Introduction

There are several important elections this year. Both investors and politicians are trying to respond to changing trends and mood swings among citizens. For instance, geopolitics and trade relations are getting in the way of business investment and stock market prospects. Even in countries that do not hold elections.

Volatile

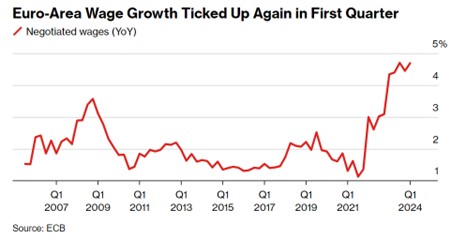

After April, May was also a volatile month. It got off to a good start with relief about the earnings trend in the US after sustained economic growth and higher interest rates in the first months of the year. This was followed by renewed uncertainty about inflation, which now also disappointed in Europe, rising from 2.4% to 2.6%. Nevertheless, the ECB has implemented the long-promised interest rate cut earlier this week. After all, it is the result of a long negotiation between northern and southern European central bankers. The Federal Reserve does not need to negotiate with states, focussing mainly on economic data and waiting to see what happens next.

‘Higher for longer’

Sticking to high money market rates (around 5.25%) did not affect all the investments in AI in the US, but it is now hurting home buyers (and sellers), who are facing mortgage rates of 7% or more. There, among consumers, the economy is also starting to sputter a bit. At the end of the month, US consumer spending, employment – and wage growth appeared to have cooled. That came as a surprise and eventually caused long-term interest rates to fall slightly in May. In Europe, they actually rose. Here, high wage growth persisted, and industrial production recovered. Stock markets fluctuated sharply but closed the month on a positive note.

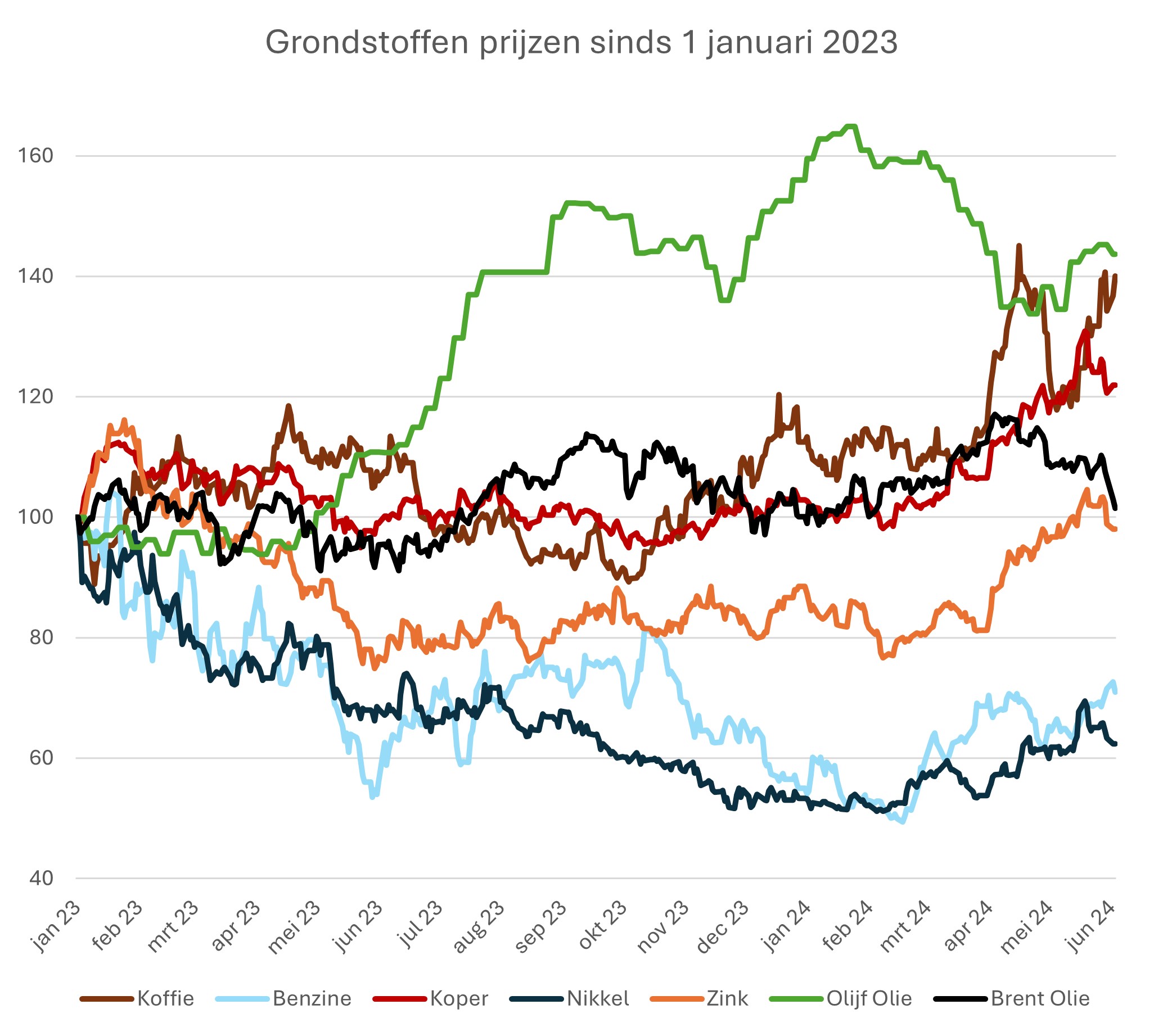

Commodities more expensive

While inflation has gradually weakened in recent quarters, it is striking how commodity prices have been on an upward trend again since late last year. Almost all metals have become 10-20-30% more expensive this year. Perhaps this has something to do with the current arms race, although many of these metals are also used for the energy transition. Oil prices have been at higher levels for some time. Last weekend, OPEC met and decided to limit its oil production even before 2025 to keep prices high. Just when the Western world wants to use fossil energy a bit longer, this might not be a favourable message for inflation later on. Finally, wage increases are often a source of inflation.

Especially in the services sector, these are usually passed on directly via rate increases. In Europe, service sector prices in May were 4% higher than a year ago.

Election rhetoric?

2024 is a key election year and this has already led to some preliminary skirmishes. In the US, we are used to some anti-Chinese trade rhetoric from Trump, but Biden is now trying to take the wind out of his sails with a drastic increase in import tariffs on Chinese goods. The one on electric cars, for instance, goes from 50% to 100% (!). Similar, albeit less far-reaching, noises are also heard in Europe, where we had elections last week, especially from France. Own people and own industry first, is the thinking here too. Unfortunately, the reality is often a lot more complicated. The big German car brands have factories in China and Tesla also builds many cars there. Their exports to the US and Europe will soon be taxed extra by this measure as well. Moreover, China promises to quickly retaliate such moves with import tariffs on many European and US products. If all these plans were to go ahead, the only way for a company to avoid import duties is to build a factory in each region. Of course, that would become a very expensive exercise. For citizens, all those duties will push up prices. These issues come into play just when one would have thought that the worst inflation was over. The question is: is this call for import tariffs pure election rhetoric or will politicians soon follow through on these plans?

Mood swings

These skirmishes simultaneously explain part of the turmoil in markets in May. After a fine recovery in Chinese equities, quite a bit had to be surrendered at the end of the month. Especially after import duties were announced. China does not do elections. Decisions are taken centrally. If they decide on a major energy transition (China had the most coal-fired power plants), things can go fast. Faster than in Europe and the US, where governments can take a break, making both industry and consumers shy away. While large numbers of electric cars wait on the docks in Europe, subsidies are being abolished and carmakers are deciding to bet more on hybrid and old-fashioned powered models.

What is unclear is how things will proceed with the planned investments on the government’s side. Especially for our infrastructure in terms of wind, electricity, hydrogen, etc… Citizens want a step back; it has gone too fast for them. Governments also hesitate now, even the big European government in Brussels. The call to preserve the old familiar seems set to prevail in the coming elections and politicians are preparing for it. Even before the voting has taken place, many companies involved in the energy transition are already out of business: consumers are throwing in the towel and hardly ordering solar panels and heat pumps any longer. Many companies had invested in staff and stock with a sunny vision, but now must sit on their hands.

Most votes count in India

Then there were elections in the world’s largest democracy: India. Prime Minister Modi won again, but without a parliamentary majority. In the stock market, euphoria over a much bigger victory gave way to disappointment. From now on, Modi will depend on coalition partners, who quite often switch places with the opposition. Incidentally, India is the world record holder not only in terms of population size (1.4bn), but also in terms of economic growth (8%). Business optimism prevails in India: brokers foresee earnings growth of 10-12% and equities are even more expensive in terms of P/E ratio than in the US. Let’s hope for all those people, that the country remains liveable too. In fact, a rather unpleasant record was set recently, when temperatures in Delhi passed 50 degrees for the first time! Almost the whole of Asia has suffered in a severe heat wave for months, attributed in part to climate change.

All in all, Emerging Markets still failed to catch up with developed stock markets in May, as the US stock market did not relent. Chip giant NVIDIA remained at the epicentre of AI developments. It still received more orders than expected after all, often from the other big Tech companies investing in their AI capabilities. NVIDIA, meanwhile, can count itself among the very largest exchange-traded stocks with a market value of nearly $3,000 billion, close to that of Microsoft and Apple.

Action item

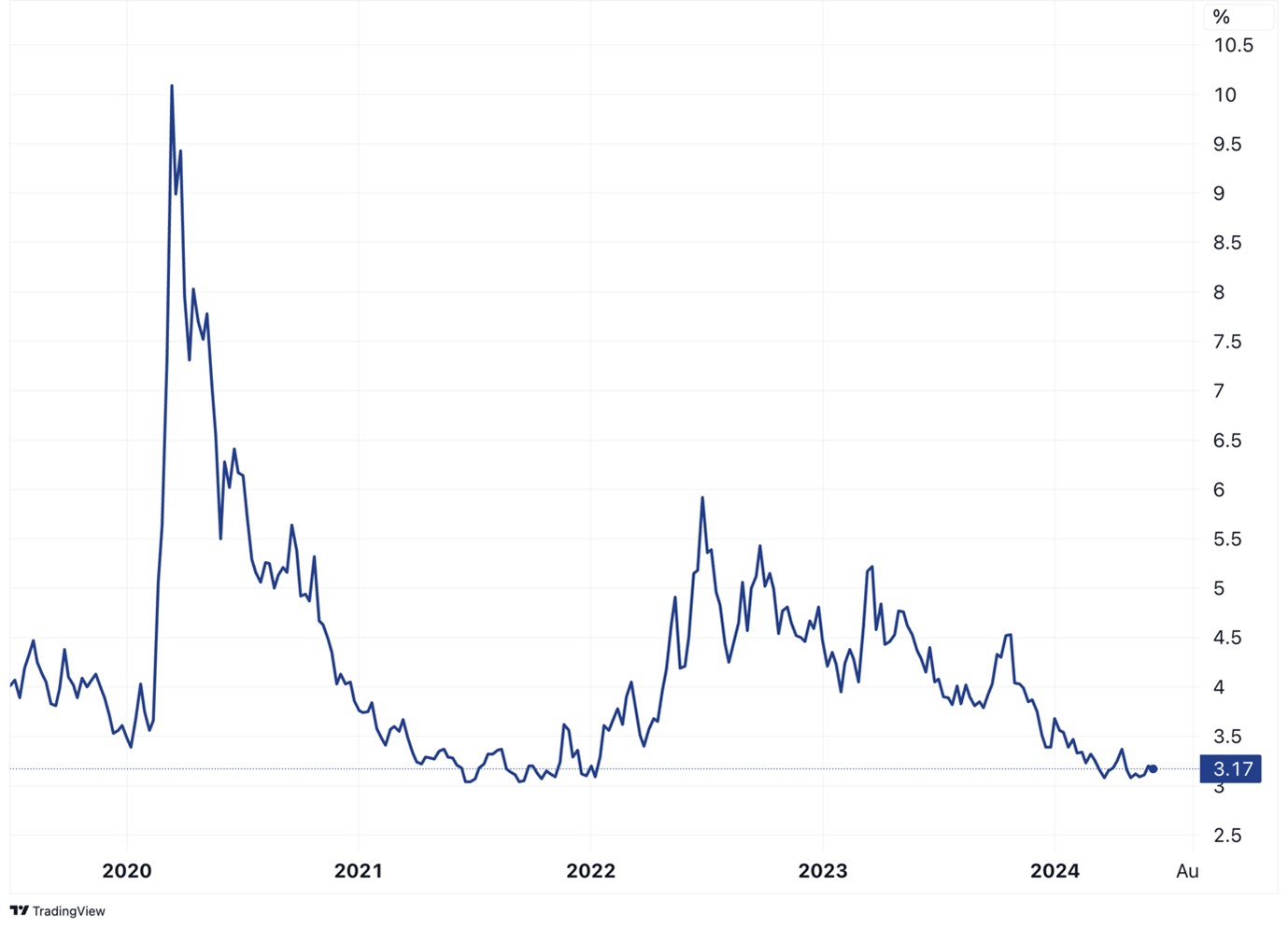

Over the past few days, we took another look at our positions in High Yield bonds. The mood in the High Yield market has been good since late 2023, too good perhaps. We know that something like this can turn around quite easily. The chart below shows the waning interest rate differential between government bonds and High Yield bonds. We have chosen to be invested only in a decidedly defensive fund and in a short-term fund (average maturity around 2 years) where any increase in the interest rate spread will have a limited impact.

Interest rate differential between High Yield bonds and government bonds

To conclude

Brussels’ influence on national legislation is often underestimated. As important as the European elections last week are for citizens and businesses, those in the US in November are even more important for Europe. Should Trump win, there is a risk that he will turn away from NATO and the Paris Climate Agreement. Either way, Europe seems to have to be more reliant on itself than before. Especially with a major and protracted conflict on its eastern border, this is an uncomfortable and costly reality. For any region of the world, it seems useful to diversify investments internationally, but for Europe, in these circumstances, this is perhaps even more true than elsewhere.

This can be done with listed investments, but certainly also with ‘Private Markets’: our investments in Infrastructure, Private Debt and Equity, Factoring and Alternative Lending are global in nature. These are managed with their illiquidity with a horizon, stretching beyond all those upcoming elections.

BY: WOUTER WEIJAND, Chief Investment Officer