Financial environment

The financial environment remained at Olympic levels in most regions last month. Economic growth caught up again, especially in the US and Europe. And this, of course, was accompanied by a ‘surprisingly’ higher inflation level: at 3.8%, German inflation reached its highest level since 1993. Although 0.5% higher than expected, the ECB announced in advance that it would not react to this increase. And admittedly, the increase is mainly driven by higher energy prices.

In the US, the Federal Reserve is now becoming a little more cautious: it is keeping the option open to start phasing out bond purchases in the coming months. The ECB on the other hand is not considering this yet. Core inflation in Europe stands at 2.3%, which is 0.3% higher than expected. And so in Europe, too, the time is approaching to start talking about phasing out the PEP (Pandemic Emergency Program) bond-buying activity. Although Mrs. Lagarde would rather not have it, of course. Northern and Southern Europe are still diametrically opposed in this respect, but out of politeness do not show this in the full limelight.

Interest rates and market developments

In the meantime, markets became somewhat concerned about the delta variant of the corona virus, which might slow economic growth. Long-term interest rates subsequently fell, but this fall in interest rates did not seem to last long.

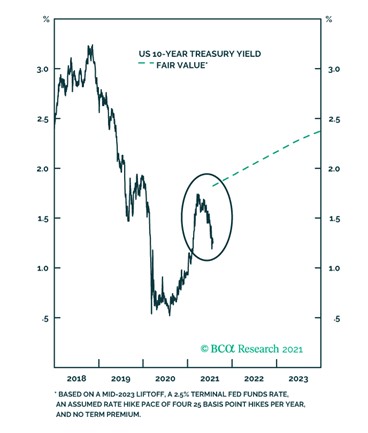

Below is the graphical display by BCA Research, showing the recent fall in 10-year US bond yields, with an green dotted estimate of where they see yields going, based on a number of future interest increases by the Federal Reserve.

Meanwhile, real interest rates (nominal rates minus inflation) have gone strongly negative, franging from about -4% in the US to about -2.5% in Germany. These extraordinary numbers also found their origin in large central bank stimulus. For us these are an extra reason to cut the interest sensitivity of the fixed income portfolio.

Equity markets liked this drop in rates, as they did like the growth figures. However, it was not hosanna everywhere: the scarcity of raw materials, parts and computer chips continues and many car factories were forced to halt production temporarily. At the same time, the old economy, with tourism, transport and shopping, started again. However, the services sector still has a lot of catching up to do.

It was not very cozy in China: equity prices fell sharply after Chinese leaders made clear to the largest IT/internet/telecom companies who is in charge in the country. Earning money is allowed, but nobody should become too big and powerful. And criticizing the party line is of course completely out of the question. Billions of dollars in fines and sudden disappearances of top management: actions like these spread like wildfire through the boardrooms and help to ‘convince’ the local business community. But such actions do not exactly motivate foreign investors. They are quite shocked by what is really going on in China. Hard work, companies that perform a lot, all OK, but do keep your mouth shut. At the end of the month, the government intervened verbally to reassure markets and they actually succeeded.

How do we handle our exposure to Emerging Markets, where China usually dominates? By choosing funds that are more diversified and with an eye for ESG (Environment, Social and Governance) issues, which lowers the weighting to China. Likewise, our exposure to Frontier Markets, the precursor to the Emerging Markets, provides additional diversification, beyond China.

Climate change

Meanwhile, the ‘Olympic’ fire has hit many countries: from Southwestern America, Western Canada, North-eastern Russia, Turkey, Greece and Italy, mother nature seems all over the place, with heat waves and massive fires. And with extreme rainfall and flooding in our part of the world. The fires alone cause further global warming, which hardly seems to stop. There are plenty of climate plans, but implementation seems slow. If it is already close to 50 degrees in Canada, what can the rest of the world expect in the coming years? And where will our coastline be located? During last month, financial markets did not seem to consider this an issue, but we are convinced we will have to make stricter choices on this major issue in the coming years. A trip to Mars is only for the very happy few.

Everyone else will really have to find a climate solution on planet Earth. And this requires an almost Olympic unity and cooperation between countries, a task that will have to be fulfilled with a kind of Olympic fire.

BY: WOUTER WEIJAND, Chief Investment Officer