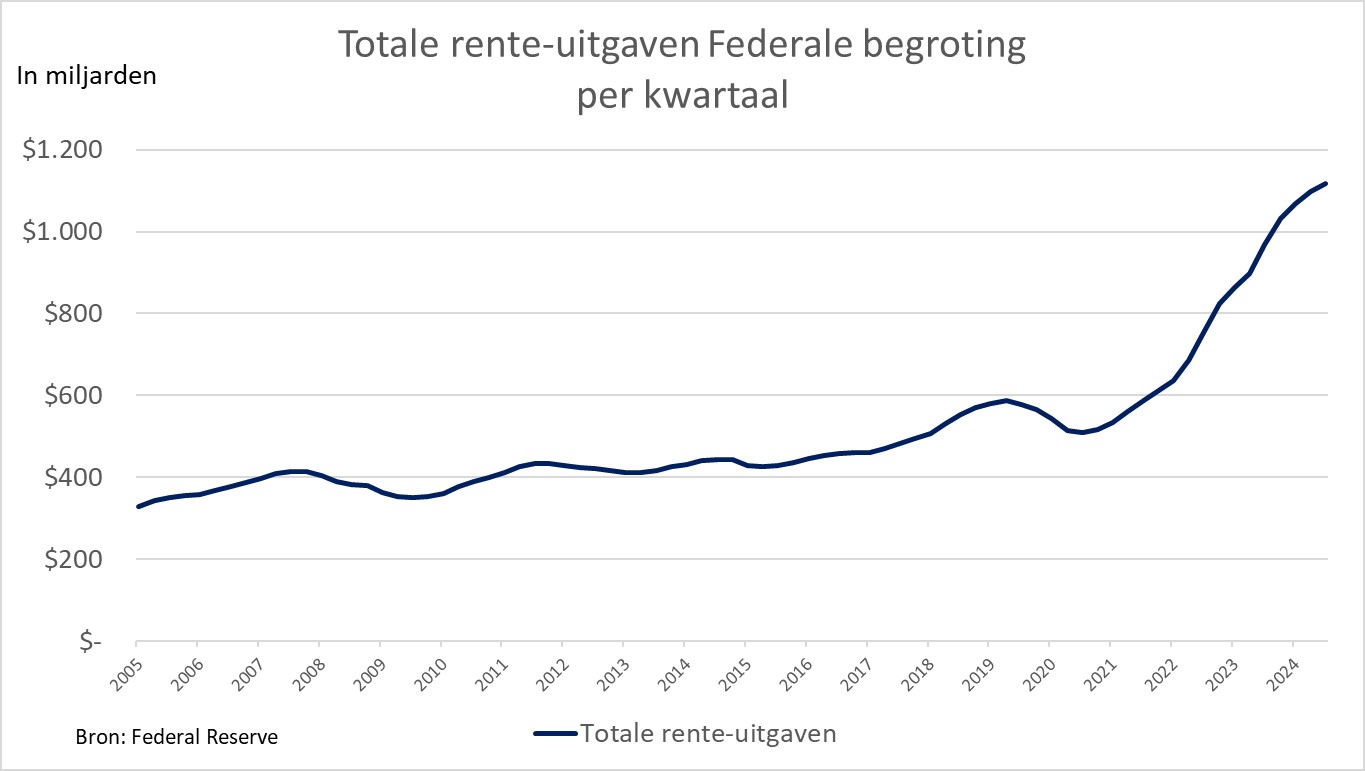

US budget deficits are now so high (up to 7% of national income) that they have even surpassed France (6%). The biggest spending item in the US budget has now become interest payments! Sure, you may say, leave that to Elon Musk: he is going to clean up federal spending. Well, if only it were that simple. The problem does not lie in US spending, no, America simply taxes too little compared to other big countries. See also my newsletter of early July on this subject.

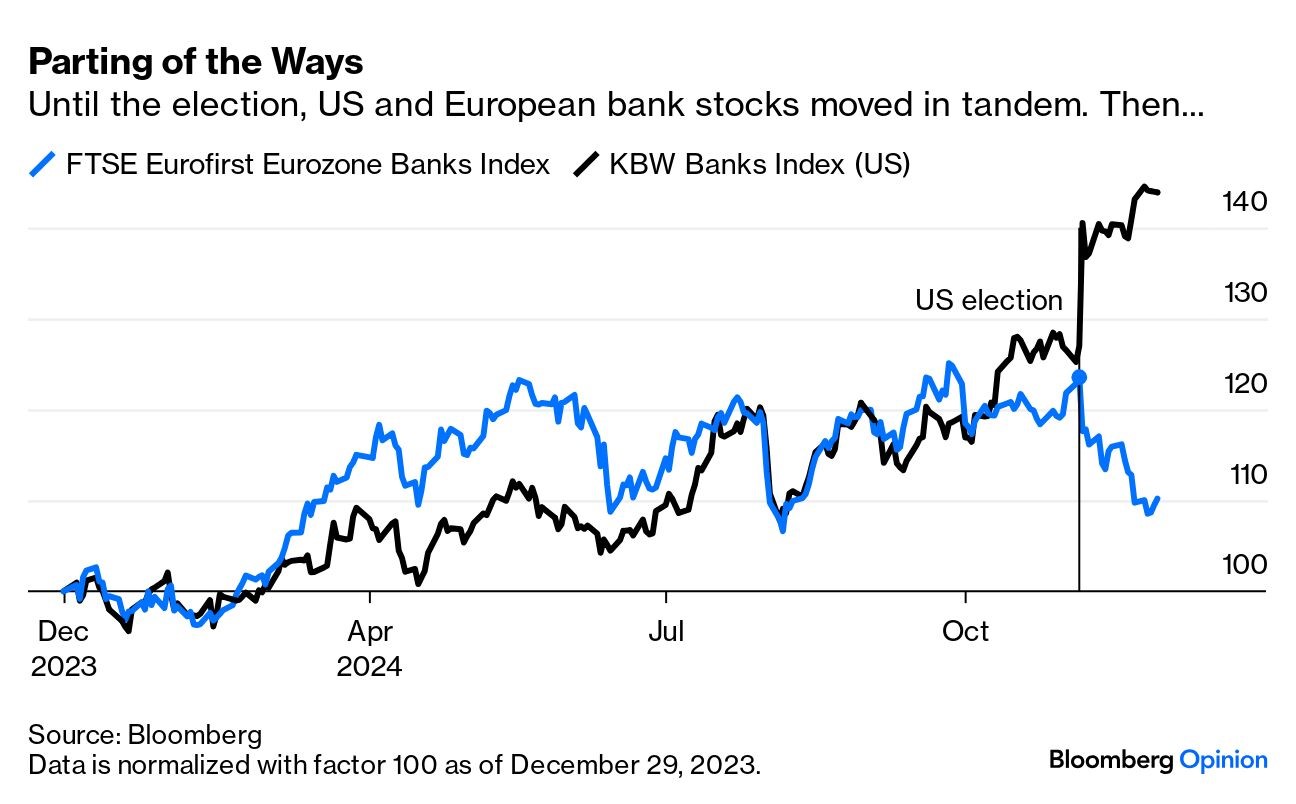

So, will Donald and Elon soon deregulate the economy? Optimism about this propelled bank shares up. Cast off the strings, don’t overextend capital requirements on banks and let them lend generously and pay dividends! One would almost forget that only last March, America had a real banking crisis. That was also the time when we included these stricken stocks in our portfolio. For a long time, these stocks lagged, but now, in this bonanza, when US bank stocks were rising and European ones were falling, we decided to take profits.

If the cowboy behaviour soon returns to the US banks, should we get euphoric about it? Our simple answer is ‘no’. We took profits and bought a broad-based global stock market tracker in return.

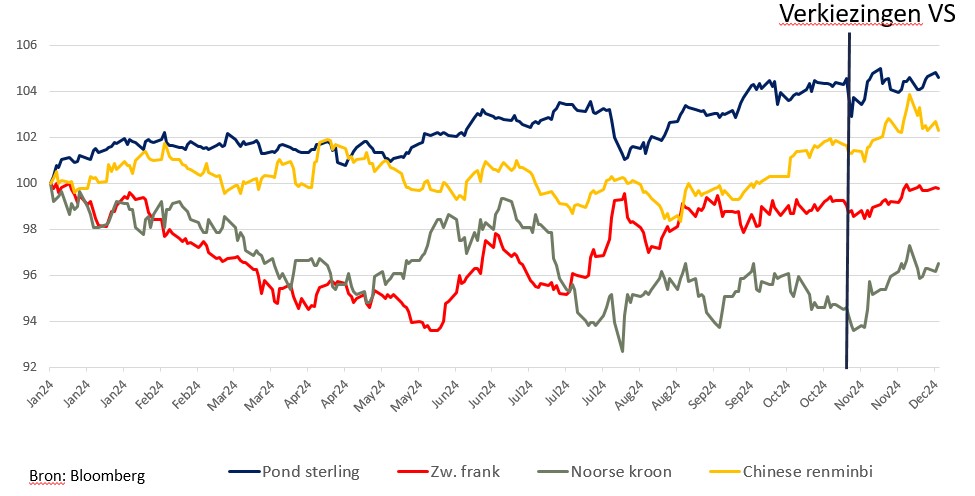

With the eurozone already lagging in stock markets, it is even more pronounced in the currency markets: the euro fell, but not only against the dollar, but also against sterling, the Swiss franc and the Norwegian krone.

Is another euro crisis looming?

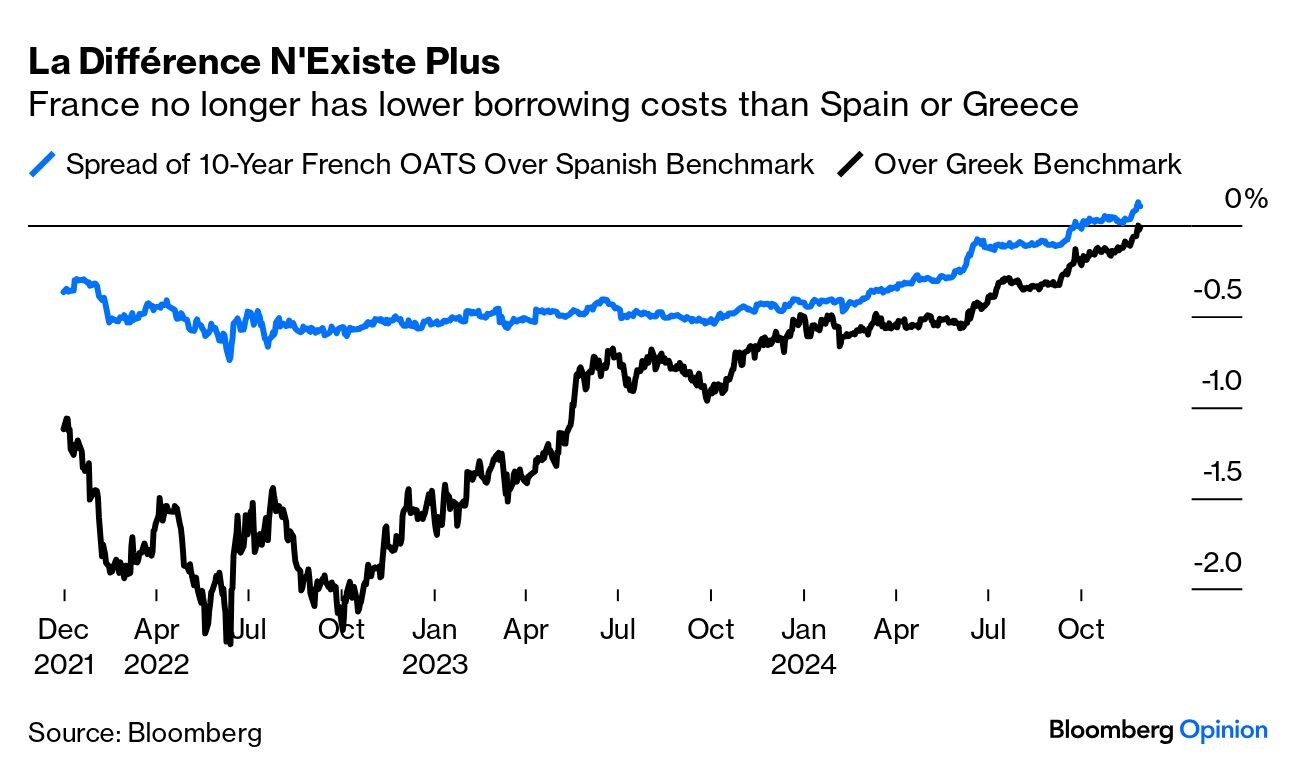

So, the euro not only lost to the dollar, but also to other European currencies. This is nothing new: France is once again the biggest headache. Its budget deficit and public debt are unsustainably large, but the fragile political situation makes decisive action difficult. French 10-year interest rates are now higher than those in Spain and even Greece, although the large amount of money from Brussels to re-capitalise Greek banks will also have played a role. Around 10 years ago, we had to bail out Greece, but it ‘only’ cost around € 240bn. France, however, carries at least 11x bigger debt. Below you can see the ‘catch-up’ of French interest rates to Spanish and Greek rates since 2021. Father Christmas, meanwhile, pays less interest on his purchases in Madrid than Macron does in Paris.

Is the ECB already working overtime to work out emergency scenarios for France? I would not be surprised if they are considering buying up French government bonds, just as they had to do for Italy for a while. However, France is not that far yet, but Prime Minister Barnier’s government did fall. Not that this brings fiscal solutions even 1 step closer, on the contrary. But in any case, the time of handing out presents really does seem to be over.

Finally, some vistas from a country, which is perhaps most ready for the arrival of Santa Claus: China. After many years of sharp underperformance, this year finally gave birth to a recovery. Do they know how to get around the hurdles that the EU and Trump seem to be putting up? With factories soon to be located in Turkey, Spain and Brazil, to avoid import duties from Europe and the US? Ultimately, everyone benefits from unfettered global trade. It is unthinkable and undesirable for Santa Claus to end up bringing his presents in only 1 country. US citizens will also discover this in the new year, as they will eventually have to pay for all those ‘presents’ themselves anyway.

BY: WOUTER WEIJAND, Chief Investment Officer